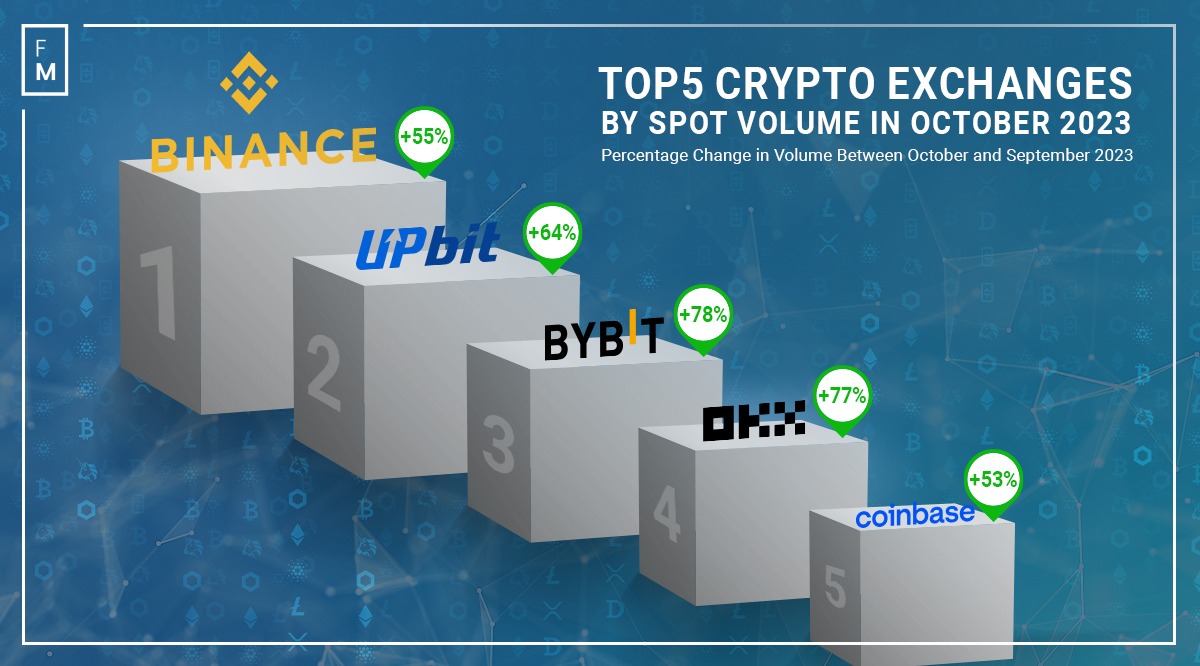

This year's cryptocurrency "Uptober" did not disappoint and benefitted the largest cryptocurrencies and centralized exchanges. Bitcoin's (BTC) nearly 30% increase drove retail trader activity, impacting a significant growth in spot volumes among the TOP 10 exchanges. On average, volumes grew 54% in October compared to September.

According to data collected by Finance Magnates Intelligencer, the total volume increased month-over-month (MoM) $153 billion, bouncing back from the worst month since the beginning of 2023.

Crypto Volumes Up in October 2023, ByBit Climbs to the Podium

October has historically been one of the best months for cryptocurrencies and the returns they achieve. The term "Uptober" is aptly coined, as it captures the month's bullish trend in cryptocurrencies and marks the start of the year's most robust quarter for digital assets.

Expectations for October were high, and ultimately, no one was disappointed: neither traders nor crypto exchanges. For record-holders such as ByBit and OKX, monthly volumes increased nearly 80%.

Dynamic leaps also caused reshuffles among the leaders; Binance and Upbit maintained their positions, but Huobi had to give way to Bybit, which found itself in third place on the podium. Bybit thus increased its market share (among the TOP 10 exchanges) from 4% reported in September to 8% in October.

Market Breaks the Unfavorable Trend

Although year-over-year (YoY) comparison of volumes did not turn out so favorably, some exchanges managed to break the trend observed in recent months of much worse results than in 2022. For example, YoY volumes for Binance and Coinbase fell 50% and 35%, respectively, but the same volumes for Upbit and Huobi grew over 50%.

Ultimately, the average result for the TOP 10 platforms comparing October 2023 to October 2022 was -6%, however, a month ago it was almost 70%.

The fluctuations in trading volumes for individual exchanges have been summarized in a table below:

Exchange | October 2023 Volume ($B) | Monthly Volumes Change | Yearly Volumes Change |

ByBit | $35.24 | +78% | +26% |

OKX | $31.17 | +77% | -31% |

Upbit | $60.32 | +64% | +53% |

Bitfinex | $3.91 | +57% | -43% |

Binance | $201.55 | +55% | -49% |

KuCoin | $10.12 | +53% | -71% |

Coinbase | $31.16 | +53% | -34% |

Kraken | $16.35 | +43% | +20% |

Huobi | $30.54 | +36% | +62% |

Bitstamp | $3.98 | +25% | +4% |

Best Crypto Market Performance since January 2021

According to a separate report prepared by CCData, the total volume of cryptocurrency exchanges for spot and derivatives trading grew for the first time in four months in October to $2.57 trillion. This is the highest total volume since June and the strongest single-month growth in almost four years since January 2021.

The report also shows a rise in CME options volumes to historic highs of $1.75 billion for BTC and $532 million for Ethereum (ETH), up 142% and 107%, respectively.

"The increase in trading volumes on the CME exchange hints at rising institutional interest in BTC and ETH as the markets enter a new cycle," CCData commented in the report.

The October increases in the cryptocurrency market, like those in June, were driven by news that the approval of the first spot ETF fund for BTC was getting closer. Although these reports ultimately proved unconfirmed rumors, BTC maintained its gains, adding another portion in November. As a result, Bitcoin is currently the most expensive it has been in over 18 months.