Bitcoin's price (BTC) is making significant gains on Tuesday, January 14, 2025, adding over $2,000 to its value. However, Monday saw the market shaken, with the price briefly dropping to a two-month low below the critical $90,000 psychological level.

In this article, I review what triggered the sudden drop, why the Bitcoin price is going up today, and how to interpret the bullish pin bar above the 50-day exponential moving average—a potentially strong buy signal.

Why Is Bitcoin Price Up Today?

On Tuesday, Bitcoin is trading above $97,000 on Binance, marking its highest value in a week. The cryptocurrency is currently up 2.7%, with altcoins following suit. Ethereum (ETH) has gained 4.9% over the past 24 hours, reaching $3,200, while XRP, the third-largest cryptocurrency by market cap, has risen 7% to $2.56.

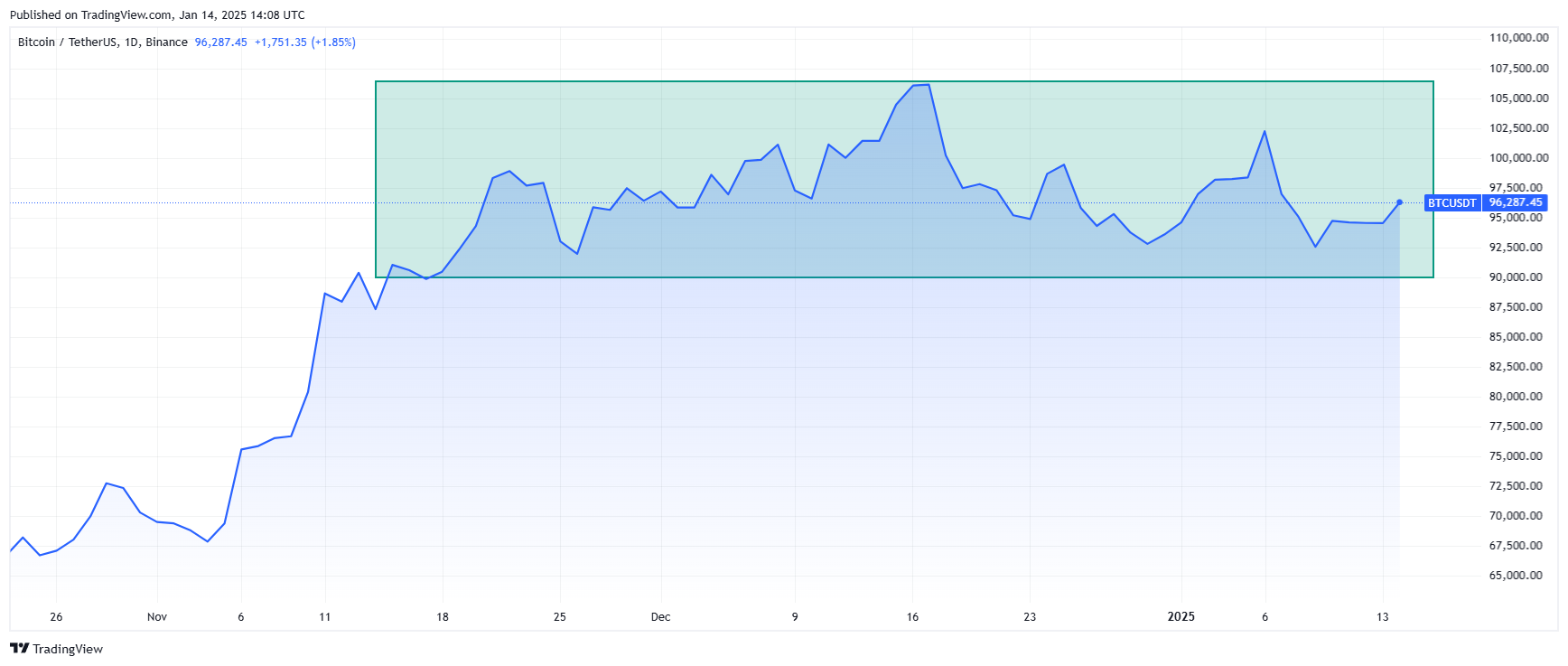

As shown in the chart below, Bitcoin's price remains in a consolidation phase that has been in place since November, with the lower boundary near $92,000 and the upper limit at its previous high of $98,000.

However, Monday painted a less optimistic picture as Bitcoin briefly dipped to just $89,398, causing significant panic and confusion among retail investors.

