We all want to reach our goals with our investments – this is the fundamental reason of investing in the first place. However, in order to make sure that any goal will not only be achievable for ourselves, but also that our clients will be satisfied with doing business with us in the long-term, we must establish a desirable outcome even before investment is made.

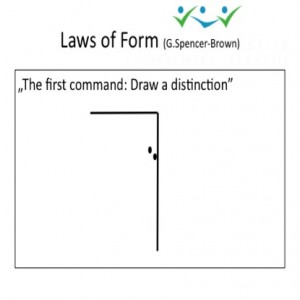

There is a fine line in trading that can make it a dream job or a dream investment, and conversely, a massive failure. So where is this distinction that will set us up to achieve our goals?

In 1969, British mathematician George Spencer wrote: “The first command: Draw a distinction.”

In these turbulent times, with more technology comes more strategies, followed by more traders and opportunities – we sometimes live on the edge of performance and often times forget what we must use as a reference point or barometer to evaluate our success. There are certainly successful investors of all the times, extraordinarily individuals who net 20% or more on average per year. However, these are very successful and will not even mange your money even if you have under $100 million to invest with them.

Mutual funds with outstanding performance and historical results average from 10 to 15 % yearly over a period of years. However, they may have few years in a row of negative performance and you must be willing to invest long-term to reach your results. That invariably means waiting a period of 10 to 15 years to achieve your results.

Capturing Rates of Return in FX

Now we have some strategies that are averaging results in the FX market that can not only match these marquee investors, but exceed them, sometimes producing around 50% in gains every year, having not felt like we have scratched the surface. If you add Leverage as another layer onto this, then you get what I call an ‘investment on steroids’ or investments that are potentially very profitable, but also very dangerous if you don’t have the necessary discipline. Add on the human emotions that often accompany trades and you have system that is not only interesting but demanding to handle. With all this overload of information and lack of time to reflect on our personal goals, it is more important than ever to self-reflect.

Having the right perception of investment is critically important, and that depends on the time we are willing to invest to learn. If we make some perception-based errors we are almost sure that we will not reach our goals. Overall, there are many critical factors when evaluating strategies of the trader to consider, though there are a few steps that should be in place before an investment is made.

Steps:

1. Defining outcomes in a reasonable time frame

Can we reach a target that is sometimes unknown? The answer is often times an obvious no.

For example, we have an investor who would like to net a 40% yearly target of a maximum drawdown of 20%. Anything above that target is a great result but not necessary – what is most essential is not to touch the 20% hard stop loss level. With this point abundantly clear and unwavering, it's worth noting what information or what proven money manager or strategy that we will utilize, as we can communicate clearly with the investor what is precisely the worst case scenario in the beginning.

This approach sets up the mind of a trader, IB (introducing business person), and investors in a much more relaxed way of doing business. We add trading activity that is appropriate for investment frame, and we are in the position not to just monito results, but also if trading behavior is in order with the outcome.

Clearly, everybody love profits, but with every profit there is a price in risk that we must pay or be mindful of. Thus, if we have a designated yearly outcome reached in just a few months, that is the indicator that potential risk is not aligned with a set up that is communicated with investor.

2. Bringing awareness to the potential problems resolves only 50% of the problem.

When we define what is problematic in the strategy or a trader, only then can we make steps that are needed to avoid negative outcomes.

3. Integrating a third person who can lead you through the process.

If we don’t have knowledge to resolve the problem, then we can look around to see where we can find a solution as solutions always exist. Usually, someone is already aware of the problem and can have solution(s) in mind. Then we can compare and contrast our experience and produce the desirable outcome that we have defined.

All successful people have coaches who can give them their advice and help them see clear in situations. World-class athletes usually have world-class coaches, physiotherapists, nutrition experts, etc.

In trading it is the same, if you have a strong team around it will be easier for everyone. Having a strong team means everybody is doing what he is best at, be it daily or night session, statistics, cybernetic of the whole system, sales or Marketing .

All these factors taken as a whole make it almost impossible to fail…

For any alternative opinions or other comments on the above, I would be very interested to hear your thoughts.