The biggest story about Bitcoin trading since the start of 2017 is the changing environment in China. Chinese exchanges, long the most active venues in the world, have been revealed to be under investigation by the central bank. This lead them to halt margin trading and impose fees, dropping the model that made bitcoin trading so popular in China.

Want to learn more? Bobby Lee, the CEO of BTCC, will be giving the keynote speech about Bitcoin and China at the iFX EXPO in Hong Kong, register now.

Now new data shows how, while this is still a new and ongoing situation, Chinese volumes are indeed going down, while the importance of other markets is emerging. The assumption is that algo-traders - those using high speed robots to take advantage of many tiny opportunities - can't profit as easily in a non-frictionless model and have stopped trading as much. Despite this, it is important to note that Chinese investors have not panicked and the bitcoin price remains strong, touching $1000 earlier today in China.

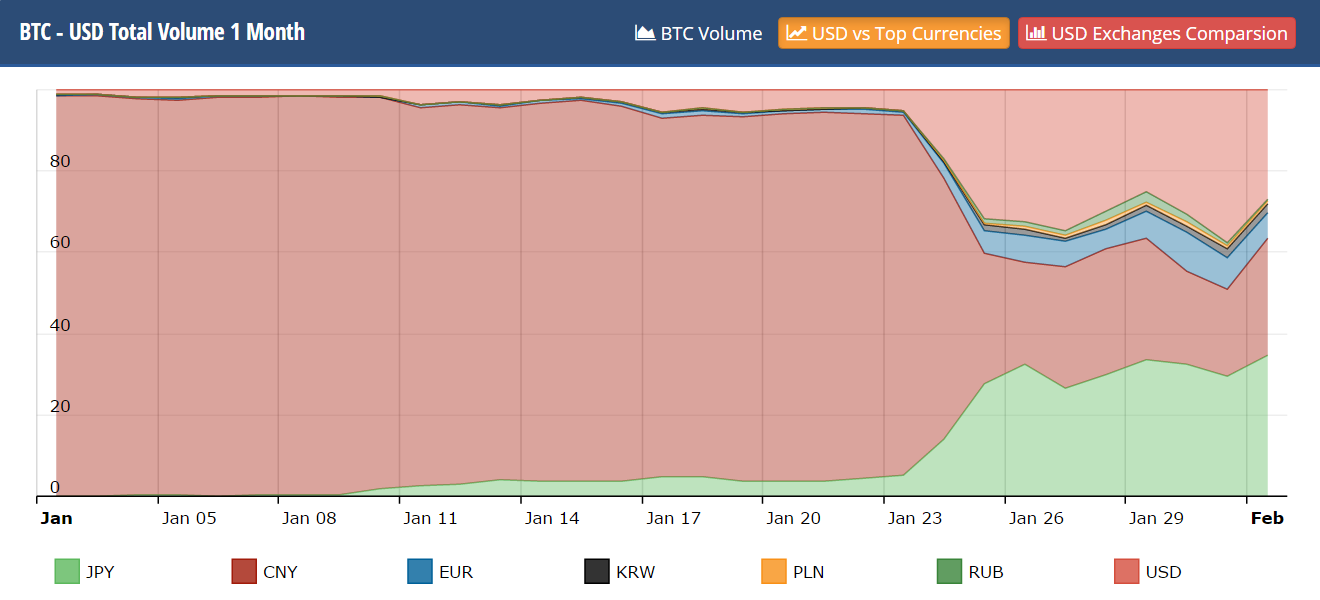

We asked real time cryptocurrency charting and forums site, CryptoCompare, to arrange global bitcoin trading volumes by corresponding currency and visualize the data.

As you can see, CNY trading volume now averages less than 30% of the global market, down from complete dominance at 98%. Surprisingly, USD trading is now also just around 30% despite being the most common currency to pair with bitcoin by all international exchanges. EUR and other European currencies make up around 10% of bitcoin volumes.

JPY volumes are now over 30% as Japanese bitcoin exchanges have picked up most of the market share lost by the Chinese. This could have implications for the way the bitcoin startup ecosystem develops, with focus moving from just entering China to reestablishing presence in Japan as well. Japan of course used to be home to the largest Exchange in the world by trading volume, MtGox, before its spectacular crash.

Charles Hayter, the CEO of CryptoCompare.com, explains how the figures show that the Chinese market is developing: "Volumes on Chinese exchanges have been dramatically impaired as fees have eaten into traders margins. There has been a shift from short term black box driven high frequency trading to longer term buy and hold strategies."