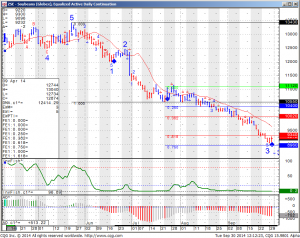

Lower highs and lower lows have been the tune the past 3 months and look to continue after long period of beans in the teens for most of the past seven years.

North American Harvest Update:

U.S. soybean production will reach a record 3.913 billion bushels, according to the USDA. Yields will total 46.6 bushels an acre, up from an August estimate of 45.4 bushels per acre, it forecast on Sept. 11. Prices tumbled 30 percent this year on expectations that a record harvest in the U.S., the top grower, will boost global supply.

South American Planting Update:

The weather has generally been favorable for early soybean planting in Brazil. As of September 26th, the state most advanced in soybean planting in Brazil is Parana in southern Brazil where 7% of the soybeans have been planted. Last year only 2% of the soybeans in the state were planted by September 26th. In small regions of the state near the cities of Cascavel and Toledo 30-35% of the soybeans

That being said, I turn to the charts. Looking at a continuous daily chart of the beans below you can see that the last two diamonds signals I got resulted in very minor bounce and the question now is how will the third one I just got this morning will pan out?

ZSE Soybeans (Globex) Equalized Active Daily Continuation

My thoughts are to use rallies as an opportunity to sell some call options premium ( unlimited risk, one must be an experienced trader to consider this aggressive strategy, read more about options here)

If you are a very short term trader ( few hours to few days) you can try to trade a counter trend play going long with a stop below the psychological $9 level with targets at 9.34 and $10 if we can get a close above the $9.34 level.

Many ways to trade any market, many ways to lose money in any market and only very few ways to lock in gains - this one is not different. If you need help creating a trading plan, visit our broker assist services.

Disclaimer - Trading Futures, Options on Futures and retail off-Exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

About Ilan Levy-Mayer

Ilan Levy-Mayer has been a commodities broker for over 15 years, and holds an MBA in Finance and Marketing from Hebrew University in Jerusalem. Ilan is currently the Vice President and a Senior Broker at Cannon Trading Company.

Take a step in the right direction and contact me today, Toll-Free: 800-454-9572 or direct: +310-859-9572. You may also directly e-mail me, Send mail.