Analysis provided by Ashton Fraser, learn more about his trading strategies at the Lasers forex forum.

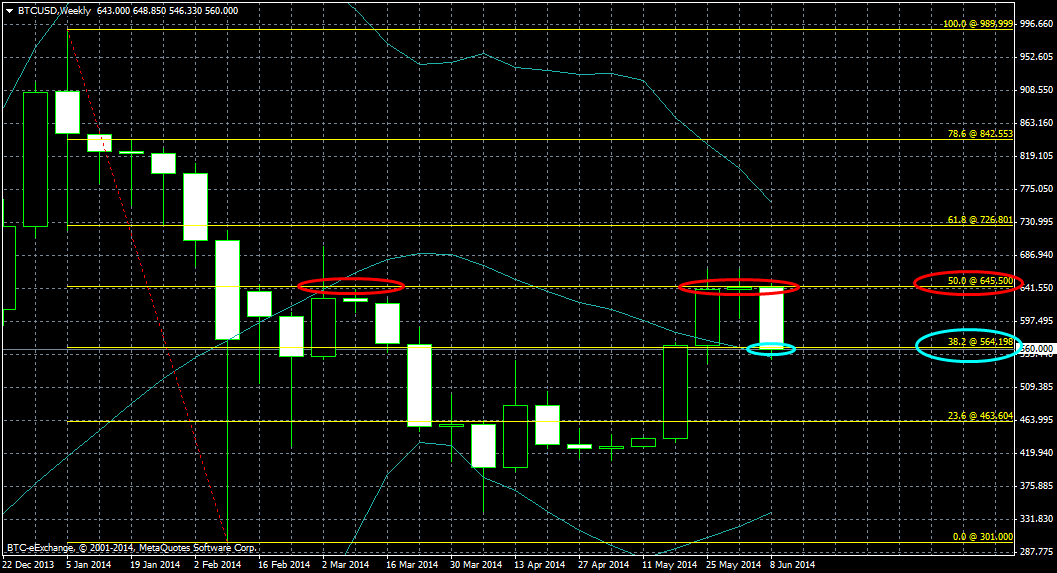

After last week's fall to 560, it seems the bears have hit some firm support, which could prove key in determining the path of price over the course of the next few weeks.

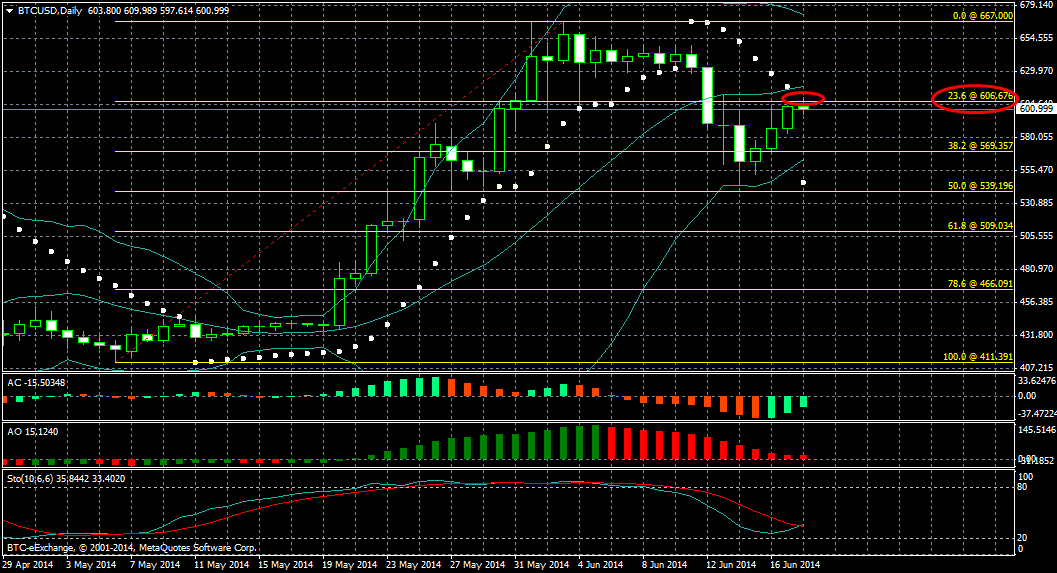

Over the weekend, I posted the following BTC/USD Daily chart:

