In the past few months Ethereum has exhibited an amazing and explosive growth like no other cryptocurrency. Naturally, such a rally invites criticism from traders, proponents and competitors alike, and indeed Ethereum has been accused of being a pump and dump scheme.

Is there really any evidence of wrongdoing? To find out, Finance Magnates turned to Charles Hayter, the CEO and co-founder of CryptoCompare.com which provides data analysis in the field since 2013. Hayter drills down into the volumes and social networks activity to provide insights on what’s going on behind the scenes. (For the record, his company holds a quantity of ether and mining equipment with ether.)

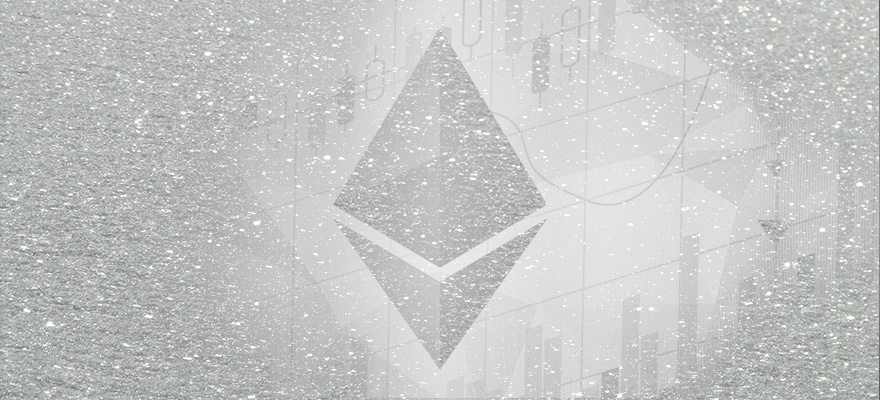

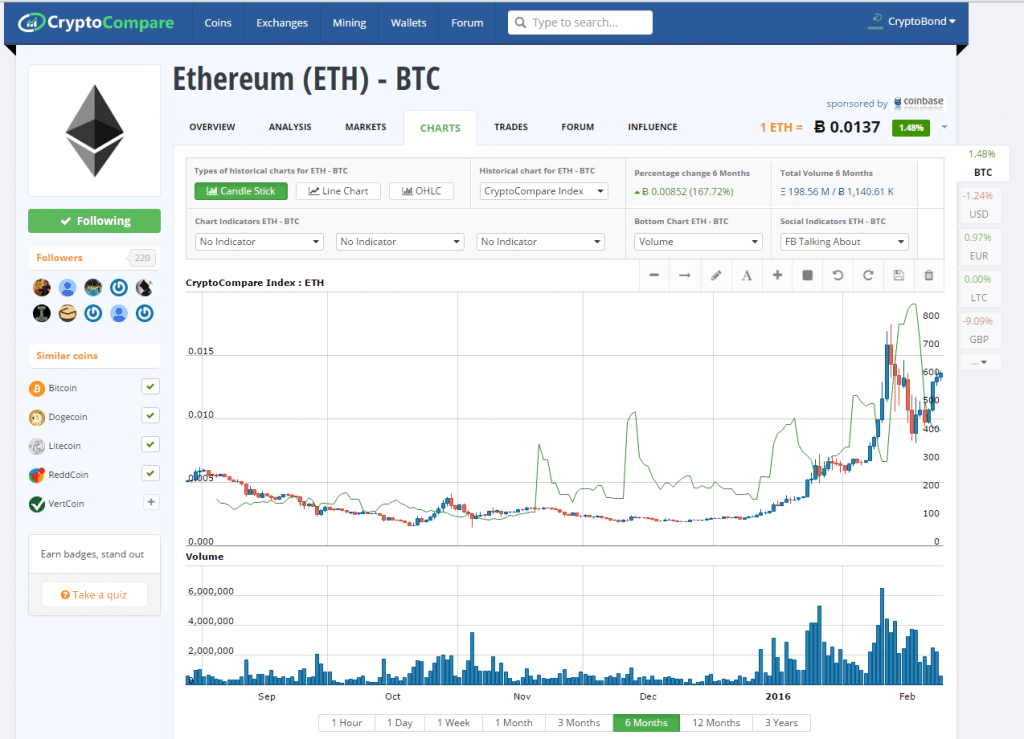

ETH-EUR 6 month price chart showing increasing volume

Let’s start from the end: do you think that ETH is under a pump and dump scheme?