"Rumours are that liquidation of DOJ's Silk Road assets has been impacting price. As per GlassNode, the ETF flows do not appear to have substantially influenced prices in the last 7 days. However, we do observe a 2x increase in t/o versus 7 days ago with an increase of new addresses hinting that new holders see prices sub $100K as an opportunity to buy into the market and position themselves for a bullish year and hence the quick bounce," commented Paul Howard, Senior Director at Wincent.

The temporary panic was also evident in the derivatives market: within four days, investors pulled $1.6 billion from cryptocurrency exchange-traded funds (ETFs), marking one of the longest selling streaks in recent times.

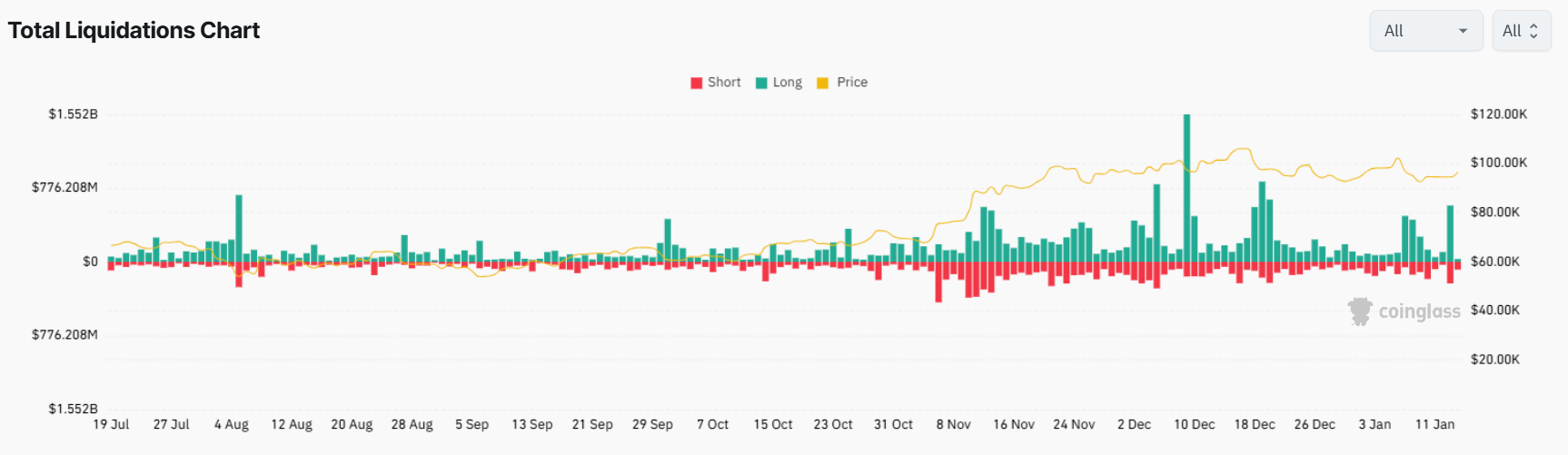

Over the past 24 hours, both bulls and bears have incurred losses. Approximately $500 million in leveraged positions were liquidated across the market, with nearly equal distribution between long and short positions. Bitcoin accounted for over 20% of this activity, with $44 million liquidated from long positions and $72 million from shorts.

Analysts attribute the recent decline in Bitcoin and the broader cryptocurrency market to two primary factors: the so-called “Trump Trade” and monetary policy.

