The cryptocurrency and decentralized finance (DeFi) sectors suffered a staggering $1.19 billion in losses due to hacks, scams, and exploits in the first half of 2024, according to a new report from blockchain security firm CertiK.

Crypto Security Woes Deepen as H1 Losses Hit $1.19 Billion

The "Hack3d: The Web3 Security Quarterly Report" for Q2 and H1 2024, released this week, paints a sobering picture of the crypto industry's ongoing security challenges. Phishing attacks emerged as the most damaging vector, accounting for $497.7 million in losses across 150 incidents.

"Q2 2024 experienced the highest losses since Q3 of the previous year, despite a relatively quiet quarter in which the markets mostly consolidated the gains from Q1," the report emailed to Finance Magnates reads.

Private key compromises were the second most costly attack type, resulting in $408.9 million lost over 42 major incidents. The Ethereum blockchain bore the brunt of the attacks, experiencing 235 security incidents that led to nearly $400 million in losses.

The largest single incident of the period was an attack on the Japanese exchange DMM Bitcoin, resulting in a staggering $304.7 million loss. Other notable breaches included a $112.5 million loss by Chris Larsen and a $90 million hack of Turkish exchange BtcTurk.

Despite the overall increase in losses, there was a silver lining: approximately $177.8 million was returned to victims across 18 separate incidents in H1, reducing the net losses for the period to $1.01 billion.

For comparison, throughout 2023, investors and exchanges were estimated to have lost $2 billion in cryptocurrencies. Although these figures are alarming, they were still half as much as in the record year of 2022, when losses reached nearly $4 billion.

Crypto Losses Surge to $688 Million in Q2 2024

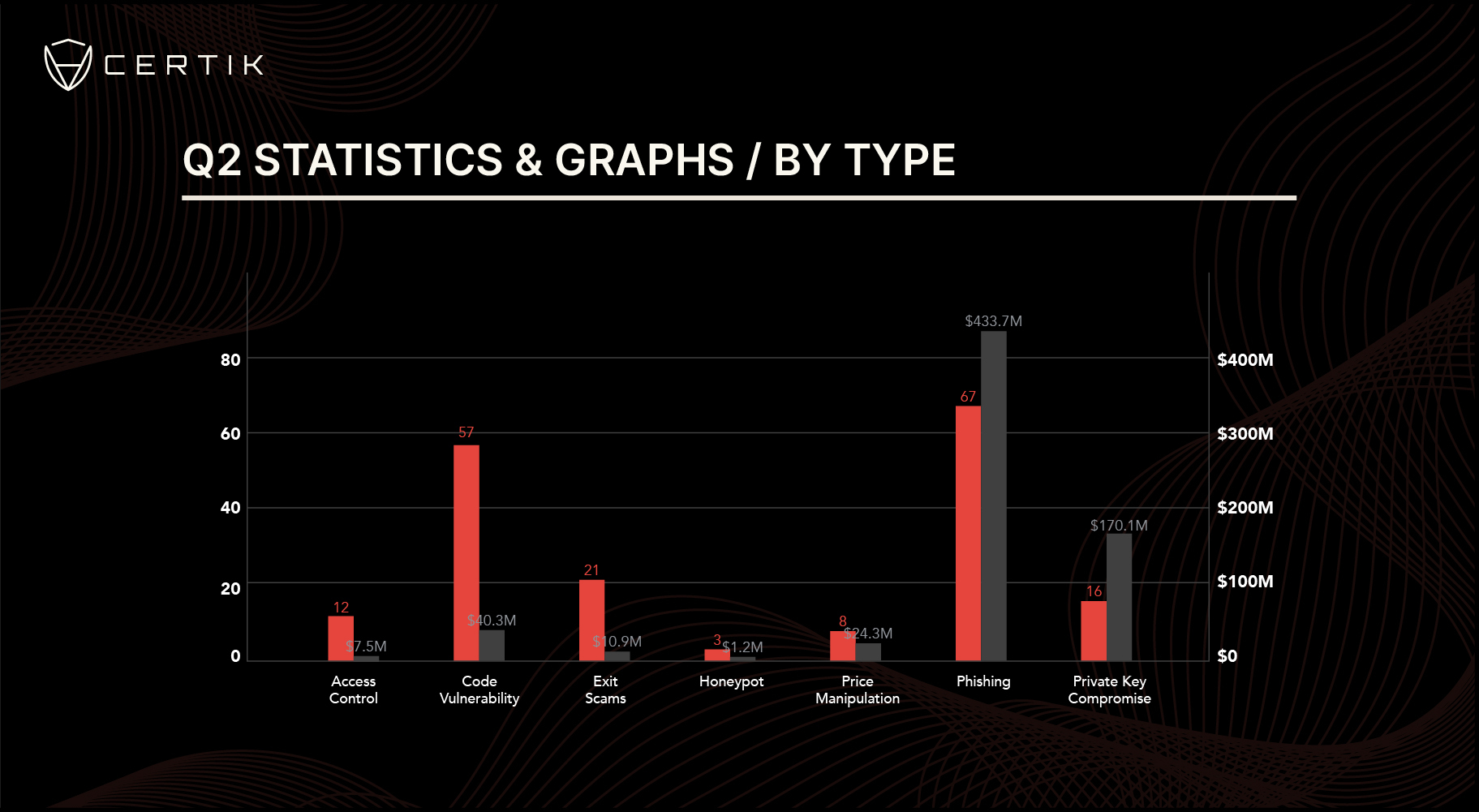

The report also provided a breakdown of Q2 2024 figures, which showed a concerning trend:

- In Q2 alone, a total of $688.1 million was lost across 184 onchain security incidents, representing a 37% increase in value lost compared to Q1 2024. This is also significantly more than the $300 million reported in Q2 of the previous year.

- Phishing remained the dominant attack vector in Q2, with $433.7 million lost across 67 incidents.

- Ethereum remained the most targeted chain in Q2, with 83 incidents resulting in $170.6 million in losses.

“Overall, Q2 2024 was marked by significant financial losses due to security breaches, emphasizing the ongoing challenges in the cryptocurrency and DeFi sectors. Phishing attacks and code vulnerabilities remain prevalent, with substantial losses impacting both individual users and large platforms,” the report adds.

The persistent security issues highlighted by CertiK's findings may pose challenges for platforms seeking to demonstrate the robustness and reliability of their systems, especially as the industry grapples with increased regulatory scrutiny and attempts to attract institutional investors.