Please tell us about yourself and how you reached your current role.

The markets have always been my passion. I started in the FX industry in 2005 as a dealer at GFT. At that time, Risk Management was not very sophisticated industry wide. There was an old school dealer mentality where gut decisions trumped math. I started to implement mathematical models into how we managed flow and there was an immediate positive impact on revenues.

I did benchmarking exercises with 5 or 6 investment banks and continued to tweak our models. I was quickly promoted to Head of Global Risk, overseeing both the US and UK Risk Management teams. I can confidently say we outperformed all of the publicly traded brokers on a revenue per million basis during my tenure at GFT.

In 2010/2011 I started seeing the explosion of the retail brokerage world and the complete lack of quality risk managers. This combined with only a handful of clunky unstable bridging options proved to be a large void in the industry.

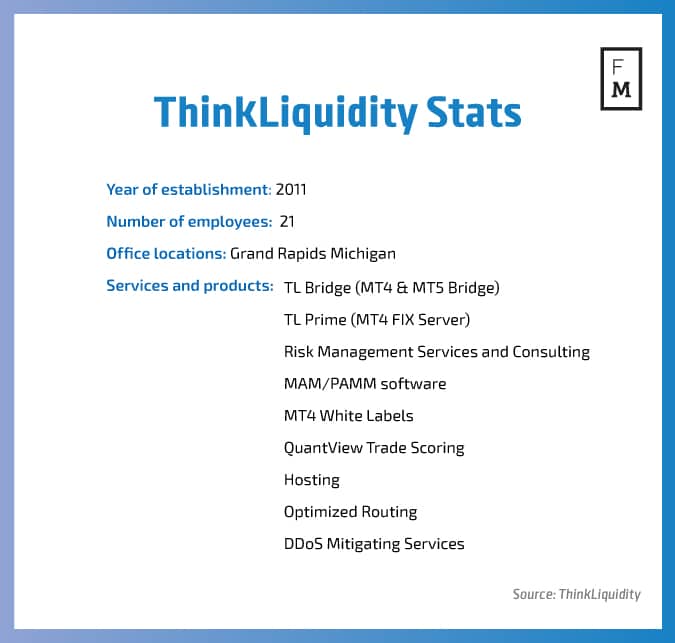

I started ThinkLiquidity to fill that void. Our risk management experts and bridging solutions are now highly regarded. At ThinkLiquidity, all of our technology is designed by risk managers and built to spec by our world class development teams.

What are your goals for the company over the next few years?

The next few years are going to be huge for ThinkLiquidity. We have been ahead of the curve in terms of risk management and we are going to be implementing big data solutions into our risk management products and services. Most tech providers in our industry offer vanilla reporting. At ThinkLiquidity we are launching products with built in intelligence. We are going to be taking the guess work out of risk management for brokers.

We’ve heard a lot of buzz about a new product that you are launching. Can you describe it?

I am extremely excited about our new product. The name of the product is QuantView and the effort behind the launch was a culmination of our in-house PhDs and development teams. QuantView is a web-based application that delivers unique data points on exposures and accounts. QuantView is much more than the regurgitated data you see in other reporting solutions out there.

The real differentiator is our patent pending scoring system. The best comparison I can give would be a credit score for somebody looking for a loan. We built a trader score that evaluates the quality of a trader so brokers can manage their flow with an extremely high degree of efficiency.

You said this is patent pending?

Yes, we filed our patent application and have been granted a patent pending status. It has been a long process, but we know we struck gold with this product. Every single trade desk can use QuantView and start generating ROI within minutes with the way the product is priced. The scoring system is so accurate and reliable; we knew it needed to be patented.

What makes this scoring system so unique?

We capture every tick for every product and map out each trade against that set of data. We then generate statistics that tell you a lot more than whether a trader is profitable or not. These statistics tell you how good, how bad, how lucky, how skilled and how consistent a trader performs.

Not only can you use these stats to better manage individual accounts, they can be aggregated to provide tremendous insight on your overall book. Our proprietary scoring system rates the entry, exit and overall quality of every trade. We present the data in a clean and easy to consume Account Scorecard.

Can you give us a little more detail about who could use QuantView?

The quickest uptake for this product will be in the OTC brokerage world. Risk managers and trade desks can use this product to classify traders from a bottom up approach. Larger desks tend to classify flow from more of a top down approach. With QuantView you can aggregate exposures by the various scores and metrics or look in depth at the individuals that make up that data.

Beyond OTC brokers, there will be a huge market for us with proprietary trading firms, market data providers and even individual traders.

What do you think sets you apart from the competition?

We are a risk management company with great technology and services. Our competitors are technology companies that take a stab at risk management products. We will continue to be on the leading edge of risk management and data solutions. We have several PHD’s and full stack developers on our risk management team.

How do you view the current state of the industry?

The industry is reaching a maturity cycle. The new entrants are slowing down dramatically and the small players are having a harder time competing. Over the next few years, we will see the best in class brokers capture even more market share. The small players who focus on their niche will continue to be successful, but it will be much harder for them to compete on a global scale.

What new fields or opportunities do you see as growth potential in the market?

New opportunities will be created by new platforms and new product offerings. I see options as a huge untapped product in our industry. I am not talking about binary options. Plain vanilla calls and puts are not fancy or flashy, but as traders and brokers get more sophisticated there will be a natural push toward options. Brokers are realizing the flexibility options offer from a risk management perspective.

Traders are looking at options for the natural Leverage , potential to generate income and built in protection they can offer. There’s still an education hurdle to overcome, but it’s only a matter of time. At ThinkLiquidity, we have a full options team and can get brokers live with this product on a number of platforms in a matter of weeks.