The following synopsis was written by my colleague John Thorpe, an ex floor trader with many years of experience in the commodities world and provides a useful, quick insight into gold fundamentals today:

Exposed hedged, inflation deflation, fear assurance, fiat vs tangible, historical context, cultural requirements.

Zirp. Inflation probabilities. Deflation probabilities

Gold as a store of value has become neutered by the strength either perceived or otherwise in the U.K., E.U., Japan, U.S. as evidenced by improving stability in labor markets and low inflationary pressures.

Economic stability, more than anything, is a function of confidence and confidence can evaporate in an instant.

Keynesian, Neo - Keynesian, Austrian theory. It all doesn't matter at the moment to the value of gold in the short run. The fact is CPI in September was running at n annual rate of 1.7 percent.

Not so long ago gold prices began a historic rally as loose credit fueled a monumental bust, Gold was soon to follow.

So why, if the E.C.B. In its official statement last week indicated that it would aim to increase its balance sheet by €1 trillion by 2016?

So why, if Abenomics's Policy to print a Tsunami of Yen to inflate the Japanese economy out of a deflationary swoon that has lasted 25 years? Have The BOJ governor announced that it will expand its monetary stimulus by stepping up asset purchases. Haruhiko Kuroda warned that the country is at a 'critical moment' in its fight to get out of deflation. He also said this is "Bank of Japan's unwavering determination to exit deflation". So why have these underlying fiat currency themes not created another tangible asset bubble? Gold prices rise for a hopeful trading day or two on any announcement of zero interest rate policy objectives and in fact gold continue its price decline. Central banks are trying to inflate to prevent the debilitating effects of a downward deflationary spiral and they are having a rough go of it.

Not so long ago gold prices began a historic rally as loose credit fueled a monumental bust, Gold was soon to follow. China's economy is currently transitional as it moves to consumerism and away from manufacturing.

Loose credit isn't fueling much of anything right now.

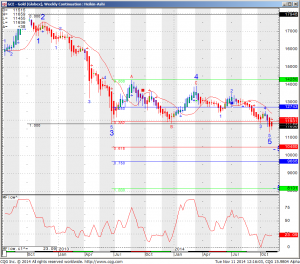

Gold Weekly Chart:

Gold (Globex) Weekly Continuation Heikin Ashi

As far as the chart, I am sharing a weekly gold chart for your review. What I am noticing is lower highs and lower lows. I included some Fibonacci extensions along with possible targets to the downside as well as possible resistance points on the upside. At this point from a longer term perspective, I still like selling the rallies in gold as I see the path of less resistance downwards.

Many ways to trade any market, many ways to lose money in any market and only very few ways to lock in gains - this one is not different. If you need help creating a trading plan, visit our broker assist services.

Disclaimer - Trading Futures, Options on Futures, and retail off-Exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

About Ilan Levy-Mayer

Ilan Levy-Mayer has been a commodities broker for over 16 years, and holds an MBA in Finance and Marketing from Hebrew University in Jerusalem. Ilan is currently the Vice President and a Senior Futures Broker overseeing online future trading platforms and Commodity Futures Trading systems at Cannon Trading Company.