There seems to definitely be an element of pump and dump surrounding the recent price moves although this is probably not the full story.

A lot of projects are starting to see an increased coverage in the news which is drawing people into looking at Ethereum more deeply. For example, the CFTC looking at Blockchain tech yesterday. This is a self-perpetuating cycle as the more the price moves, the more people become interested, the more articles are written and the more the price moves. Classically this has characteristics of a bubble but the underlying characteristics of Ethereum could be potentially huge. It comes down to valuation and whether the value is being overhyped or not.

At this stage is the value overhyped in your opinion?

Charles Hayter,

CEO, CryptoCompare.com

Valuing a Crypto Currency like ethereum is finger in the wind stuff. There is no method to say on ether should be worth x. The value speculators, traders and investors are placing on it come from its expected and hoped future utility in the ecosystem that is being built around it.

Is the network justifiably worth more than litecoin and ripple combined?

Again finger in the wind - but playing advocate for Ethereum there is an air of positivity in the projects coming off the pipeline and their tie ups - Slock.it being a case in point.

Would the network really benefit from a strong Ether if its purpose is to become a utility and not a storage of wealth like bitcoin?

In one sense yes and another sense no - With an increased price comes increased attention and development that fleshes out the ecosystem but the flipside is that running a contract or transferring some ethereum becomes more expensive. It's a balance.

Where are the volumes coming from?

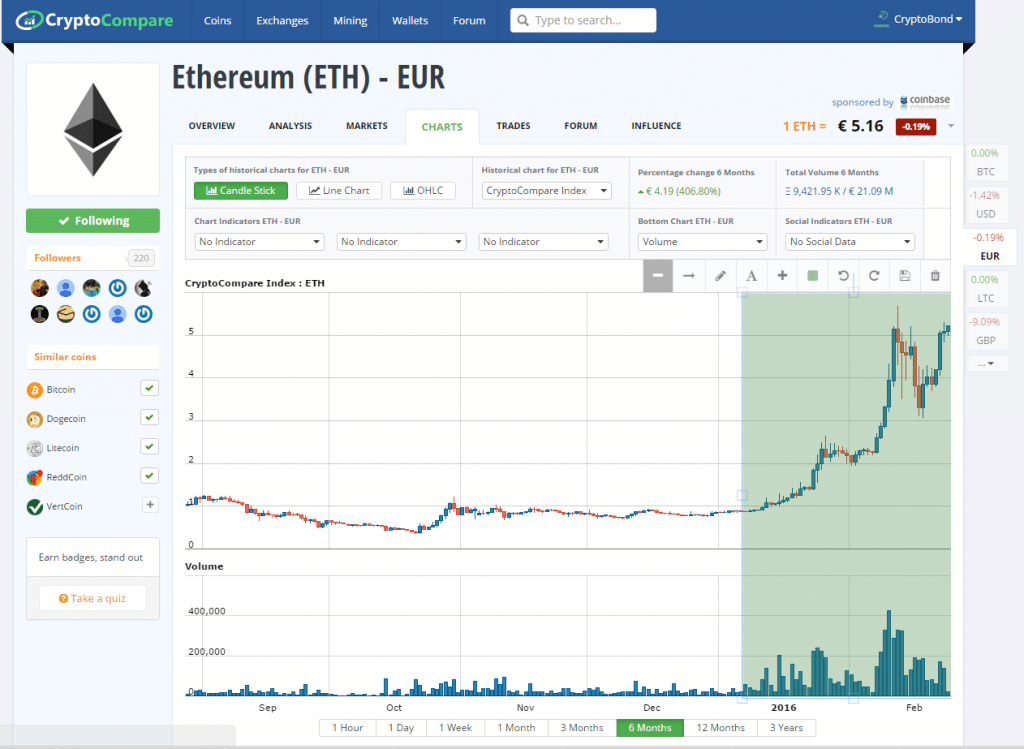

The majority of trading volume comes from Bitcoin to Ether - about 90% in general - with Poloniex controlling the majority market share at just over 50%. Gatecoin and Kraken make up the rest.

The other 10% is made up of Euro USD and Renminbi to Ethereum trading with the Euro pair strongest at 5%.

An interesting metric to watch is the growth of fiat pairs directly into ethereum - for example the Euro and CNY pairs were relatively nonexistent over two months ago.

