Web3 startup funding saw a significant slowdown at the end of 2022, according to data gathered by Crunchbase. The prolonged cryptocurrency winter and the high-profile collapse of the FTX exchange were two main reasons behind the recent slump.

Web3 Funding Plummets from $9.3b to $2.4b

The cryptocurrency industry recorded rapid growth during the pandemic, and all Web3-related projects began to gain alongside, dominating in 2021 and most of 2022. However, the last quarter brought a marked slowdown and a drastic drop in the number of funds pumped into the industry.

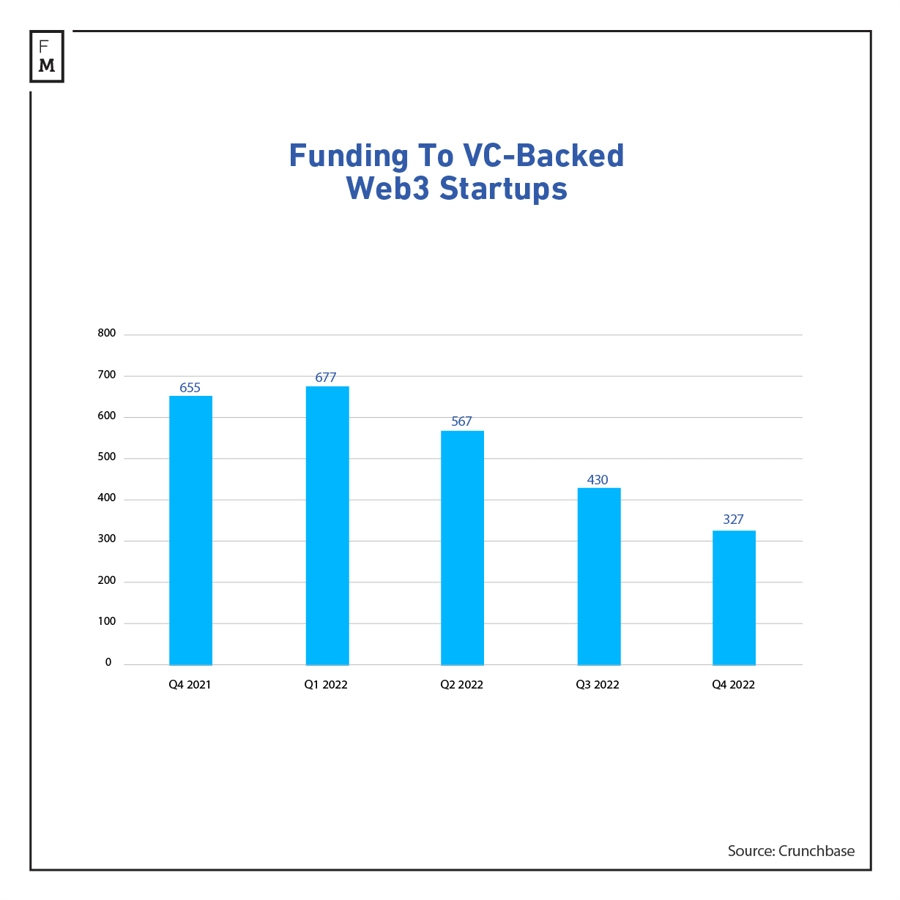

In Q4 2022, venture capitalists made 327 investments with a total value of $2.4 billion, which is down nearly $7 billion from the same period a year earlier. In Q4 2021, the Web3 industry witnessed 655 financings that raised $9.3 billion.

The beginning of 2022 maintained a good pace, with $8.9 billion raised in Q1, but a slowdown was evident in subsequent quarters. In Q2 2022, Web3 startups raised $6.8 billion through 567 deals; while in Q3, it was only $3.3 billion in 430 deals.

Only four companies in the Web3 space announced funding rounds worth more than $100 million last quarter, and it was definitely less than 20 similar rounds a year earlier.

Check out the latest FMLS22 session on: "NFTs for Fintechs: From Asset Class to the Machinery of Ownership."

2022 Still a Good Year for Web3

Despite substantial declines since the middle of the year, Web3 startups managed to close 2022 with $21.5 billion of additional capital raised in 1,986 deals. A year earlier, there were only 88 more, but with significantly higher overall funding of $29.2 billion.

Two years ago, Robinhood and NYDIG managed to raise $1 billion. In 2022, the most significant funding was $450 million for blockchain startup ConsenSys.

Fintech Funding Falls with Web3

Last year was generally worse for startups than the record-breaking 2021, according to Innovative Finance. A report published in January showed that global support for the fintech industry shrank by 30% to $95 billion. Meanwhile, the number of completed investments dropped from 6,146 to 5,263.

The UK proved more resilient to global declines, with the local market attracting $12.5 billion, compared to $13.5 billion reported a year earlier. Rising interest rates and market shocks triggered by the war in Ukraine interrupted the fintech industry's decade-long steady growth.