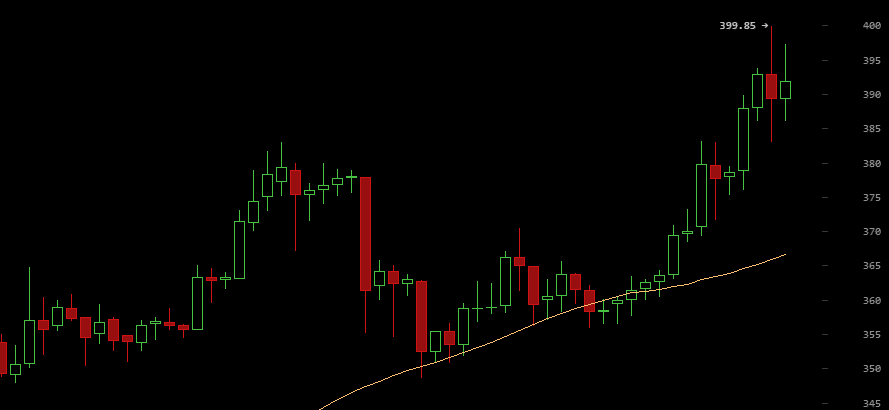

Bitcoin (BTC/USD) revisited $400 for the first time in over a month, gaining over 10% this weekend.

The direction of bitcoin’s next move had been particularly uncertain in recent days. It appeared vulnerable to shed more from one of its biggest bubbles in recent memory. On the other hand, it had stabilized long enough in the mid-300’s to suggest that a further unwinding is unlikely.

Prior to this weekend’s jump, bitcoin was suspiciously flat in this range for three days, which is often a precursor to big moves.

The jump to $400 does bear some resemblance to the last one, which saw a wide disparity in prices between exchanges, particularly with those in China. Today, bitcoin touched $399.85 on Bitstamp, but rose to $407.57 on Bitfinex and the equivalent of $416.75 in yuan-based trading on Huobi. On BTC-e, bitcoin only reached $392. At current prices, the China premium is about 4%, which approaches levels last seen during the wild trade one month ago.

It is possible that Chinese exchanges are dragging the markets higher again, stretching the gap between their peers who are still catching up. It has been suggested that last month’s bubble was fueled by demand for bitcoin by Chinese flocking to a Russian Ponzi scheme.

Very telling is the fact that reported Chinese volumes have been well in excess of those from during the $500 bubble. Total global volumes reported from that period were the highest ever, with above average representation from China. Over 19.5 billion bitcoins ($7.3 billion) have been reportedly traded during the past week alone- 30% more than the total number of bitcoins in circulation.

It should be noted that the reported volumes from most exchanges cannot be independently verified, and those from Chinese exchanges have been questioned in the past.

Barring a spectacular collapse, bitcoin is likely to finish 2015 in positive territory after trading in the red for most of the year.

Litecoin’s (LTC/USD) rise was less dramatic. It reached a high of $3.55. The LTC/BTC rate fell to 0.0088, its lowest since November 10.