Oracles are an absolute necessity for the development of better and more useful blockchains, and understanding their roles in the crypto universe and in the stock market can lead to a better understanding of where tech and finance are going in the future.

As advanced blockchains use smart contracts (agreements on the blockchain which only execute if certain conditions are met), the role of oracles is quickly becoming more and more important, but can they take the stock market to a completely new level?

Understanding How Smart Contracts Work

Smart contracts have gone from simple lines of code which stated: “if User 1 gives User 2 10 X tokens, then User 2 will in turn give User 1 5 Y tokens,” to now requiring real-world, real-life conditions and events to be verified and reported, meaning that they have finally 'breached' into the real world.

As an example of this, theoretically, you can now write insurance contracts where a user commits to paying a monthly premium and, in the event of a flood, house fire, and so forth, the smart contract will pay him or her a specified amount, or a farmer can do the same as means to protect his or her crops.

The question you are probably asking is obvious: how would a blockchain know if a house burned to the ground or a farmer lost his or her crops?

Enter the Oracles: What Is an Oracle and What Do Oracles Do in Crypto?

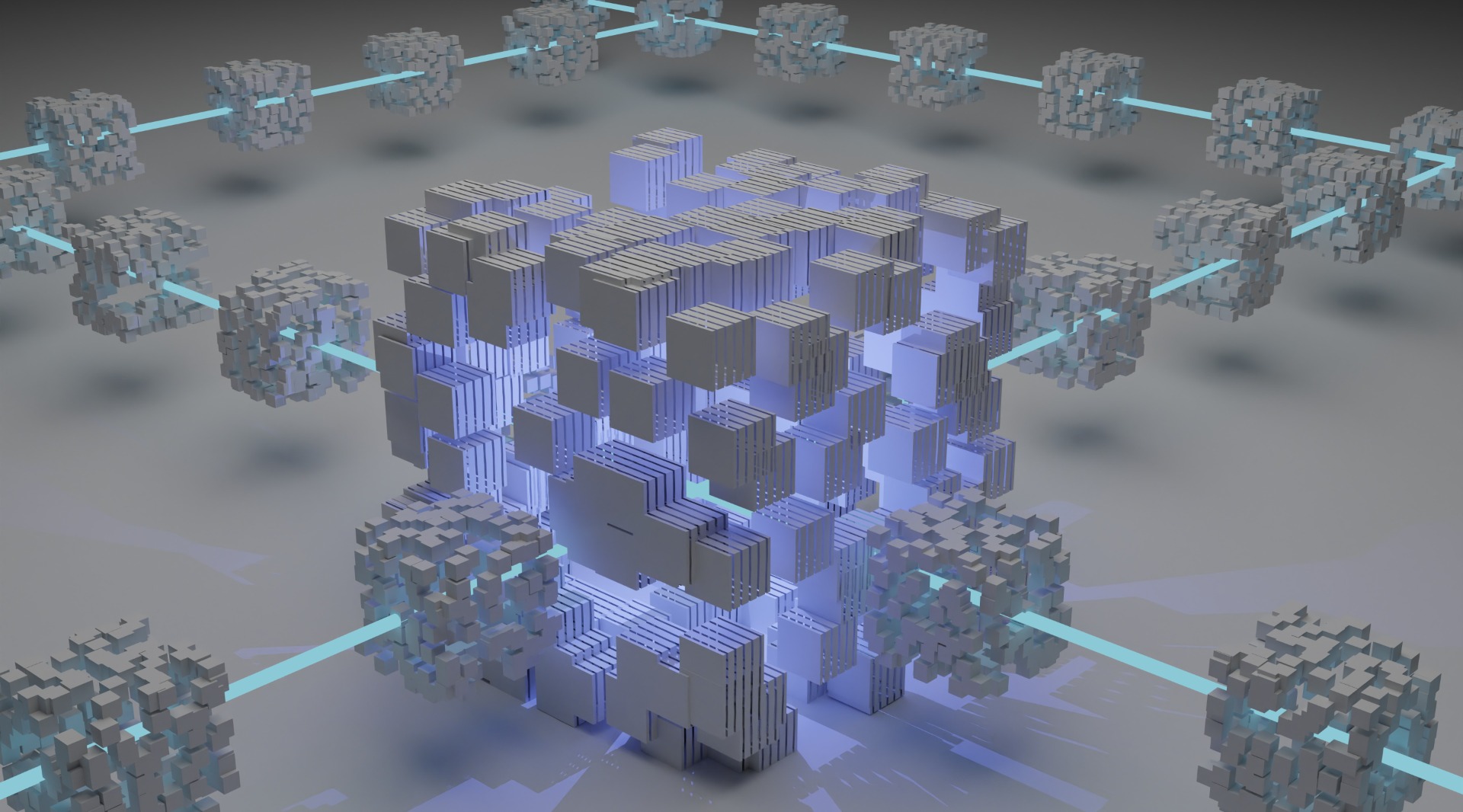

An oracle is a trusted third party that feeds the blockchain or smart contracts with reliable data outside the information it could have access to.

As a blockchain is only programmed to store data and transactions, it is not able to 'see' outside of its own code, as such, it is simply not possible for it to query an online search engine, ask for more information, and verify the authenticity and veracity of its results.

As such, smart contracts can be written in a way that they rely on trustworthy third parties with said processes (Oracles).

An important clarification must be made here: oracles are usually coded, which users trust and not a real physical oracle.

What Do Oracles Mean for the Stock Market?

An oracle can be programmed to return innumerous information, including stock prices.

As such it is not a very big step from here to create a price oracle, meaning a synthetic token which follows the price of a stock.

Thus, price data can easily be streamed onto the blockchain and by doing so, investors from all over the world could invest in stocks without ever having to present their social security numbers, report their taxes, and so forth.

It would basically operate as a mirror protocol such as the M-GOOG token, which was developed to exactly mirror the price of the real Google stock.

Wrapping Up

It might not be too long before we finally see a fully decentralized stock exchange on a blockchain.

Many projects out there are claiming that they are the ones which will become the future of finance, but the question which matters the most still stands: which one will finally do it?