Back in August, I prepared the following piece about Crude Oil: Since then Crude has broken more than a few major support levels and has been on a steady, yet some what volatile decline.

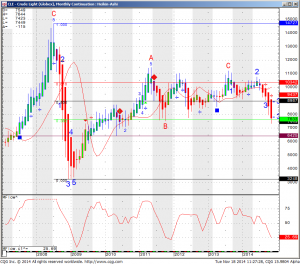

Take a look below at the monthly continuation chart for some of the next levels/ possible targets on the down side.

Crude Oil Monthly Chart:

CLE-Crude Light (Globex), Monthly Continuation: Heikin-Ashi

It seems that current prices ( $74.40 basis Dec. contract as of Nov. 18th mid session) are BELOW the lows made in 2012 and 2011 and I believe that a close below $74 will open the door for a test of 64.25 initially. The big question is how does one speculate if he or she agrees to this market view?

Straight futures require strong stomach and deep pockets. Crude Oil can easily bounce more than a few $$ before it may resume the down trend.

My preferred approach would be to buy veritcal put spreads, where you buy an option closer to the money and sell an option further out of the money. You can read more about this strategy here.

Another approach would be to trade a futures spread, for example selling the February contract and buying the June contract. Both strategies are more advanced than straight futures or straight buying calls/ puts but in my opinion will offer better staying power in this volatile market.

If you need help with either strategy mentioned above, visit our broker assist services.

Disclaimer - Trading Futures, Options on Futures, and retail off-Exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

About Ilan Levy-Mayer

Ilan Levy-Mayer has been a commodities broker for over 16 years, and holds an MBA in Finance and Marketing from Hebrew University in Jerusalem. Ilan is currently the Vice President and a Senior Futures Broker overseeing online future trading platforms and Commodity Futures Trading systems at Cannon Trading Company.