Middle East is a very diverse region and certain markets are more mature and have a higher level of trader knowledge. In terms of how this translates into needs, FX brokers provide localised products and services, which can then be tailored to the specific requirements of the individual trader.

After oil prices wallowed at lows not seen for more than a decade, many Arab countries, which used to have a wealthy potential client base, are looking now to reform their economies and capital markets. However, FXTM still see the region as an interesting revenue stream.

Take the lead from today’s leaders. FM London Summit. Register here!

All these developments and more were discussed during Finance Magnates’ interview with Hussein Sayed, Chief Market Strategist for the Gulf and Middle East region at FXTM.

This article is the second part of the special interview with the CNBC Arabia’s star. You can read the first part from here.

What are the main caveats to consider when taking your business into Middle Eastern markets?

It is always important to consider the specific culture and needs of your potential clients before taking your business to any new market, and the Middle East is no exception. It is of upmost importance for us to see that traders in the Middle East obtain enough awareness of the forex markets, the risks involved in trading, and the appropriate ways of formulating a robust trading strategy. The strong appetite for trading needs to be matched with a thorough investment in education, and that’s why we’ve really focussed on developing educational tools in Arabic and providing local seminars and events. Our traders can also benefit from the personalised training and support offered by their dedicated account manager, giving them the kind of trading experience they ask for and deserve.

How does the company adapt its technology and product offerings in order to best accommodate the local audience?

We have two key aims when it comes to developing our technology and product offerings. First, we focus on tailoring our products and services to the local markets and finding ways of elevating our clients trading experience. Secondly, we stick true to our motto. We want maximize the value that our clients derive from their most precious commodity – time. In order to achieve these aims, our products are developed in-house by our own Research and Development team and are based on traders’ feedback, meaning that we are always looking to address real client needs.

To ensure that our MENA clients can easily and comfortably access the markets, a lot of our products and services are provided in a specific market’s local language – in this case for the MENA region, Arabic. This includes our customer service line, educational resources - including the widely-read market analysis reports, and the MyFXTM platform. Our popular ForexTime App, which we launched last year in order to give access to traders on market updates on-the-go is also available in Arabic and compatible with multiple mobile platforms. We also provide a swap-free option across all our accounts.

What is your evaluation of FXTM business in other regions, particularly in Western markets?

So far 2016 has been a really exciting year for us, as we continue to expand the business both in terms of the range of products we offer, as well as our growing global clientele. In Europe, we are particularly proud to have opened our first fully operational division in the UK which took place in April. The UK office offers a strategic positon from which we can expand our presence in the European market, and offer both our clients in this region and globally, secure and state-of-the-art products and services. We’ve also launched a number of new products designed to reflect our traders’ interests, including the aforementioned FXTM Shares Account, and FXTM Invest.

A few years ago, you wrote an interesting article entitled "The dark side of forex trading". Within FXTM, what do you offer for beginners, inexperienced traders and anyone considering trading currencies to avoid this "dark side"?

The article I wrote five years ago, highlighted the risks of trading leveraged products, as I felt that many FX brokers were not fully explaining the risks when selling such products to their clients. Since then, the forex industry has grown, and with increased regulation, brokers have been required to flag the risks associated with leverage. Since the company’s launch, FXTM has been committed to providing a transparent service, and I’m looking forward to contributing further to the company’s mission to guide traders through understanding the risks and incorporate Risk Management strategies into their trading plans.

What do you believe are the most successful trading products among Arab traders, and are they more concerned over spread and execution speed, or as many say, the Islamic terms of trading?

Amongst Arab traders, we have seen strong interest towards ECN trading due to the favourable trading conditions it can offer. As such, our FXTM ECN Pro account has really grown in popularity, with traders valuing its highly competitive pricing and ultra-fast market execution to provide a first rate trading experience. Trading CFDs on shares is also popular among Arab traders and we have seen strong interest in our FXTM Shares account, as well as our investment program, FXTM Invest.

Spread and execution speed are key elements which traders look for when selecting their broker, and as such the company offers excellent trading terms and award-winning order execution speeds. We also pride ourselves on offering quick deposits and withdrawals, and a fast client approval process. Islamic terms of trading are of course a hugely important consideration and we offer a swap-free option on all of our account types.