ETH trading volume market share

Are investors leaving bitcoin?

It's a tricky one but I would say there are two trades going on. The speculators are looking at a "need for gains trade" - or more immediate capital gains. There is an aspect of flight to safety as bitcoin might be seen as some to be a ship in trouble and therefore losing USD market capitalisation. There will be continue to be a love hate relationship between bitcoin - in terms of moving from one to another as their fortunes ebb and flow.

Any evidence that bots are being used on the exchanges to pump ETH volumes?

It's possible but this has generally been the domain of Chinese exchanges playing "who's orderbook is bigger" on bitcoin CNY pairs by allowing zero percent fees for trading but relatively large exit fees to get the money out of the exchange. I would say there are black boxes out there taking advantage of the market conditions.

It seems as all across the board in the main ethereum exchanges there has been an uptick in volumes and this is more likely to come from the news volume than bots. But better market conditions will draw in more sophisticated traders.

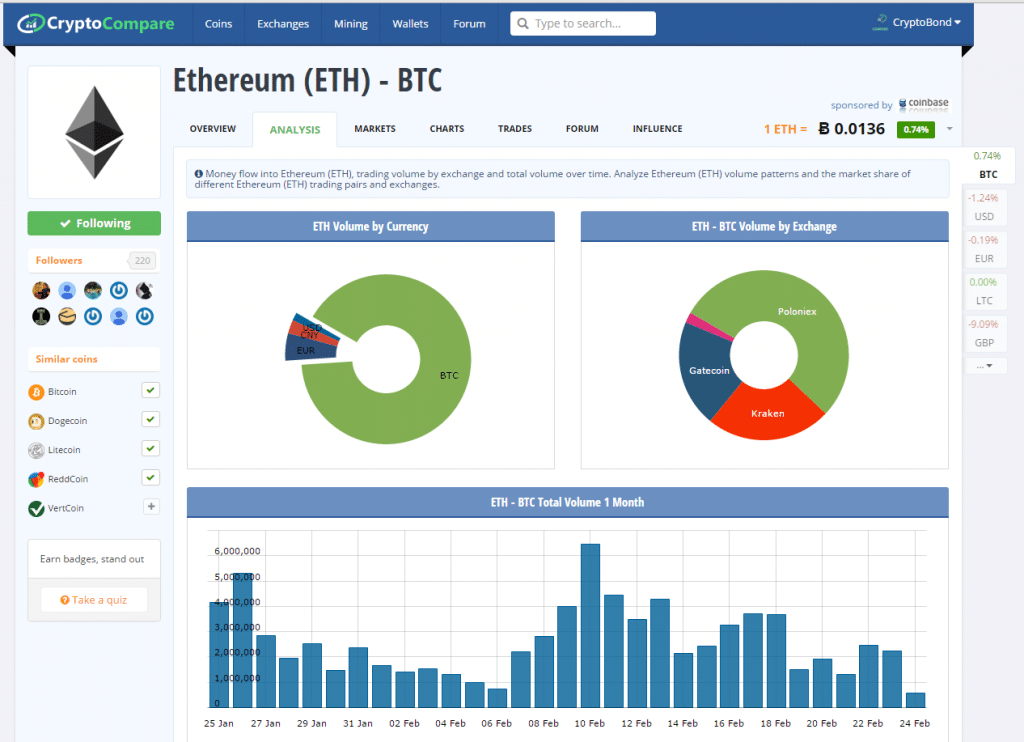

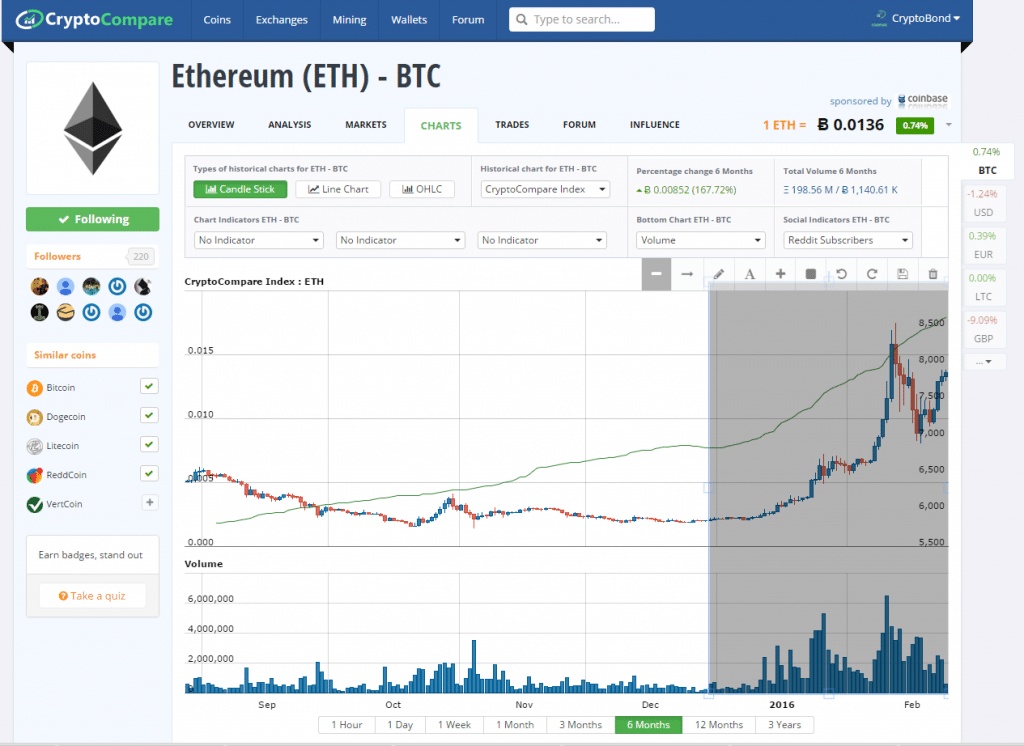

Our Social data shows the community growth over time and level of chatter on Reddit, Facebook and Twitter. A concerted campaign could replicate the increase that we have seen but it is unlikely - so this points to a news driving interested parties.

Bitcoin people accused ETH people of sending lots of SPAM, what was that about?

Yes - I received that too. That is the smoking gun in terms of a coordinated pump and dump team pushing the price up - which is well known in the crypto world. It's what gives this industry a bad name and makes the recent ethereum price moves look undeserved. I'm on the fence as to whether they are the catalyst that caused the rise or reaction to it - there are convincing arguments on both sides.

ETH-BTC 6 month price chart with Reddit Subscribers Overlay

Was it like a penny stock email?

Yes a basic penny stock cold call worthy of Gordon Gecko.

Here it is:

“Hello, I would like to apologize to you. I did not think my messages were very bad, but the overwhelmingly negative reaction surprised me. Thats why I want to say I am sorry and give you a bit of explanation.

