Christmas usually brings joy to the world, but when it comes to the cryptocurrency traders, this holiday is all doom and gloom. The already struggling market pulled out more than $15 billion from its total valuation in the last 24 hours.

Last Christmas, as Bitcoin was trading above $14,000 and the market was booming with demand from all over the world, a similar bear was triggered during the Christmas day trading session, as the market shed around $26 billion. However, the growing demand pushed the price back up, and in less than 15 days, the crypto market touched its apex valuation of $828 billion.

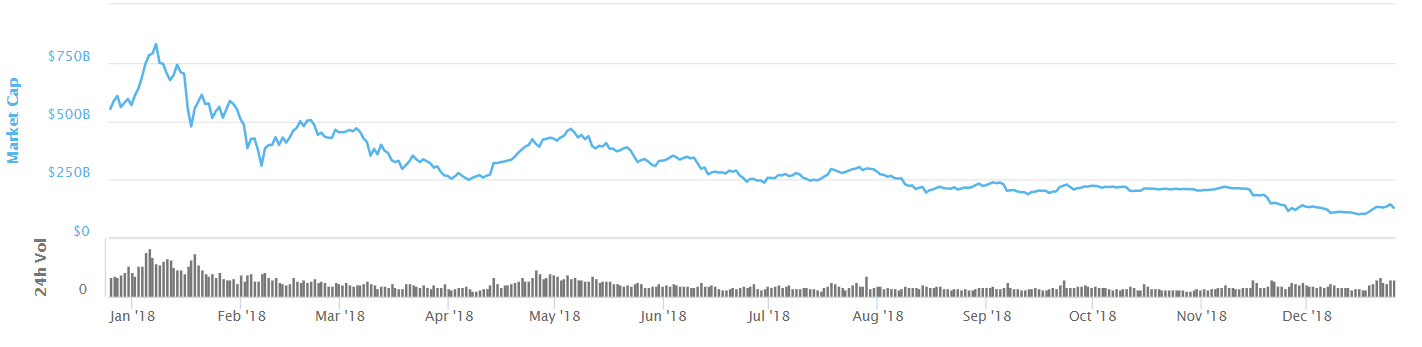

A year-long trend of the crypto market: Coinmarketcap.com

Today, Bitcoin is trading at $3,812, around 80 percent less than its apex value, while the condition of other major coins is even worse. Ethereum is down by 90 percent from its peak value, and Ripple, the second largest coin in the market, by 91.5 percent.

However, the recent Christmas bloodbath came after massive recovery signs showed by the coins in the past week that was triggered as the market reached another bottom - $102 billion in total capitalization.

Friends With the Banks

Ripple is one of the leading gainers in the last ten days as the coin reached from as low as $0.28 to the current value of $0.37 - a 24 percent rally. This was triggered by many market developments like the South Korean Blockchain firm Coinone’s tie-up with Ripple for remittance transfer to Thailand and the Philippines along with Binance’s addition of XRP as the exchange's base currency.

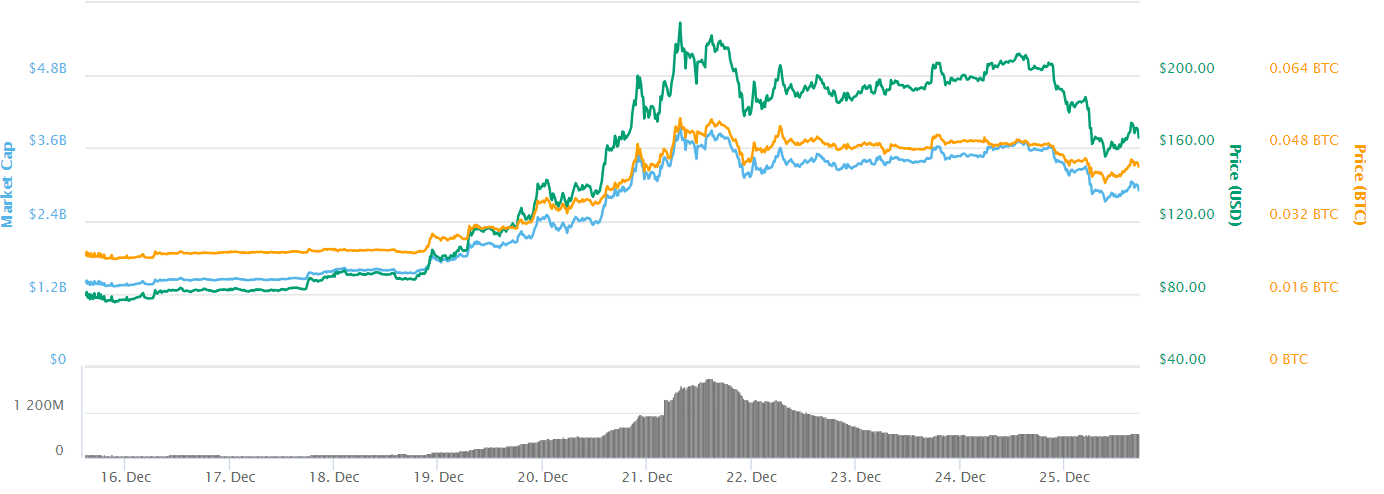

Bitcoin Cash, the split-sister of Bitcoin , is another token that bounced back from the abyss, gaining more than 55 percent. This was mainly triggered by Roger Ver’s development talks about Bitcoin Cash’s future. According to Cash.coin.dance, a website showing BCH’s hard fork statistics, “the Bitcoin Cash network has now been upgraded! 5461 blocks have been mined under the new consensus rules! Bitcoin Cash is currently 20.4% ahead on proof of work. Bitcoin Cash is currently 54 blocks ahead.”

However, in the last 24-hour span the coin shed 17 percent of its value and is trading around $169, according to Coinmarketcap.com.

BCH price chart for the last ten days: Coinmarketcap.com

Old, But Gold

Now to the original cryptocurrency Bitcoin. The coin does not provide a positive picture at first glance. Maintaining a strong bearish trend, the coin recently went below 3,300. However, the week-long bull afterward pushed the price above $4,200. But, due to lack of demand, the coin slipped below $3,900 again.

Despite the poor performance of Bitcoin in the past year, many established traders and investors are still going bullish for the digital asset.

The recent clash between the US President Donald Trump and the Congress has made a huge dent in the US stock market since last Wednesday. However, crypto investors are optimistic about this as Ross Garber, CEO of Gerber Kawasaki Wealth and Investment Management, pointed out that Trump’s recent policies might trigger an upward Bitcoin rally again.