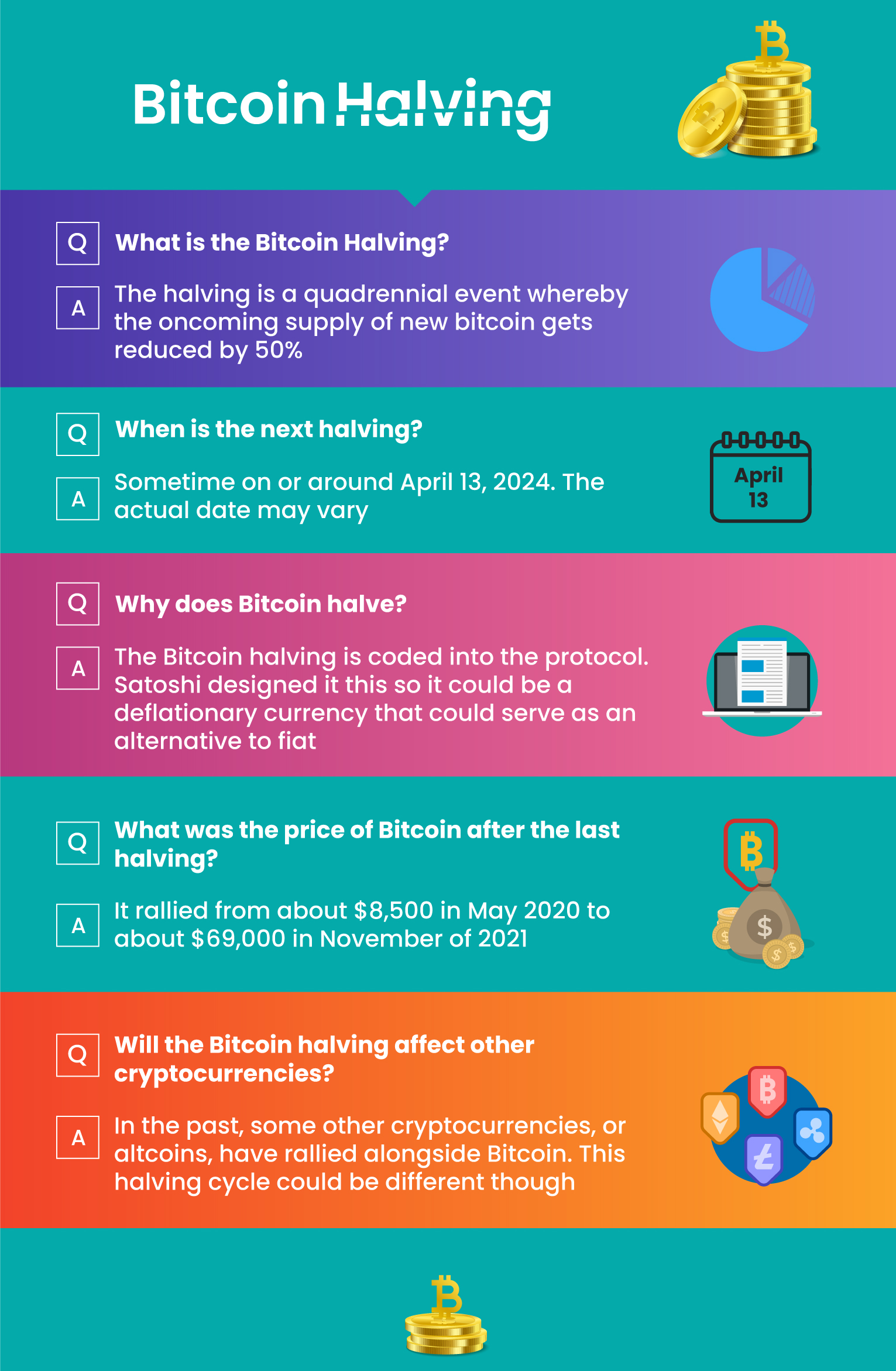

With spot Bitcoin ETFs having been approved the same year that the halving is set to take place, many newcomers to the space may be wondering: what is the Bitcoin halving? This is a common question among those wanting to learn more about the Bitcoin protocol. Expected to be the most important event in Bitcoin’s history, the 2024 halving is expected to occur sometime on or around April 13.

Here we will cover the basics of how the Bitcoin halving works, what the Bitcoin halving is, why it happens, and what it may mean for markets this year and beyond.