Why Bitcoin Fell? Fed Policy and Market Uncertainty Shake BTC Price

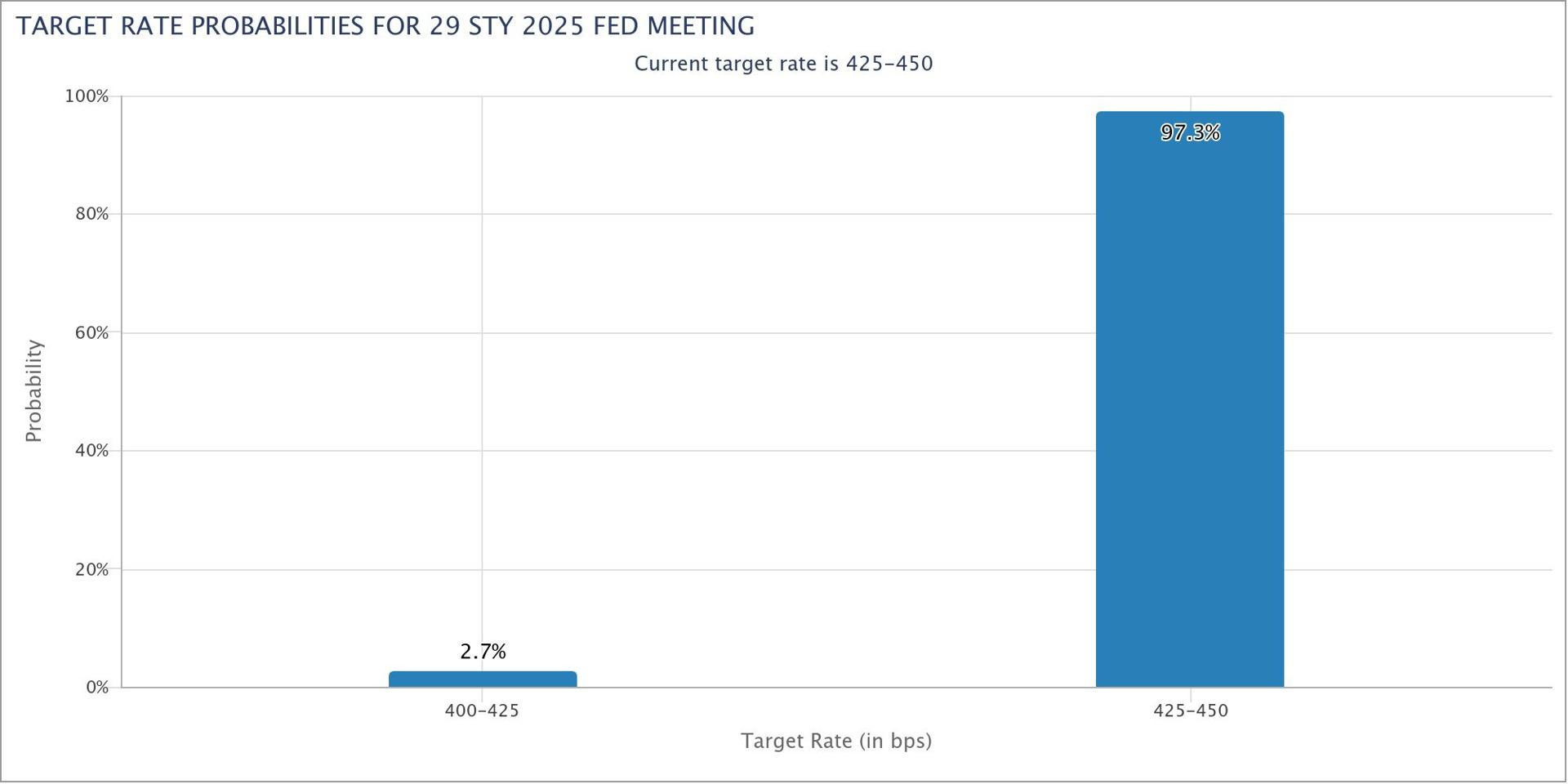

The cryptocurrency market's downturn is primarily driven by shifting expectations about Federal Reserve (Fed) interest rate policies. Strong economic indicators have led investors to anticipate a longer period of higher interest rates. The robust U.S. job market, with 256,000 new nonfarm payrolls and a 4.1% unemployment rate, has particularly influenced this outlook.

According to the CME’s FedWatch tool, the probability of a rate cut at the next meeting, scheduled for January 29, is just 2.7%. The market is currently pricing in a stronger likelihood (around 40%) of a cut to the 4.00–4.25% range in the second half of the year. Earlier expectations were for a more aggressive path of rate cuts, which was expected to fuel risk assets such as cryptocurrencies and stocks.

Moreover, the initial euphoria surrounding Trump's pro-crypto stance has given way to more cautious market sentiment. While Trump's upcoming presidency promised to make the U.S. the “crypto capital of the world,” investors are now focusing on immediate economic realities rather than future policy promises.

The cryptocurrency decline isn't occurring in isolation. The selloff in Treasury markets has created a ripple effect across various asset classes, affecting both crypto and traditional markets. This broader market reaction demonstrates Bitcoin's increasing correlation with conventional risk assets.

Will Bitcoin Keep Going Up? BTC Price Prediction and Technical Analysis

The candlestick I want to highlight in the technical analysis of Bitcoin 's price chart may seem modest and even barely noticeable. However, in my view, it carries significant strength and buying potential. This is a bullish pin bar (or doji candle) with an almost invisible body and a very long lower wick, indicating that bears were in control but had to concede to bulls by the session's close.

