First Global Credit, a firm that allows cryptocurrencies to be used as collateral margin to trade stocks and ETFs, has started a search for talent to join their ‘Elite’ Private Trading Group. Membership in the group provides access to a "partly subsidized" professional-grade stocks and currency trading account on the platform.

The company says that while there are no educational or prior trading requirements, traders do need to provide a strategy statement of no more than 750 words indicating how they intend to use the Bitcoin collateral to make profits trading stocks, ETFs or currency on the platform.

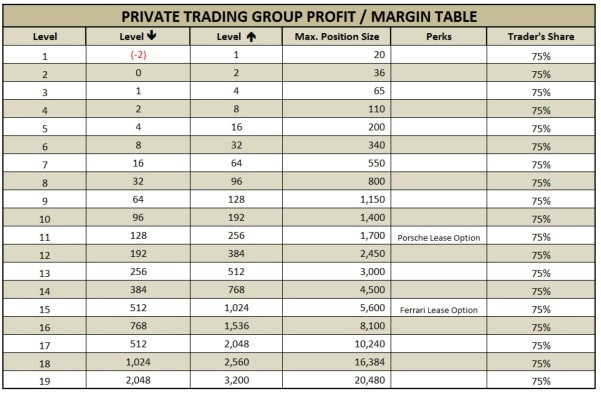

The "subsidy" works as margin trading as for every bitcoin the trader deposits, First Global matches that with another bitcoin. As the account is classed as professional these 2 bitcoins of collateral initially give the trader up to 20 bitcoins worth of capital (based on 10 times Leverage ) for stock and ETF trading. At the same time the trader can also move their collateral into and out of fiat currency to simultaneously take advantage of currency price moves. Profit is split between the trader (75%) and First Global Credit (25%).

Marcie Terman, First Global Credit

“I am so excited about seeing what kind of talent we attract with this initiative,” says First Global Communications Director Marcie Terman. “The Private Trading Program will give traders the opportunity to develop their skills with relatively low risk. The trader’s risk is limited to their original bitcoin deposit. First Global assumes any additional risk if things don’t go to plan and the market gaps strongly against a trader. We are doing this to make a profit but also to encourage people that would not normally have the opportunity to build a career in market trading It is my hope that we will attract people living outside of trading centers who ordinarily would not get a chance to pursue a career in market trading.”

“I believe to be a success in this program you need some kind of training, either self-directed or formal coupled with inborn talent,” continues Terman. “The strategy statements will not be judged on quality of strategy, but will prove the trader has thought through their approach to the markets. The statements will also make it possible to provide balance among the group members. The goal will be to include both people that have a strong view on currency as well as stock trading, people who short markets, trade intra-day as well as take the long-view. When commodity futures trading is released onto the platform in February additional traders will be invited to join the program as well."

Source: First Global Credit

Those interested in joining need to submit their trading strategy statement before Monday, the 15th of February.