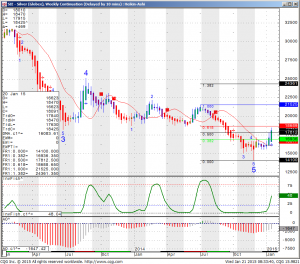

After a long period of declining prices we finally saw a significant bounce on silver futures, and if you look at my weekly chart below you will see that I got my first "buy signal" in more than 18 months.

I tried to research and speculate on what the Europe QE announcement will do for silver prices and then I decided to stop... I think the market is already anticipating and expecting the announcement from Europe and I am guessing it is about 70% discounted. The rest will be determined based on the language and if any surprises take place.

From a chart perspective, I think this market is ready to change direction and start spending more time in an uptrend. I base my speculation completely based on chart patterns and indicators which are marked in the chart below. While I suspect we will see extreme Volatility in many markets including silver (see Swiss franc, January 14th) I favor the long side with initial targets of 18.68 and 21.52.

Failure to break higher followed by a breach below 16.90 will send me back to the drawing board as my speculation will probably be wrong.

I personally like using a little longer-term call spreads for this market outlook, where I will buy call options closer to the money and sell call options out of the money to help finance the trade. Every trader is different, with different risk tolerance and risk capital hence different strategies might be more suitable for different traders.

Weekly chart below shows the market respected some indicators I use (blue +, free trial available here) attempting to reach the next Fibonacci extension at 18.68.

Silver (Globex) Weekly Continuation Heikin-Ashi

Many ways to trade any market, many ways to lose money in any market and only very few ways to lock in gains - this one is not different. If you need help creating a trading plan, visit our broker assist services.

Disclaimer - Trading futures, options on futures, and retail off-Exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge and financial resources. You may lose all or more of your initial investment. Opinions, market data and recommendations are subject to change at any time.

About Ilan Levy-Mayer

Ilan Levy-Mayer has been a commodities broker for over 16 years and holds an MBA in finance and marketing from the Hebrew University in Jerusalem. Ilan is currently the vice president and a senior futures broker overseeing Online Future Trading Platforms and Commodity Futures Trading at Cannon Trading Company.