The day after a historic Greek default with the International Monetary Fund (IMF), or more aptly put arrears, life on the ground in Greece appears to have changed little. However, fresh polls ahead of the referendum on July 5, 2015 have given some clairvoyance into the developing situation that may hold substantial ramifications for the country and its government moving forward.

Yesterday was a day many had circled on their calendars as a watershed moment in the Greek impasse – months of negotiations between Eurogroup lenders and their Greek counterparts, led by Prime Minister Alexis Tsipras and Finance Minister Yanis Varoufakis, ultimately failed to secure funding, leading to the forgoing of a €1.6 billion (1.79$ billion) payment to the IMF. Perhaps of greater influence was the expiration of Greece’s current bailout policy yesterday, leaving the member’s fate more uncertain than ever.

Initial Polling Casts Light on Greek Opinion

With Greece and the rest of Europe bracing for its referendum vote on July 5, the latest polls have shown majority support for a ‘no’ vote. The ‘no’ position, strongly backed by the Greek government, calls for a rejection of the Eurogroup’s bailout measures that have left the country exasperated and its economy contracting. However, the repercussions of a ‘no’ vote prevailing in Greece has drawn mixed opinions, with some European leaders championing membership continuation at all costs – others are not so optimistic.

Alternatively, a ‘yes’ vote would also leave Greece with an uncertain future as well. Mr. Tsipras has asserted he would step down in the case of a ‘yes’ vote reaching a majority threshold, which would signal new elections. In this scenario, a ‘yes’ vote would likely provide the needed impetus to finally secure an agreement with Eurogroup lenders on a third bailout for the beleaguered country, albeit at the potential risk of a resolution lag via political turnover.

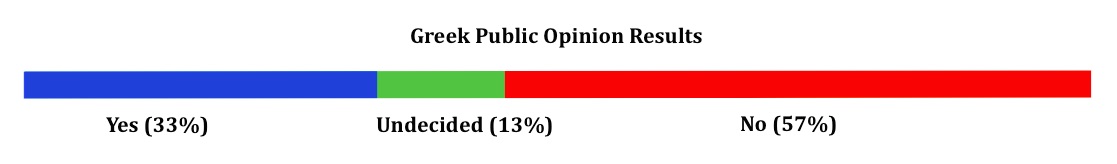

According to the ProRata Institute’s latest polling gathered earlier this week, as published in the Efimerida ton Syntatkton newspaper, 54% of Greeks are planning to vote ‘no’, opposing the European bailout conditions, with 33% in favor, and 13% undecided – no margin of error was given.

Source: ProRata Institute

This Greek mood has shown signs of a gradual shift however, with the same poll taken before the announcement of bank closures last month showing 57% opposed with only 30% in favor, and 13% still undecided – no margin of error was provided. Ultimately, several days exist between now and Greece’s July 5 referendum, which will likely see a further oscillation in public opinion to some degree. By virtually any indication, the vote is expected to be tight, given the political and social stakes behind the decision.

Payday in Greece

Despite the previously announced closure of banks until at least July 5 and the imposition of capital controls that sequester withdrawals to just €60 ($66.7) a day, Greek retirees were lining up in droves this morning to collect their pensions. Nearly a third of Greek banks opened their doors to the public, ending a three-day holiday, though pensions were capped at €120 ($133), far lower than a monthly average of €600 ($666) according to a recent Bloomberg report.

The referendum itself is not just a momentous decision for Greek people but a race against time. Despite the Greek Central Bank’s guarantee on deposits and promises of Solvency , finances in the country are clearly stretched to the limit after the latest rejection of a lifeline from the Eurogroup. This is unlikely to change ahead of the referendum with German Chancellor, Angela Merkel crushing any doubts of a deal in the next few days before the vote.

Indeed, yesterday yielded a surprise development in the late afternoon, with the Greek delegation attempting to reopen negotiations for an 11th hour deal with a fresh proposal to avert default. For their part, the Eurogroup promptly shot down such a proposal, citing a lack of agreeable measures that had done little to allay their concerns from previous iterations of a submitted proposal.

Latest Developments

Despite the prompt rejection of Greek proposals yesterday and all signs pointing towards a resolute stance on each side leading up to the vote, Mr. Tsipras has submitted a formal manifest, suggesting he is currently open to accepting the creditors' proposals with changes. A copy of the document can be found by accessing the following link, which includes a number of the reforms levied by the Eurogroup.

The letter was sent to the European Commission President Jean Claude Juncker, European Central Bank (ECB) President Mario Draghi and IMF Managing Director Christine Lagarde. It is unclear with such a proposal on the table how Eurogroup leaders will react, namely as there are a number of points still left to contestation, i.e. the abolishment of Greek island discounts and pension reforms.