Understanding the Bitcoin Halving

Before looking at the potential impacts of the 2024 halving, let’s discuss how the Bitcoin halving works.

Bitcoin operates on a deflationary model, where the reward for mining new blocks is halved every 210,000 blocks, or approximately every four years, a process known as the "halving." This event is significant because it reduces the rate at which new bitcoin are generated, thereby limiting supply. Bitcoin is the only asset in human history to have a fixed supply that never increases, making it the hardest currency ever known.

This aspect of the protocol cannot be changed due to the decentralized distribution of nodes. For the supply limit of Bitcoin to be increased, the majority of nodes would have to agree to such a change. While this might be possibly in theory, it’s hard to imagine a scenario where it becomes reality. Thousands of independent node operators around the world would have to agree to making themselves poorer and reducing the value of Bitcoin as a whole.

The 2024 halving will slash the block reward from 6.25 bitcoin to 3.125 bitcoin. Historically, each halving event has been followed by a notable increase in bitcoin's price, although past performance is no guarantee of future results. However, the anticipation alone can lead to increased trading volume and price volatility, as we’ve seen in recent weeks.

Contrary to what some market commentators may say, the halving can never be truly priced in before it happens. That’s because much of the selling pressure in the market comes from miners, who must sell coins to cover their operating expenses. After the halving, this selling pressure gets reduced by 50%, as the miner revenue declines by the same amount.

What Happens to Miners after the Bitcoin Halving?

Miners can struggle after the halving, as they see a significant reduction in revenue. Larger, public mining companies can have a lifeline by accessing capital markets for further investment. In the absence of a swift increase in the Bitcoin price, some smaller miners may be forced to shut down.

As a result, the network’s hash rate tends to come down for a time after the halving. This then leads to a difficulty adjustment downwards, which can eventually make it possible for more miners to come back online.

The Impact of the Bitcoin Halving

This year’s halving may be the most important halving event in Bitcoin’s history. There are several converging factors that haven’t been present during previous halving cycles. Some of these include:

- The emergence of spot Bitcoin ETFs;

- increased regulatory clarity surrounding Bitcoin, cryptocurrencies, and exchanges;

- a washout of many bad actors from the previous cycle (think FTX, Celsius, Voyager, etc.);

- potential nation-state adoption of bitcoin (El Salvador and rumors of other, larger countries);

- and, corporate adoption of bitcoin (Microstrategy, other public Bitcoin companies).

In the past, the halving has been a significant event for both Bitcoin’s price and the industry as a whole, even in the absence of the above variables. It stands to reason that this time around could be astronomical given the compounding effect of these new developments.

In addition, because retail investors can now gain exposure to bitcoin through ETFs, there could be ripple effects throughout the entire financial system. How this might take shape is anyone’s guess.

A few of the more certain impacts of the halving and associated bull market include:

- an increase in crypto transactions. Merchants who accept cryptocurrency as payment tend to see a rise in purchases, as holders look for ways to take profits;

- increased trading volume. This can be so extreme that exchanges encounter difficulties. For example, Coinbase suffered an outage on February 28 that led to users seeing a “0” balance in their accounts for a time, as the Bitcoin price rapidly shot up to $64,000;

- renewed investment and hiring in the crypto space. Bitcoin and blockchain-related companies tend to do a lot of hiring during this time, and investors look to fund more startups;

- and, speculation and market sentiment. Not surprisingly, market sentiment tends to get euphoric, and speculation in Bitcoin and altcoins can reach extreme levels. The legendary volatility of the asset class shows its full potential during this time.

And most entertaining of all, the creation of new Bitcoin-related memes tends to skyrocket during this period.

Stay tuned to social media for more on the subject.

Bitcoin Halving Conclusion

The Bitcoin halving is a pivotal event, occurring approximately every four years and reducing the rate at which new bitcoin comes online. As we approach the 2024 halving, there’s a lot of anticipation for its potential impact on Bitcoin's price and the broader industry.

With the emergence of spot Bitcoin ETFs, increased regulatory clarity, and growing adoption by both nations and corporations, this halving could be more significant than ever before. While the exact outcomes remain uncertain, past halving events have historically led to increased trading volume, market volatility, and renewed investment in the crypto space. As we navigate through this exciting period, investors may want to stay informed and prepared for potential opportunities and challenges ahead.