The reason I started sending these messages is mainly because I believe in Ethereum long term. For a long time I tried discussing with people on ways to improve bitcoin, but anything that doubts the status quo is immidiately downvoted or censored.

When I found out about Ethereum I was amazed that most of the ideas I though of before were actually already implemented in it. So I wondered why I never read about it in the common information channels.

Then I realized, the censorship in /r/bitcoin is much more deep-rooted than just theymos, it is actually most of the community. So many of the participants really want the value of bitcoin to go up and get rich quick that they are incentiviced to downvote anyone who doubts the current decisions of the status quo.

Then I realized I can easily by-pass the censorship by sending private messages, there is nothing the status quo can do about that. All I want to do it try to inspire people like me to find the information they need to make a rational informed decision.”

And another one:

“Tired of waiting an hour for your bitcoin transaction to get 6 confirmations? In Ethereum it takes about 20 seconds for a confirmation.

With Ethereum the dream of having a truly decentralized financial system will finally happen. All real life applications of cryptocurrency can easily be implemented as and Ethereum Decentralized Application. There are tons of these special apps over at dapps.ethercasts.com.”

These were sent 22 and 23 days ago.

What's the bottom line?

The issue with crypto currency is that it is a wild west and with any new industry there are manias, bubbles, panics and crashes. Look at railway stocks at their birth, Kimberly and Klondike too - and these always attract an unscrupulous set of characters. The world of crypto is the same from cloud mining scams and new Cryptocurrencies being launched and pumped and dumped. The unfortunate thing is it’s very difficult for users new and old to get hold of all the information - and very easy for the scam operators to pull the wool over people's eyes.

ETH-BTC 6 Month Social Date Chart Showing Facebook Activity by Period