This article presents a number of compelling arguments for investing in gold. It explores gold’s role as a Risk Management vehicle that offers excellent portfolio diversification benefits and provides tail-risk protection, as well as gold’s use as a source of capital preservation that hedges against inflation and currency devaluation. Finally, this report provides some examples of academic research into the role and weighting that gold may have in an investment portfolio.

Gold has two primary functions in investors’ portfolios: as a risk management vehicle and as a source of capital preservation.[1]

Gold As a Risk-Management Vehicle:

1. Gold provides excellent portfolio diversification due to its lack of correlation with traditional asset classes. As changes in the gold price are not significantly correlated with changes in the price of other mainstream asset classes, gold brings considerable diversification benefits to an investor’s portfolio. Importantly, this is a relationship that has been shown to hold across markets and over time.[2]

Modern Portfolio Theory suggests that investors should hold a combination of assets in their portfolio that achieves the least volatility for a given return, or achieves the maximum return for a given exposure to volatility.[3] Portfolio diversification allows investors to reduce the likelihood of substantial losses that may be caused by a change in economic conditions that negatively affects one or more asset classes.

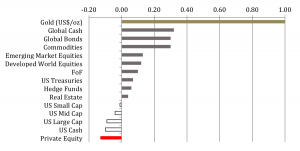

The following graph shows the correlation of the monthly performance of gold to a variety of traditional and alternative asset classes and illustrates the diversification benefits of gold.

Chart 1: Correlation of gold vs. other asset classes in US dollar terms

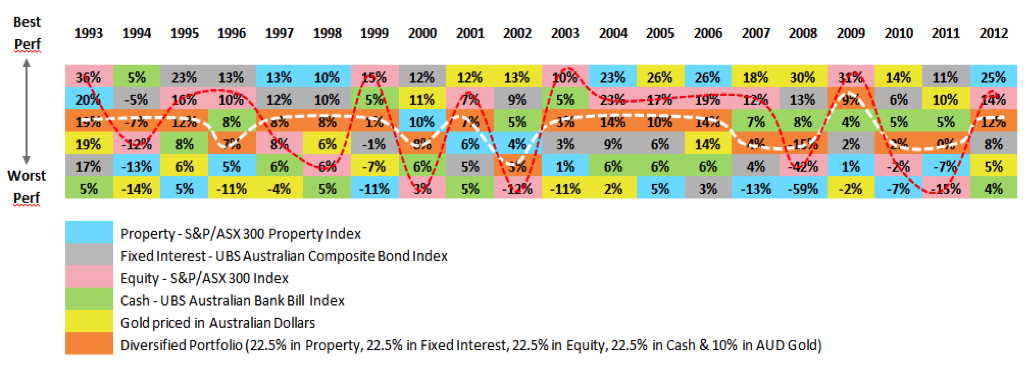

The table below shows the year-on-year performance of five individual asset classes, which are widely considered to be relevant to Australian investors, compared with a diversified portfolio containing gold priced in Australian dollars. The red dashed line passes through the returns of a portfolio that consists of 100% Australian equities. The white dashed line passes through the returns of a portfolio that is arbitrarily diversified among property (22.5%), cash (22.5%), fixed interest (22.5%), equities (22.5%), and an allocation of 10% in Australian dollar-denominated gold, illustrating the decreased volatility achieved through diversification.

Chart 2: Improved long term average return and lower volatility through diversification

Data source: Thomson Reuters, UBS AG, Investment Solutions

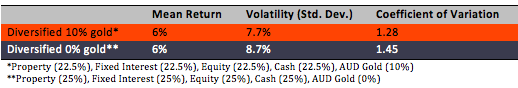

The table below shows the returns and volatility of the example portfolio as discussed above. The diversified portfolio with a ten percent gold allocation has an equal return and less volatility than the diversified portfolio with no gold allocation.

Our calculations show that the example portfolio would have achieved a better risk-return with a coefficient of variation[4] of 1.28, compared with 1.45 for a portfolio of zero percent gold allocation. In other words, for the same average return, the portfolio would have had less risk as measured by the standard deviations.

December 1993 - December 2012

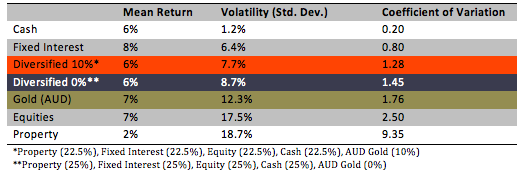

The table below shows how the diversified portfolios with and without gold would have performed against other traditional asset classes over the same period.

