Shares of Overstock.com (NASDAQ:OSTK) fell hard in after-hours trading on Monday after reporting revenues that missed analyst estimates.

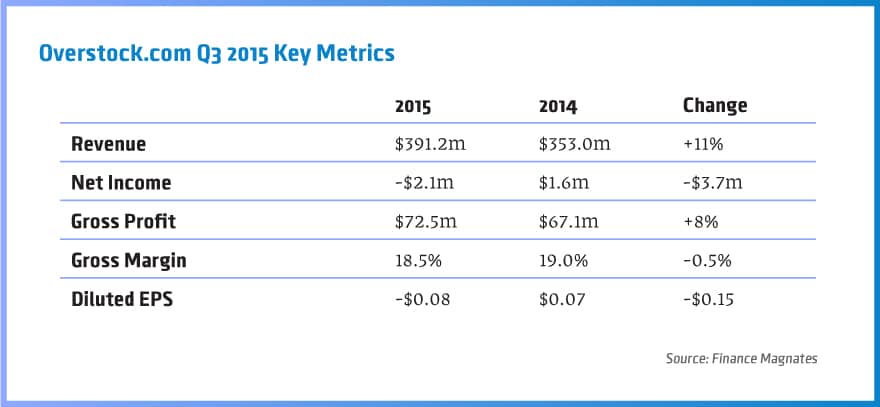

The e-tailer reported Q3 2015 revenues of $391.2 million, an 11% increase year-over-year, but 2.6% below analyst estimates of $401.6 million.

It reported a net loss of $2.1 million, or 8 cents per share, down from a net profit of $1.6 million one year ago.

Shares fell by 12.35% in after-hours trading to $14.90, just above their 52-week low of $14.85, and bringing year-to-date losses to 38.6%.

Shares of Overstock.com slumped by 12.3% after falling short in Q3 earnings. Chart source: Google Finance

[gap]

Overstock was one of the highest profile companies to accept Bitcoin for payment when it did so in early 2014. Months later, it embarked on a project, Medici, to use the Blockchain to streamline the settlement of securities trades.

The company is now identified more with its crypto ambitions than its e-commerce business, and indeed, these ambitions were a major highlight in the earnings report.

CEO Patrick Byrne lauded the blockchain’s potential and noted that by mashing together “cryptotechnologists” with various friends within Wall Street ("yes, I still have some") and IP lawyers, the company has filed for five patents. He expects that they “may have significant value some day.”

He further mentioned the company’s acquisition of SpeedRoute, a trade routing technology firm that would help connect Medici’s crypto platform to the broader markets. He framed the acquisition as accretive to earnings.

The costs of Medici in the quarter ($3.2 million) were enough to swing the company to a loss- its first in 15 quarters. Direct costs of roughly $8 million are expected for the year, but the real costs are higher when accounting for shared overhead and dual-tasked employees. Overstock's costs in general were controlled, he said, and the company underspent its internal budget.

Byrne believes, “for obvious reasons”, that Medici can in fact be co-managed with the seemingly unrelated online retail business.

More Highlights

Though not discussed in the report, the company’s financials may have also been impacted by other holdings, though perhaps only marginally. Unlike most businesses accepting bitcoins, Overstock elects to hold onto a significant portion without having them converted to fiat currency. Bitcoin’s value has declined significantly since the peak in bitcoin-based sales during the first half of last year, but fortunately for Overstock, the e-tailer has fallen far short of its estimates for such sales.

Also, the company recently revealed that it has been accumulating precious metals since the last financial crisis in order to weather against the next one. Gold has appreciated since March 2009, but has lost roughly one-third of its value during the past three years.

Byrne said that Overstock’s main operation, the online retail business, underperformed because of changes in online search algorithms such as Google, inadequate execution in the transition from a discount to rewards program and dynamics in the economy (despite “Janet Yellen's Magic Money Machine”).

Byrne also provided an update on his long-running battle with Wall Street, which includes legal action involving prime brokers in the California Supreme Court. In the past, Byrne has alleged that short sellers were unfairly driving down the value of his company’s stock. He indicated that the earnings release was delayed in the expectation of a major announcement on this front, and regulatory requirements prevented further delay.

Byrne has been a vocal critic of US monetary policy and Wall Street, taking strong issue with practices such as naked short selling- issues he hopes to address with Medici.

He ended the report by praising the company’s development of human capital and noted that many of its “hungry entrepreneurs” are female.