Gemini, the cryptocurrency exchange founded by the Winklevoss twins, is adding support for Litecoin, the 7th largest cryptocurrency with a market valuation of over $3 billion.

Following approval from the New York Department of Financial Services (NYDFS), Gemini will begin accepting deposits of Litecoin on Saturday, October 13th at 9:30 am EDT, the exchange said in a Medium post.

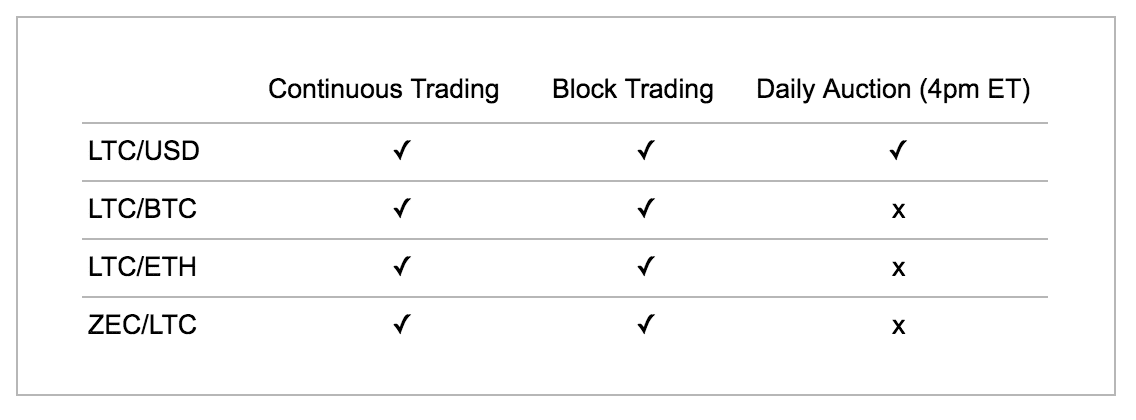

Litecoin trading pairs and services at Gemini

In addition to being approved to custody and trade Litecoin, Gemini says it expects to announce support for Bitcoin Cash, with a market value of $7.8 billion, though details about when this cryptocurrency might go live remain unknown.

Winklevoss explained that part of the delay of Bitcoin Cash (BCH) is its possible hard forks arriving in mid-November.

“Some of those forks lack the replay protection feature that would be required for Gemini to safely support Bitcoin Cash. Because of this situation, we are delaying our launch of Bitcoin Cash deposits, withdrawals, and trading until late November, after the forks have passed and we can evaluate the health of the Bitcoin Cash ecosystem,” it added.

Beyond those Cryptocurrencies , the Gemini exchange also trades Bitcoin, Ethereum and Zcash. All Gemini’s cryptocurrencies are members of what it calls the “Nakamoto Family Tree,” which are derived from the same open-source bitcoin codebase. Collectively, the exchange is the 39th largest in the world and its trading volume over the past 24 hours is $33 million, according to Coinmarketcap data.

Meanwhile, Gemini is taking a proactive approach with regulatory clampdowns looming every now and then. It has recently hired Nasdaq’s SMARTS Market Surveillance, an industry benchmark technology used across Wall Street, to add more security and identify criminal trading behavior in its venue.

The development is also important for Litecoin bulls, as the coin has been in a bear trend since the beginning of the year. However, Litecoin gained almost 20 percent in October amid a border bull rally in the crypto market that also came to an end this week.