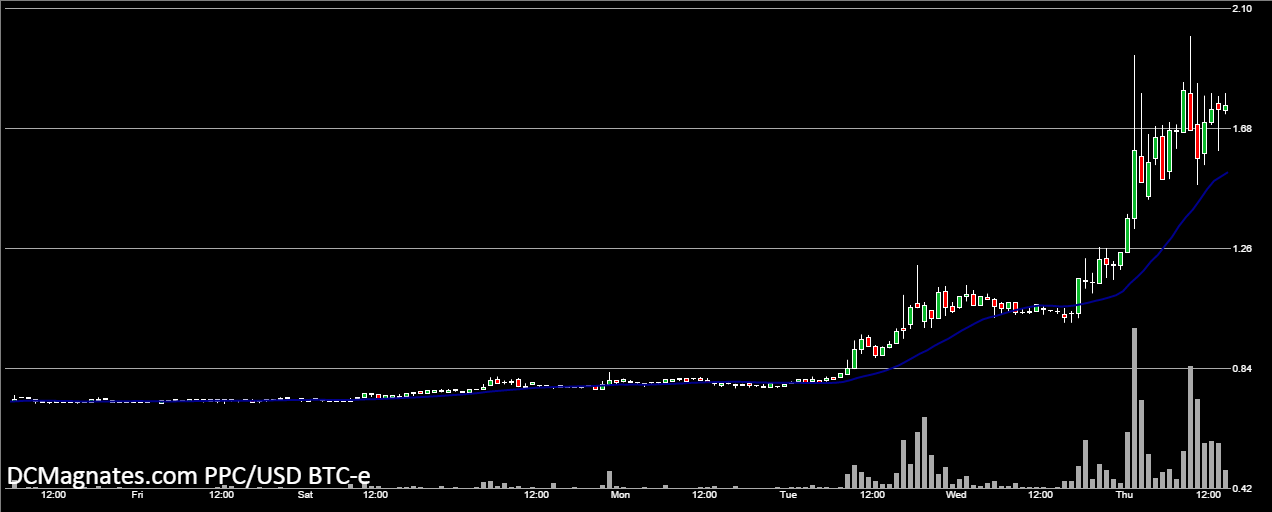

Peercoin (PPC) is having its biggest rally since late 2013, soaring 140% in the past 60h. It is now trading at $1.75 (4 mBTC). This, despite the declines experienced in Bitcoin and the broader crypto markets today.

Peercoin had been stuck in a vicious cycle of decline for much of 2014, falling by more than 85% since its peak in early January. It is still a long way off but the jump has been large enough to bring it back to within 57% of its all-time bitcoin-denominated highs.

It has thus easily reclaimed 5th spot in market cap rank, returning the favor to Dogecoin, which had overtaken Peercoin during a rally of its own last week. PPC's total valuation is now $38 million. It ranks right behind Litecoin among mineable currencies.

Over $3.3 million worth of PPC has been traded in the past 24h, 2nd only to Bitcoin.

Rises of such a scale have become a rarity for mature, top ranked coins. They are more typical for new or small cap alts, often pumped to unrealistic levels sustained for minimal periods of time.

The rise has been attributed to the announcement of the coming launch of Nubits for September 23. Nubits is a project launched by the developers of Peershares, which seek to decentralize finance and have dealings settled in Peercoin. Beyond this, few details are known about the project. The website will get into specifics following launch and currently showcases the countdown toward it. It does make reference to comments by Deloitte in June:

"Just as speculators buy and sell global currencies to profit from fluctuations in currency value, increasing numbers of bitcoin speculators are now investing short term in the virtual currency, which in turn fuels Volatility . This has reduced bitcoin’s utility as a medium of exchange—no one wants to use bitcoin to make future commitments, or even buy a cup of coffee, when its value can change by 30 percent overnight. Unless bitcoin’s volatility settles, it will be used less as a currency and more as a vehicle for speculation.”

The partial irony of the whole thing is that prices have skyrocketed because of something designed to help stabilize them. The understanding is that the coin will indeed have more value to offer when not subject to wild price swings. Such swings have been highlighted by many as one of the major drawbacks of Cryptocurrencies in their pursuit for equal treatment as money.