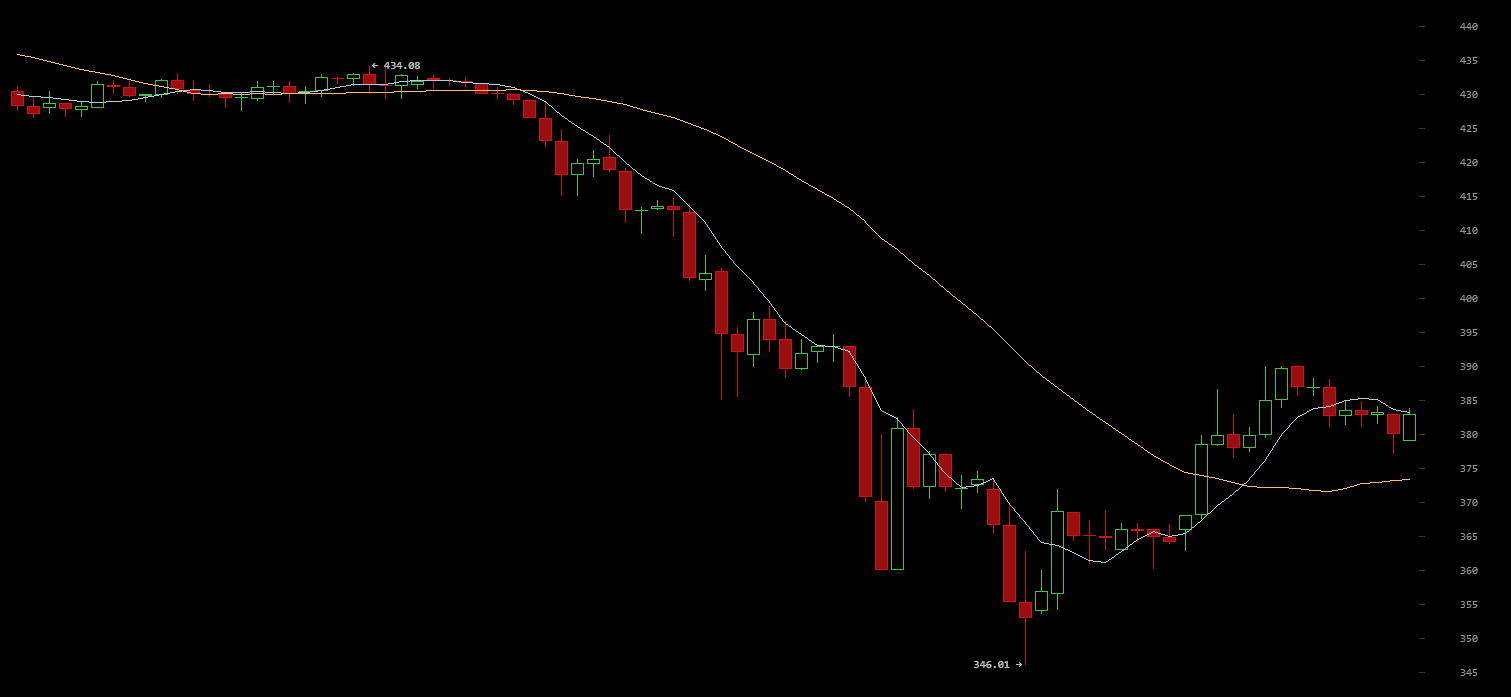

Following a rough couple of days, the price of bitcoin (BTC/USD) has now seemed to have reversed its fall and stabilized around $380. After reaching as high as $450 just two weeks ago, the rate fell about $100 from this high at one point during the weekend, trading as low as just $346 on BTC-e and $352 on Bitstamp.

BTC/USD Chart: Bitcoinwisdom

The reason for the crash was the announcement of veteran core bitcoin developer, Mike Hearn, that he is quitting the development of the cryptocurrency, selling all his holdings in it and branding bitcoin a failed experiment. In a very long and detailed blog post Hearn accused the bitcoin community of creating an alternative that is actually worse than the current financial system and one that is on the brink of collapse due to that.

Hearn said the system suffers large backlogs, cited fears that recent changes allow buyers to take back Payments after walking out of shops, and said that transaction fees were wildly unpredictable, high and rising fast. Most dramatic where his determinations that the people leading bitcoin are in "open civil war" and that the system has become "controlled by China."

The underline reason for most of these issues is the ongoing clash between those who think increasing block sizes is critical and should have already occurred, such as Hearn, to those saying a resolution of the issue can be postponed further until it is widely adopted. The consequences of this civil war led to influential forums censoring all information on alternative solutions that they did not agree with as well as massive cyber attacks on competing implementations (DDoSing of network nodes running Bitcoin XT).

Reactions

While some in the bitcoin community took Hearn's departure with grace, thanked him for his many years of development, and simply attributed it to his frustration over his failure to get the changes he wanted to the block size issue adopted, others accused him of deliberately trying to sabotage the success of the cryptocurrency.

Chief among the nefarious reasons that some claimed were behind Hearn's public denunciation of bitcoin, was his recent crossing over to the R3 blockchain consortium. Supposedly giving credence to this conspiracy theory was the fact that the New York Times quickly followed on the blog post with a long, admiring profile story on Hearn, calling him disillusioned with bitcoin, thus making sure the general public heard that a lead developer of bitcoin considers it a failure - on behalf of the major banks backing R3.

The drop in the BTC/USD rate also dragged with it the prices of most alternative Cryptocurrencies , leading them suffer weekly losses, including the second and third largest by market capitalization, Ripple and Litecoin. Most notably bucking the trend was Ethereum’s cryptocurrency, Ether, whose market capitalization is now $95 million, higher than last week's record.