December 1993 - December 2012

2. Gold provides tail-risk protection by consistently reducing portfolio losses incurred in extreme circumstances. Gold helps manage risk more effectively by protecting against infrequent or unlikely but consequential negative events, often referred to as “tail risks”.[5]

Short- and medium-term holders can take advantage of the lack of correlation of gold to other assets to achieve better returns during times of turmoil. Long-term holders can manage risk through an allocation to gold, without necessarily sacrificing returns.[6]

Gold returns tend to outperform other assets during periods of economic and financial turmoil, allowing investors to reduce risk when it is most needed.[7] This allows investors to use gold as an asset to hedge risk and reduce losses under extreme market conditions, such as during periods of fiscal or monetary mismanagement, crises of various kinds, or a fundamental change in their dominant currency.[8]

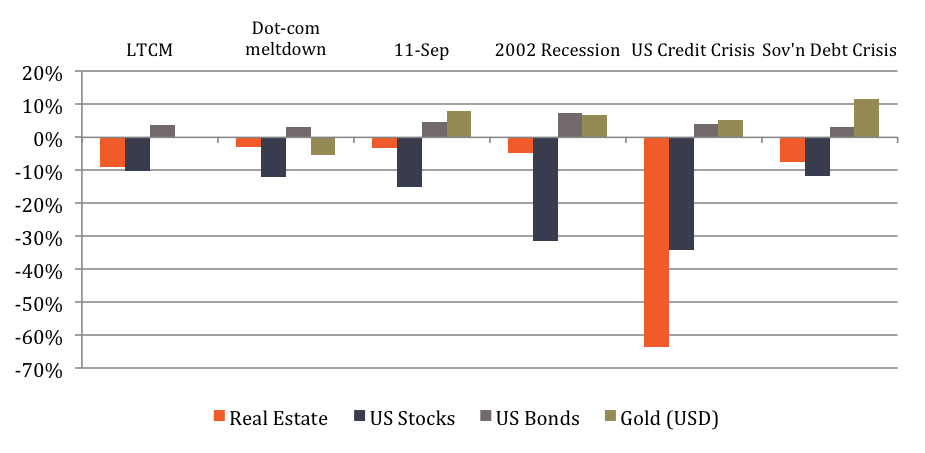

Ultimately, gold can be used to manage risk more effectively and protect an investor’s capital against potential losses during negative economic conditions.[9] As can be seen in the chart below, gold consistently outperforms Real Estate and US Stocks in times of economic crisis. US Bonds had traditionally provided somewhat of a safe haven in times of crisis, however with the failing of the US financial system, this asset class became justifiably less appealing.

Chart 3: Return on alternatives during periods of turmoil, in US dollars[10]

Notes: LTCM: Q3 1998, Dot-com meltdown: Q1 2001, September 11: Q3 2001, 2002 Recession: Q2/Q3 2002, US credit crisis: Q4 2008/Q1 2009, European sovereign debt crisis: Q2 2010. Data source: Thomson Reuters, World Gold Council

3. Gold is a high quality and liquid asset. According to the LBMA, 10.9bn ounces of gold worth approximately USD 15,200bn were traded in the first quarter of 2011.[11] This equates to a daily turnover of around USD 240bn and means a higher daily turnover than most liquid equities, German Bunds, UK Gilts, and most of the currency pairs.[12] By comparison, the daily turnover of Apple shares is about USD 5.5bn.[13]

Gold’s Liquidity therefore reduces its risk as an investment, as investors can easily translate their gold investment into currency.

Additionally, the lack of credit risk associated with holding allocated gold assists investors in balancing the risks present in their fixed income and equity allocations. Allocated physical gold is one of the very few liquid investment assets that involve neither a liability nor a creditor relationship.

[1] World Gold Council, Gold Investor: Risk management and capital preservation (2013).

[2] World Gold Council, An investor’s guide to the gold market, UK edition (2010).

[3] H.M. Markowitz, Portfolio Selection: Efficient Diversification of Investments (1959).

[4] The coefficient of variation allows an investor to determine the amount of risk (volatility) assumed in comparison to return. A lower ratio is preferred from a risk-reward perspective.

[5] World Gold Council, Gold Investor: Risk management and capital preservation (2013).

[6] World Gold Council, Gold: hedging against tail risk (2010).

[7] World Gold Council, Gold: alternative investment, foundation asset (2011).

[8] World Gold Council, Gold As A Strategic Asset (2006).

[9] World Gold Council, Gold: hedging against tail risk (2010).

[10] World Gold Council, Gold: alternative investment, foundation asset (2011).

[11] London Bullion Market Association (LMBA), Gold Turnover Survey for 2011 (2011).

[12] World Gold Council, Gold Investor: Risk management and capital preservation (2013).

[13] Erste Group Research, Goldreport 2012 (2012).