After staying quite stable around the $430 mark since the new year started, the price of Bitcoin (BTC/USD) has today reached $450 for the first time in 2016. The trading volumes has also spiked which would suggest the price move is a result of a rush of new traders hitting the market.

One plausible explanation, and the most likely one, for the jump in price today is the stock market crash in China. Chinese bitcoin exchanges have been responsible for the majority of the cryptocurrency's trading volumes for a long while now and it is possible that Chinese investors see bitcoin as a safe haven when the stock market is in trouble. It is also possible, as the Chinese stopped trading after the stocks dropped 7%, that speculators were just looking for an outlet in a market that is never closed.

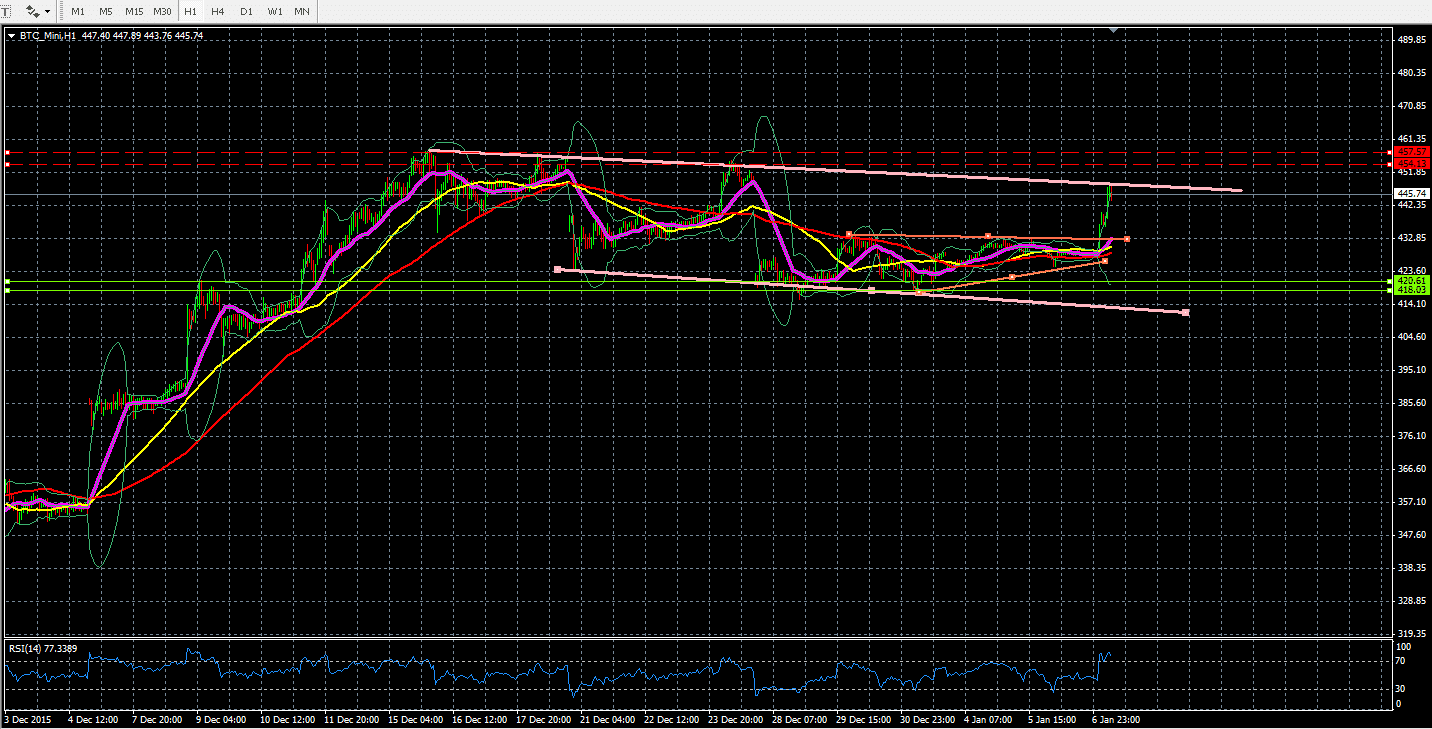

Bitcoin price, January 7. Source: Bitcoinwisdom

The Technical View

Naeem Aslam, Chief Market Analyst, at AVATRADE shared with us his analysis of the price movement:

Naeem Aslam, Chief Market Analyst, AVATRADE

Bitcoin is trading in a downward sloping channel on a 60 minute time frame. The price is challenging the upper line of this channel and a break of this trend line towards the upside will confirm that the bulls have taken a strong control of the price. The price has also broken out of the ascending wedge pattern which is shown by orange lines and this is another confirmation of the bullish price action.

However, it is important to look at the three moving averages which we have shown on the chart. The 20 day moving average (shown in pink) is trading above the 50 day MA (shown in yellow) and 100 day MA(shown in red). This is a confirmation that the price action is strongly biased towards the upside. In terms of Volatility , the price has pierced the Bollinger band and this point also is close to the upper line of the downward sloping channel and this can bring a little pause for the current trend.

Similarly, the RSI- the momentum indicator, is also indicating that the current price action is overbought and we could see some correction.

Important Zones: 457.57 - 454.13 Resistance 420.16- 418.06 Support