Where I mentioned, "It was the 50% resistance (marked in red), which has been preventing price from continuing its bullish momentum we witnessed in May. This has resulted in a fall to the 38.2% Fib level at 565, marked in blue. So here we have the reason - the 38.2% Fib on the Weekly hold more water than the 23.6% Fib on the Daily, enough speculators have continued to hold on their shorts until this Weekly Fib, at the very least. This is especially true as 38.2% on the Weekly isn't too far below 23.6% on the Daily, so the progression to this level was natural."

And that's as far as the price managed to reach, as a significant number bearish speculators exited, resulting in a bounce of 38.2% at 565. The fact that support has formed here, is unsurprising, given the fact there are so many bullish technicals on the weekly timeframe still at play, such as the Stochastic Oscillator heading north, both Bill Williams' indicators (Awesome and Accelerator ) staying green, along with the Parabolic SAR dots beneath the candlestick, as we can see below on the latest Weekly chart:

As of this morning, Bitcoin has hit a week high at 607. Will the bulls manage to rise even further? It looks unlikely this week, since 607 represents a confluence of two key Fibonacci resistance zones, if we zoom into the Daily timeframe.

Firstly, 607 is located at the 23.6% Fib level from our longer term study which I performed over the weekend (marked in red):

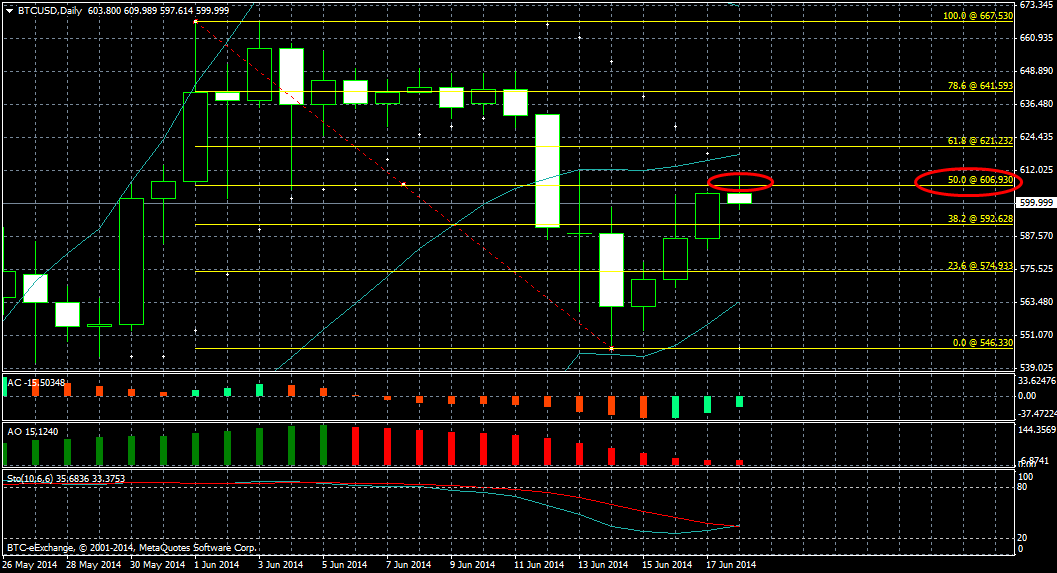

Secondly, 607 is also located at the 50% level if we perform a shorter term Fib study from this month's high until this month's low (marked in red):

Consequently, this resistance may prove too strong for a further hike this week, although we can't ignore the Stochastics potential to cross up from a (relative lowly) position, which could entail some ranging over the next few days.

Learn more at https://www.forexlasers.com