After the last couple of weeks' surging bulls, this week has been so far, a drab affair, relatively speaking ,with the 50% resistance zone proving to be much stronger than I had expected, although if we're to zoom into the four hour time frame, there are some technical nuggets to be found.

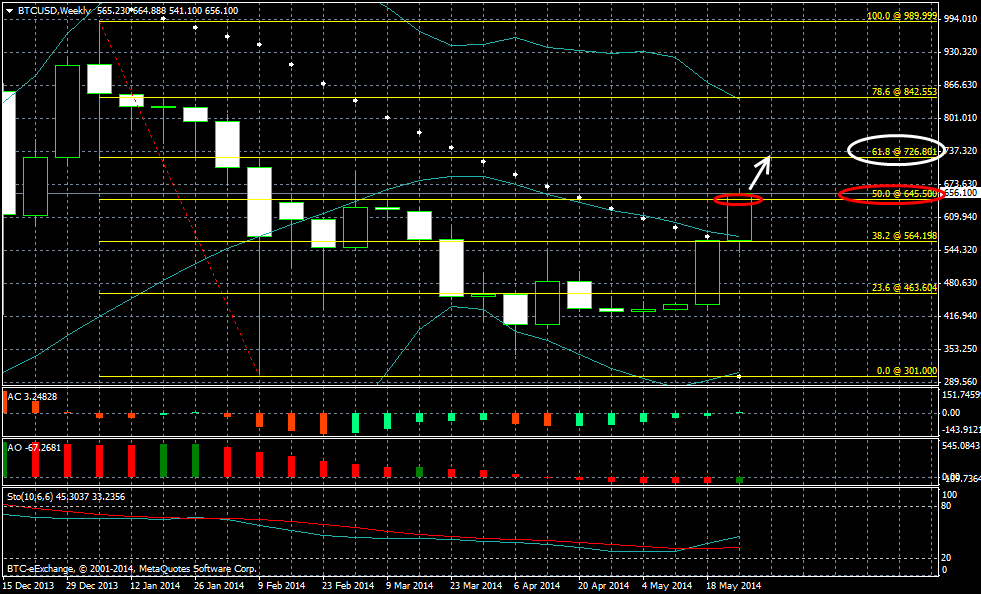

Over the weekend, I posted the following chart (click to expand):

Where I mentioned: "the bulls have just continued to surge forth, currently hovering around the 50% mark at 650, (marked in red), as we predicted earlier this morning, where, in addition to the Stochastics heading north and the Accelerator Oscillator turning green some weeks ago, we’ve just seen (as in today), the Awesome Oscillator also turn green, giving me added confidence in a rise to the next key Fib retracement level, i.e. the 61.8% Fib level at 725, marked in white, sooner rather than later, provided price closes above the current (seemingly feeble) resistance at 50% on the Daily timeframe."

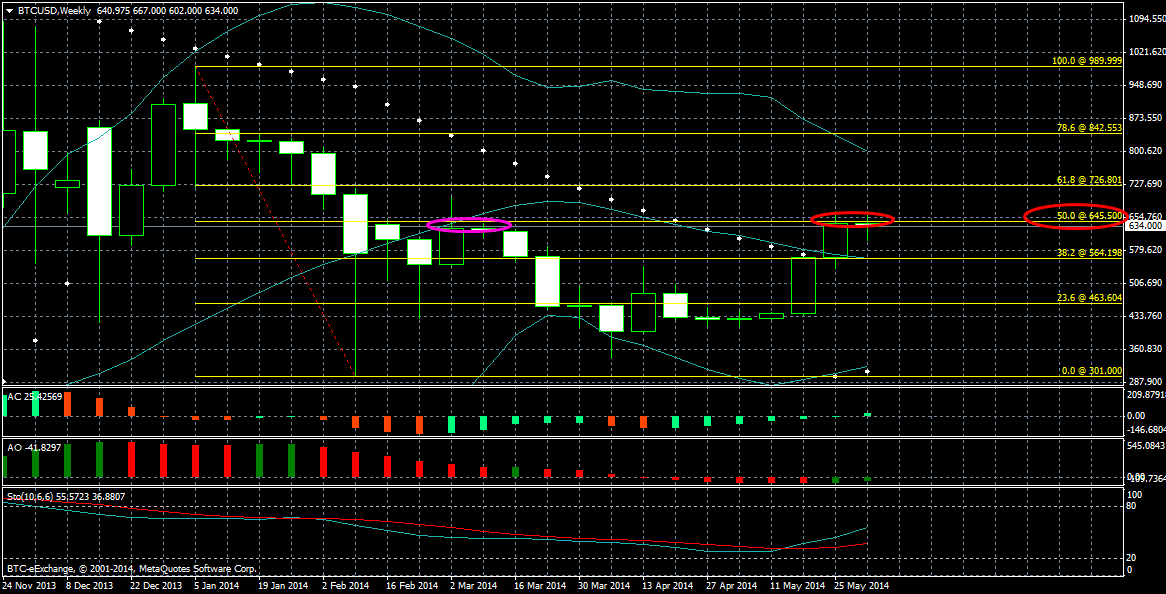

Yet, if we take a look at the current W1 chart below, it's clear my claim that the 50% resistance was "feeble" was misguided, as it's proven to be anything but...

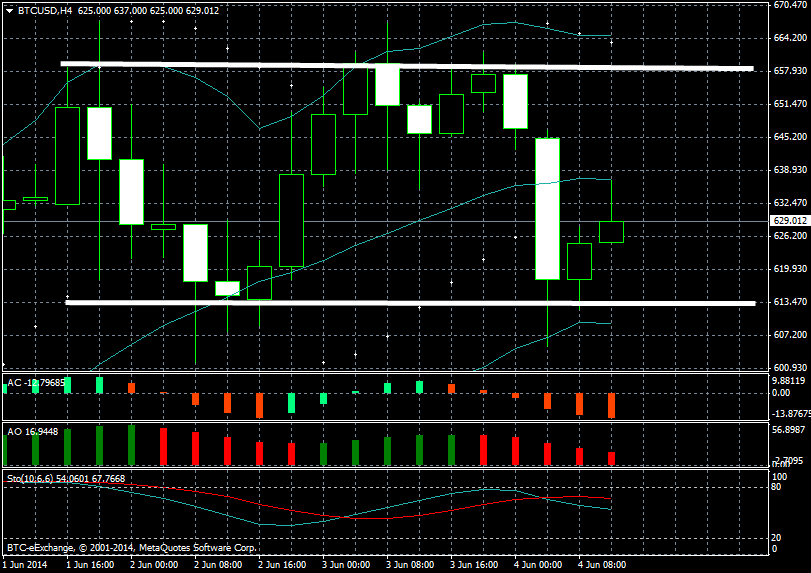

The majority of the technicals were pointing towards more gains, and I really didn't expect 50% at 650 to hold, but it's managed to restrain price with firmness, rejecting the bulls every time they threaten to surpass it, as demonstrated by the double top (and consequent double bottom) we're currently observing on the H4 timeframe below:

Having said that, I still feel 50% could break by the weekend, there's still so many bullish technicals at work, including the Accelerator and Awesome Oscillators as green, the Stochastic Oscillator heading north from a near oversold position, and the Parabolic SAR dots beneath the candlesticks. My main concern is that 50% has been tested before, back in March (circled in purple on the current Weekly chart above); price hasn't been above that level since, so the stalling could continue for some time yet.