Given the distinctively different nature and financial regulatory environment of each country in MENA, in a nutshell, could you describe the key characteristics and business potentials outside UAE, particularly in North Africa?

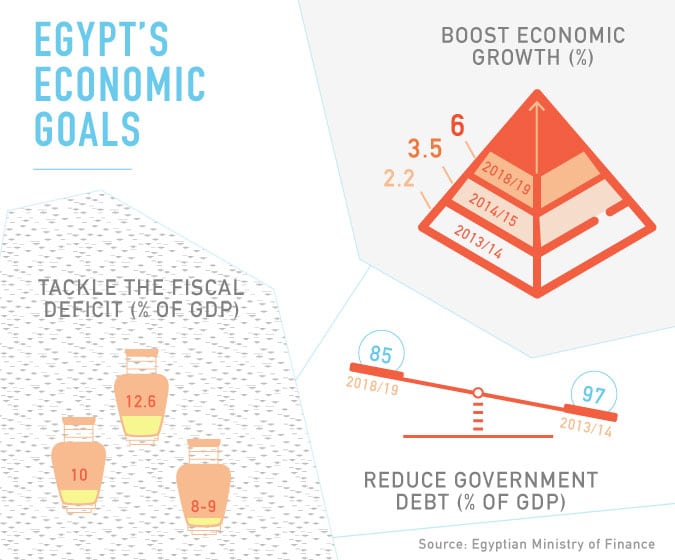

North Africa definitely holds potential for the forex industry, with Egypt in particular being one of the most mature markets of the region. We are noticing a growing interest from all kinds of traders in Egypt, from beginners to professional fund managers. Investors from the region are looking for new ways to diversify their investment portfolio, and trading currencies and commodities provides one such an alternative. Moreover, online trading offers investors the flexibility to trade from their homes, and to fit their trading activity around their other work or family commitments, which works well for many people.

Do you consider getting an operational license from a UAE regulator? And if so, what is the best location/licensing options in this case?

We are constantly reviewing our compliance and regulatory requirements as a company. At the moment there are no plans for acquiring an operational license from a UAE regulator.

After the shocking results of Brexit , how do you think the event affected the industry. And do you believe such effects will extend gradually beyond the first shock reaction?

It is still a bit early to pinpoint the exact impact the Brexit outcome will have on the wider forex industry. On the other hand, after last year’s Swiss National Bank crisis, which deeply affected the industry, brokers were much better prepared to counteract any shocks to the market. From a trader’s perspective, the EU referendum has in fact created opportunities to profit due to the increased volatility seen in the global markets but due to this, there was also an equal potential for losses. However, increased risk exposure must of course be matched with a strong risk management strategy.

After oil prices wallowed at lows not seen for more than a decade, many Arab countries, which used to have a wealthy potential client base, are looking now to reform their economies and capital markets. Have these developments been reflected among participants in the region’s forex market, and does FXTM still consider Gulf markets as an interesting revenue stream?

The Gulf is absolutely an interesting revenue stream for FXTM, and we have seen our business expand in the Middle East year-on-year. We have a wide range of clients in this region, and have seen strong interest in a variety of our trading tools.

As the global regulators sharpen their teeth, after a number of high-profile market manipulation scandals, do you think there is a need for stricter oversight in MENA’s regulatory landscape?

The recent market manipulation scandals, such as the LIBOR case, were focussed on high level financial institutions involved in institutional forex trading. However, as a fully regulated broker, we always welcome the safeguards and structure that regulation brings to the forex industry.

As the habits of retail traders change and information becomes more accessible, an increasing number of brokers are optimizing their product range to attract and retain clients. What are FXTM’s plans for this particular market segment over the next year. And what are the main advantages you have over your competitors?

One of the things that makes FXTM unique is that we have always been focused on offering products and services tailored to traders’ needs. We are looking forward to continuing our momentum from the start of the year by launching a range of updates to our products and services. We are especially excited for the expansion of our educational program which is also in the plans for 2016. Traders should keep a particular eye out for the updated ForexTime App which will be released shortly. We’ll also be launching new promotions and trading competitions, which our clients in the Middle East can participate in. Traders should also follow BASE jumper, Valery Rozov’s progress in the #FXTMbasejump project, which will be running for the rest of 2016. In terms of our competitive advantage, it has to be our commitment to innovation and our ambition to stay at the forefront of the forex industry, which is the driving force behind our expansion.