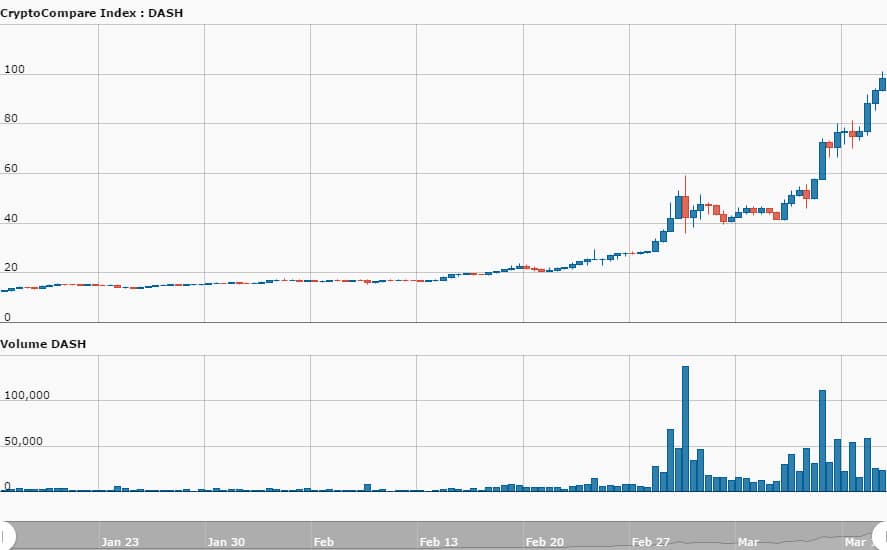

Already on an incredible rally recently, Dash has went into overdrive today. The price of the privacy-focused cryptocurrency is now trading around $100 - an amazing rise of 125% from a week prior and about 30% over the last twenty-four hours alone. As a result, the total market cap of the Dash Blockchain is now above $700 million.

We talked with Ryan Taylor, Dash's Director of Finance, regarding the cryptocurrency's performance.

To what do you attribute Dash's recent price rise?

Ryan Taylor, Director of Finance, Dash

"Dash’s recent valuation increases are the largest we’ve seen. This kind of dramatic growth is only possible due to a combination of many factors coming together at once. Year after year, Dash has built a track record of innovations that improve the user experience and apply Payments industry best-practices to our product. What I think you’re seeing is Dash’s emergence as a viable alternative to Bitcoin’s dominance of the cryptocurrency market, at a time when Bitcoin’s user experience as a payment network is suffering due to capacity constraints and a backlog of unconfirmed transactions.

Dash has also scored a number of large wins this year, including a successful rollout of a new version of our software, the opening of our offices at Arizona State University’s innovation center, and integrations with leading providers in the cryptocurrency industry. In short, Dash is firing on all cylinders and sizable investors are clearly taking notice."

Do you see the rejection of the Bitcoin ETF as having an effect on Dash's recent rally?

"My hypothesis is that Dash is doing well for other reasons, as our price rally started long before the ETF results. This weekend’s price movement was a continuation of a longer trend.

That said, the ETF rejection means that the value of cryptocurrencies may come from their utility as payment networks, more so than their utility as a store of value like gold. If that is true, then Dash is likely better positioned than Bitcoin long term, since we offer a better payment experience including instant transactions, user privacy, higher transaction capacity, and lower fees."