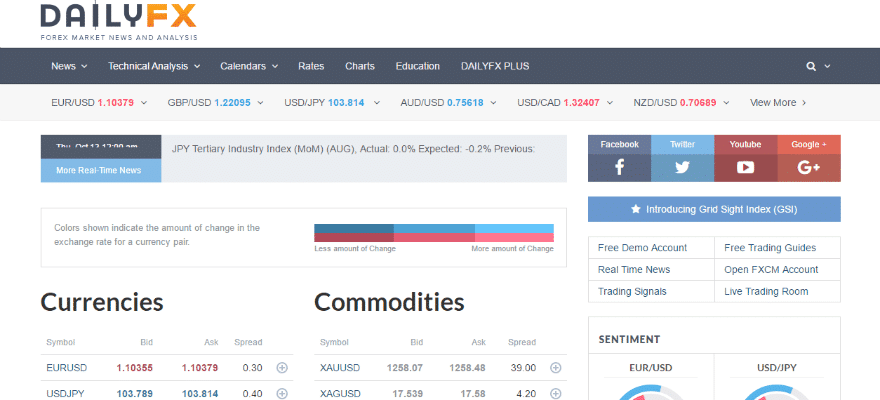

As we saw during the SNB debacle and more recently with the Volatility around oil, brokers need to protect their clients and themselves from excessive losses. Quite a few brokers were caught with their pants down during the SNB affair and so recently the industry has been pretty cautious about volatility. With the recent OPEC meeting, most brokers were prepared. Some decided to cut leverage, others decided to stop buying orders and others just to warn their customers. Whichever route your company took, there is a marketing opportunity to be taken. The new world of Online Trading , fintech and marketing - register now for the Finance Magnates Tel Aviv Conference, June 29th 2016. Let’s first take a look at the aftermath of the SNB decision. With everyone scrambling to handle internal issues and assess the damage, OANDA‘S Ed Eger was on television and any publication that would have him telling the market that they will eat the loss and protect their customers. A few days after, they were running advertising talking about this. OANDA got an outsized return from this decision, not only from the large number of traders signing up with them but also from the improved brand perception in the market place. Traders know that OANDA has got their back. Sure, other brokers did the same, but if you are not the first and the loudest, nobody will remember you for it, except the clients you helped. So what’s the lesson here? Well, I would first say that being generous with your clients always pays off. Yes OANDA took the loss, but I would bet anything they got a 10x return in new business, goodwill and brand awareness. While OANDA was busy being nice to customers, Saxo Bank took the opposite route and requoted everyone a day or more after the event to their own benefit. Maybe a good business decision, not so much from a marketing perspective. The second lesson here is that if you are not the first and the most decisive to communicate something, nobody will remember you for it. FXCM was not the first to implement a STP model, but it was surely the most effective at communicating it. It got the entire industry to rename it NDD, and when you mention the principle, traders will almost instantly recall FXCM for it. The third lesson is that while this was the right move for OANDA, it probably wouldn’t have been for a company like Plus500. Companies have to be congruent with their brand. OANDA once famously promoted its 'Traders Bill of Rights', which fits perfectly with the actions they took, and customers recognize this fact. So, how should a broker use the marketing opportunity of a volatile market? Make sure your policy fits your brand, but always err on the side of being generous. Communicate often and early from the highest levels of your company to the salesperson in charge of a client. And for added synergy, make sure your advertising amplifies the message of your PR communication. And please, have a plan before something happens.

As we saw during the SNB debacle and more recently with the Volatility around oil, brokers need to protect their clients and themselves from excessive losses. Quite a few brokers were caught with their pants down during the SNB affair and so recently the industry has been pretty cautious about volatility. With the recent OPEC meeting, most brokers were prepared. Some decided to cut leverage, others decided to stop buying orders and others just to warn their customers. Whichever route your company took, there is a marketing opportunity to be taken. The new world of Online Trading , fintech and marketing - register now for the Finance Magnates Tel Aviv Conference, June 29th 2016. Let’s first take a look at the aftermath of the SNB decision. With everyone scrambling to handle internal issues and assess the damage, OANDA‘S Ed Eger was on television and any publication that would have him telling the market that they will eat the loss and protect their customers. A few days after, they were running advertising talking about this. OANDA got an outsized return from this decision, not only from the large number of traders signing up with them but also from the improved brand perception in the market place. Traders know that OANDA has got their back. Sure, other brokers did the same, but if you are not the first and the loudest, nobody will remember you for it, except the clients you helped. So what’s the lesson here? Well, I would first say that being generous with your clients always pays off. Yes OANDA took the loss, but I would bet anything they got a 10x return in new business, goodwill and brand awareness. While OANDA was busy being nice to customers, Saxo Bank took the opposite route and requoted everyone a day or more after the event to their own benefit. Maybe a good business decision, not so much from a marketing perspective. The second lesson here is that if you are not the first and the most decisive to communicate something, nobody will remember you for it. FXCM was not the first to implement a STP model, but it was surely the most effective at communicating it. It got the entire industry to rename it NDD, and when you mention the principle, traders will almost instantly recall FXCM for it. The third lesson is that while this was the right move for OANDA, it probably wouldn’t have been for a company like Plus500. Companies have to be congruent with their brand. OANDA once famously promoted its 'Traders Bill of Rights', which fits perfectly with the actions they took, and customers recognize this fact. So, how should a broker use the marketing opportunity of a volatile market? Make sure your policy fits your brand, but always err on the side of being generous. Communicate often and early from the highest levels of your company to the salesperson in charge of a client. And for added synergy, make sure your advertising amplifies the message of your PR communication. And please, have a plan before something happens.