Prices of Bitcoin continue to rally today, hitting an all-time high of $259.97 on BitStamp. Since spiking rapidly to $245 in April, prices of bitcoin tanked to just over $50 in a few days, but have since spent the next seven months more or less around $100. During this time, except for several spikes lower, including a dip to $80 when Silk Road was seized by US officials, prices could be categorized as stable. This is in part due to the continued adoption of the digital currency which has widened public interest and created a net of demand during sell-off periods.

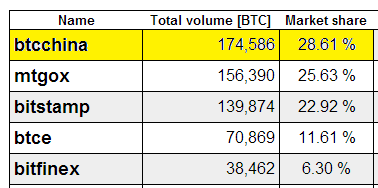

The current rally which started with prices around $125, has its origins in the announcement from Baidu that it would begin to accept bitcoins as payment for its Jaisule, firewall and DDOS services. Since that time, demand from China has grown rapidly. As a result, BTC China, the country’s leading bitcoin Exchange has seen its overall market share of transactions triple to just below 30%, as it holds the top spot among major exchanges for the last three and seven day periods. (On a side note, today’s volume is being led by MtGox which has seen its market share plummet from around 60% to below 30%. This probably has more to do with the record taking place which has reactivated interest in the exchange from existing account holders.)

Bitcoin Exchange Market Share Last Seven Days (Source: Bitcoinity)

Based on current fundamental demand coming from China, there is little stopping prices from continuing to rally until we see market share from the country beginning to subside. As a result, while we have seen prices react to DDOS attacks and FBI seizures, over the short term, it’s a Chinese-driven market, with the country being the main point of future headline risk.