What does the chart show?

- The bullish pin bar tested the 50 EMA and two critical support levels: $92,000 and $90,000.

- All three levels held, and the price responded with an immediate increase the following day.

- This strong bullish signal confirmed the lower boundary of the consolidation range, signaling that buyers are likely to actively defend the green-marked support zone.

While Bitcoin remains in consolidation, this reaction suggests, from a purely technical standpoint, the potential for a move toward $103,000 (the 2025 highs) and ultimately $108,000, the all-time high (ATH) to date.

Bitcoin Price Key Support and Resistance Levels

Support | Resistance |

$90,000 – psychological round level | $100,000 – psychological round level |

$92,000 – local lows tested in November, December and January | $103,000 – highs from 2025 |

50 EMA – currently at $94,482 | $108,000 – current ATH |

Breaking above the current all-time high is a necessary condition for considering ambitious forecasts for 2025 and beyond. Some of these projections are truly bold.

Bitcoin Price Prediction: Will BTC Reach $1 Million?

Late last year, I explored the question, “Will Bitcoin hit $1 million?” According to Jeff Park, Head of Alpha Strategies at Bitwise Asset Management, this could be possible if the U.S. government were to adopt a Bitcoin reserve strategy. However, he currently assigns only a 10% probability to this scenario.

Arthur Hayes, the Founder of the cryptocurrency exchange BitMEX, has frequently mentioned such ambitious levels as $1 million. Last week, he appeared as a guest on Tom Bilyeu's show, where he discussed the current state of the cryptocurrency market during a nearly two-hour interview. Hayes suggested that Bitcoin is gradually heading toward seven-figure valuations and could potentially reach them within the next five years.

“It’s the bull market. When the music is playing you gotta $DANCE.” ~ Arthur Hayes x Tom Bilyeu#crypto #dance #memecoin #solana #bullrun pic.twitter.com/g9MdkEtIZe

— DANCE MEMECOIN 🤩 (@dancememecoin) January 7, 2025

“Bitcoin has already survived for 15 years. This makes investors start to believe that it can last for decades to come,” Hayes commented. “BTC will be here for the next 15, 20, 100 years. I think it will be a store of value. I can use it to pay for things I need, so I'm going to take 2%, 3%, 4%, 5%, 10% of my retirement income or savings and start buying that asset now.”

Other experts, including VanEck analysts, predict more down-to-earth numbers. A month ago, they forecasted that Bitcoin price could reach $180,000 in 2025.

JUST IN: $118 billion VanEck predicts $180,000 #Bitcoin and the U.S. will embrace a Strategic BTC Reserve in 2025 🇺🇸 pic.twitter.com/s7lnNgkyhn

— Bitcoin Magazine (@BitcoinMagazine) December 13, 2024

Bitcoin Price, FAQ

Why Is the Price of Bitcoin Going Up?

Bitcoin's price is rising due to a strong bullish pin bar forming above critical support levels, signaling strong buying activity. Market sentiment improved as Bitcoin rebounded from a two-month low of $89,398 to trade above $97,000. This movement reflects consolidation within the $92,000–$98,000 range, supported by technical indicators and broader market optimism.

Will Bitcoin Rise Again?

Bitcoin's price is expected to rise further based on technical analysis. If it breaks through key resistance at $103,000, it could test the all-time high of $108,000. Long-term projections remain optimistic, with some experts predicting significant gains by 2025, assuming market conditions remain favorable.

Why Is Bitcoin So Valuable Today?

Bitcoin's value stems from its status as a decentralized digital asset with limited supply, serving as a hedge against inflation and a potential store of value. Its increasing adoption, network security, and potential as a global reserve asset contribute to its high valuation.

Why Did Bitcoin Fall Recently?

Bitcoin's recent decline was driven by market reactions to expectations of prolonged higher interest rates from the Federal Reserve. Strong U.S. economic data reduced the likelihood of rate cuts, pressuring risk assets like cryptocurrencies. Additionally, shifting sentiment around pro-crypto policies under the upcoming U.S. administration added to market uncertainty.

How Much Will Bitcoin Cost in 2025?

Bitcoin's 2025 price predictions vary widely. Analysts forecast potential highs ranging from $180,000 (VanEck) to over $1 million (Arthur Hayes), depending on adoption trends, macroeconomic conditions, and regulatory developments. A more conservative estimate places Bitcoin at $180,000, reflecting steady growth without speculative excess.