When Bitcoin is cautiously approaching the $25,000 mark, the derivatives market remains bullish on the digital currency. More and more professional investors are betting on the future prices of Cryptocurrencies , and the platforms offering crypto derivatives instruments are setting records with their open interests constantly.

This growing interest in crypto derivatives is important for bringing the digital currencies closer to professional and institutional investors.

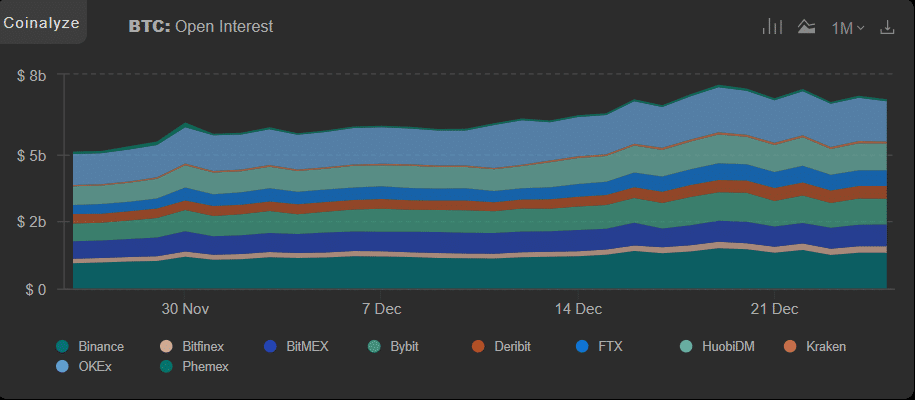

BTC Open Interest

Haohan Xu, CEO at Apifiny

“The enormous jump in crypto derivatives volume in 2020 Q1 teased us with the idea that mainstream institutional capital was starting to take interest in crypto. In the second half of 2020, that idea became a reality when Paypal, Square, MassMutual, MicroStrategy, and many public companies took in Bitcoin,” Haohan Xu, CEO and Founder of Apifiny, told Finance Magnates.

“This is only the beginning of mainstream institutional adoption and, in 2021, it will help drive derivatives growth faster.”

Options Is Going to Rule

Crypto derivatives providers are offering all types of instruments to traders, the most popular ones being options and perpetual swaps.

According to a projection by skew, the Bitcoin options market is set to exceed $10 billion in open interest in 2021.

#bitcoin options grew quickly this year with total open interest set to exceed $10bln in 2021 pic.twitter.com/QbccTVii8n

— skew (@skewdotcom) December 24, 2020

Three Arrows Capital’s Su Zhu also predicted that the options markets volume would become over 50 percent of all crypto derivatives.

Ulrik Lykke of ARK36

“With the increasing demand for assets such as bitcoin, many of the native crypto exchanges now use different kinds of derivatives as a way to stand out and cater to the needs of more sophisticated traders who are typically looking for more ways of trading other than just spot,” ARK36’s Co-founder, Ulrik Lykke said.

Limitations Persist

The derivatives market always echoes the institutional demand of any financial instrument. The 2017 Bitcoin rally peaked with the launch of derivatives by two US derivatives giants: the Chicago Board Options Exchange (CBOE) and the CME Group.

CME #bitcoin futures open interest new highs $1.4bln pic.twitter.com/YoWWrq4jKE

— skew (@skewdotcom) December 18, 2020

While the derivatives market outside crypto is already multiple times bigger than the spot market, it is not the same for crypto. And there are many limitations.

As Xu pointed out, it is unlikely that the crypto derivatives market outside Bitcoin and Ethereum will see the same surge.

“Due to their lack of Liquidity , the volume of all other non-mainstream cryptocurrency futures contracts is less than 10% of the market. Some of the runner up tokens to BTC and ETH already have 1 - 3% of total contract volume, but it is unlikely that they will gain significant market share in the future,” he said.

Additionally, the lack of regulations is keeping many professional players outside the crypto derivatives market. While exchanges like Binance and OKEx dominate in the crypto futures market, most of their demand is generated from Asian countries.

Moreover, the recent lawsuit against BitMEX and its co-founders by the US prosecutors is keeping Wall Street investors away from crypto derivatives.

“Recent events with exchanges such as BitMEX also show that the native crypto-exchanges are much more prone to regulatory scrutiny. The reason for that is that they operate in a field that, historically, has been very poorly regulated,” Lykke said.

“As a consequence, these exchanges have not been forced yet to adjust to the standards set out for the traditional markets.”

Furthermore, the UK’s ban on selling crypto derivatives to retail traders shows major regulators’ stance toward them.

The Crypto CFDs Market

Apart from the crypto exchanges directly offering crypto derivatives, brokerage firms are also offering synthetic products: an alternative market for derivatives trading. In recent years, brokerages jumped in to offer crypto CFDs with increasing demand for such instruments.

But, as Lykke pointed out, those trading platforms have disadvantages compared to exchanges.

“The major advantage of trading derivatives on native cryptocurrency platforms like BitMEX or Binance is that they offer settlement directly in the cryptos you are trading. In other words, you are not trading synthetic products that are vaguely linked to an asset, but rather you are trading something that is bound to the real deal,” Lykke told Finance Magnates.

“These platforms also offer around-the-clock trading options whereas the CFD providers typically follow the trading hours of the general stock market. This is a big issue as it means your positions will be locked through weekends when price fluctuations can still happen.”

Despite the shortcomings of CFDs, he is optimistic about the launch of more versatile CFDs products as well as their rising popularity in the future.

“The crypto derivatives market is just getting started,” Apifiny’s Xu added. “As mainstream institutions start to accept cryptocurrency, the crypto spot market will see a promising growth of average daily trading volume and market capitalization. This will add more volume and variety to the crypto derivatives market that has already been gaining traction over the past two years.”