Quote of the Day “In the largest scheme of things, just as no one has the right to tell us our true value, no one has the right to tell us what we truly owe.” – David Graeber, Debt: The First 5,000 Years 5 Things You Need to Know Today Saudi Arabia Is Borrowing Billions. They did the same thing in the 1990s when oil was around $20 a barrel. And they’ll be fine. But expect to hear lots of crying and wailing about how this means the end of the world or something. They will borrow $20-30 billion next year, too, and their national debt will still be 2.5% of GDP. LOL. (Japan’s debt is 230% of GDP. Double LOL. That’s a lot of debt. It will be interesting to find out how they deal with that.) I Got Really Interested in Debt Yesterday. I read Debt, The First 5,000 Years today, and here is what I learned:

- Nations with a massive debt load eventually canceled that debt,

- And usually did it when a new ruler was elected (Trump, anyone?)

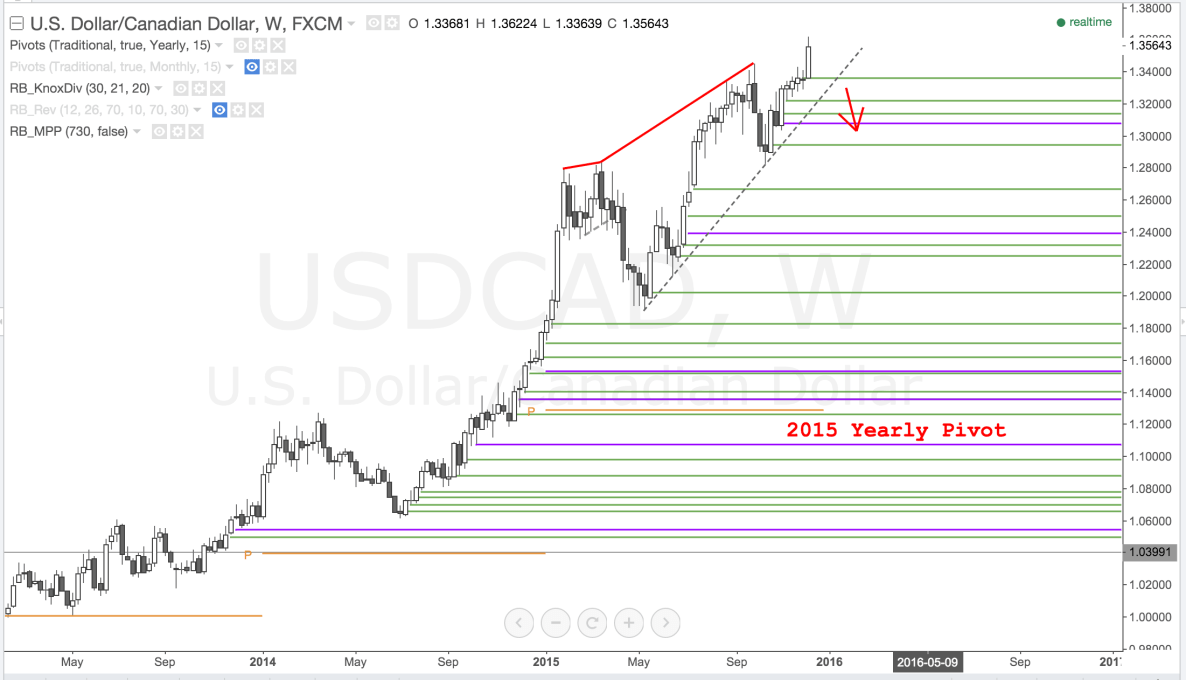

I enjoyed the book. But it’s really long. Be careful. Also, be careful about debt in general. Bad times are coming. Bad Times Are Coming for Investors in Junk Bonds.I bought SJB. That goes up when junk bonds go down in value. But you already knew that. I may get out before the end of the year and get back in if it drops. Speaking of getting out of a bad trade … Yahoo Will Sell off Its (Worthless) Internet Business. Previously they were going to spin off the Alibaba stake. But now they are selling off the Internet business. I so, so, so wish that I could buy it. I’m not exactly sure what I would do with it. I’m also sure this would be the biggest fail of my trading career. Do 95% of Forex Traders Fail? No. That’s a huge lie from uninformed people who repeat anything that is told to them. The 3rd Quarter report from FinanceMagnates.com shows that traders at Interactive Brokers were more profitable than traders from any other broker. Traders at MB Trading were the worst. [NOTE: I think it’s important to completely disregard the #1 position held by IB. They are mainly an Equities and options shop and the reason they have the #1 ranking is because traders at IB don’t actually take very many trades. Which is why they’re #1. Brokers with super active high frequency traders have fewer profitable traders. Period. I don’t care what anyone else says.] [NOTE #2: Ok, now I’m getting worked up about this. Brokers who target active traders with “super low spreads” are marketing to high frequency, short-term traders. In 15 years of traveling and talking to traders, the ones who trade small, use lower Leverage , don’t worry about day to day swings – these are the winners over time.] Chart of the Day

Get Rob’s email updates for traders at robbooker.com