The strength in US dollar over this past 6 months created one of the best “trend following trades” this past year. Longer term traders who were long dollar index and/ or short the Euro, Canadian, Australian dollar to name a few and had the PATIENCE and discipline to stay in the trade should have benefited nicely. However, things are always easier in hindsight…. and today we are looking at a real time, live example of decisions traders must make without the benefit of the 20/20 hindsight vision – Is the current bounce in the Euro and the current sell off in the Dollar index signaling a trend reversal or just a relief rally from all the shorts who are covering positions?

The real longer term answer will lie in a careful analysis of the fundamental picture behind the currency market.

I think the main force behind this move is our federal reserve. Yellen does not like the recent strength in the US dollar. I am writing this article before today’s FOMC which may provide more clues about the topic.

From a chart perspective, I believe the current rally may have a bit more legs but to answer my own question above, the answer is NO to both parts…. i.e. This is probably not a long term trend reversal and this is probably more than just a short covering/relief rally.

Currency markets are known to have longer trends than other physical commodities in our business.

I think it would be premature to call this a trend reversal. However, price action over the past few weeks suggests to me that the downside may be limited going forward and that I personally don’t think we will see new lows in the Euro any time soon.

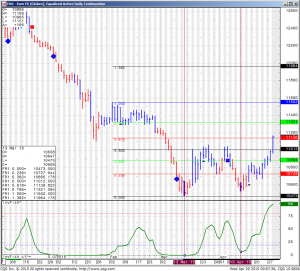

EU6 – Euro FX (Globex), Equalized Daily Active Continuation

looking at the daily continuation chart of the Euro Currency above, We have seen higher highs and higher lows over the past 6 weeks. Today’s upside breakout took out highest levels since March 5th.

My point of view on the Euro in specific and the currency markets in general is that the straight line down may be over for a while and we should see opportunities and risks going both ways, long and short.

Looking at the Euro I will look to trade this market on shorter term basis, days NOT weeks as I believe we will see good size swings going both ways. In my opinion the market will trade in a range between 105 and 115 for a while. A break above 115.52 may change my mind and a break below 107.00 may change my mind as well. In between we have a very wide range that can offer different strategies with both futures and options and combinations of the two. I think the fear factor is now with both the longs and the shorts, so my preferred method would be to look for oversold/overbought indicators ( %R, RSI) along with price confirmation (if we get a sell signal, look for near term support to be taken out before jumping in) and go with the momentum.

This is definitely an exciting market to watch and I will update you again soon as price action unfolds.

Disclaimer - Trading Futures, Options on Futures, and retail off-Exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

About Ilan Levy-Mayer

Ilan Levy-Mayer has been a commodities broker for over 16 years and holds an MBA in finance and Marketing from the Hebrew University in Jerusalem. Ilan is currently the vice president and a senior futures broker overseeing Online Future Trading Platforms and Commodity Futures Trading at Cannon Trading Company.