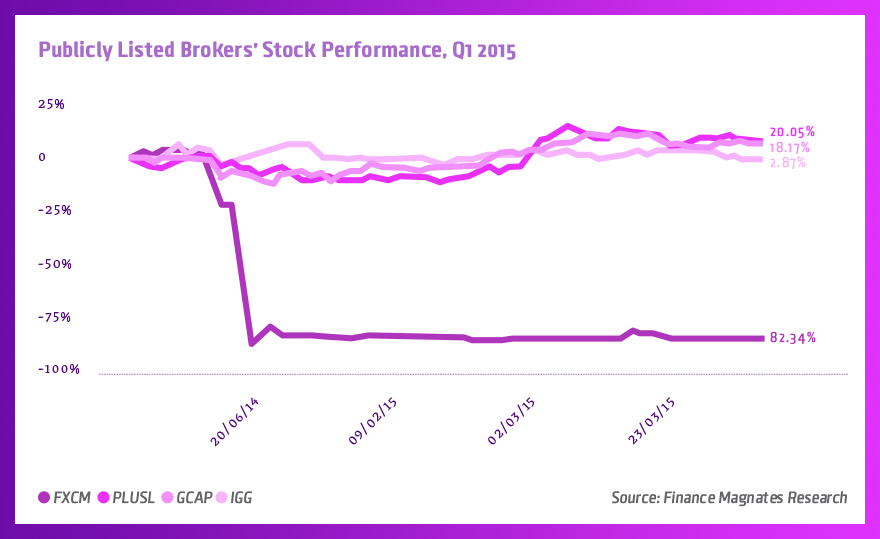

Ahead of its Quarterly results report, announced tomorrow, US-headquartered forex broker GAIN Capital (NYSE:GCAP) aims to position itself as a major UK player. A March metrics report showed an impressive monthly increase in volumes and a review of the listed brokers' stock performance has placed it high on the winners side - currently it is understood that the broker is a frontrunner in the bid for Citigroup's retail FX business.

Mr. Stevens recently told the UK’s Financial Conduct Authority (FCA), that the client identification requirements (legally referred to as Know-Your-Customer) in other European jurisdictions are very limited compared to its procedures. In some pointed comments towards offshore brokers, in the London Evening Standard newspaper, he felt that traders are “literally able to open an account as Kermit the Frog and Mickey Mouse” with some firms.

Finance Magnates spoke with GAIN Capital's CEO Glenn Stevens about the company's acquisition of City Index, which pushed GAIN's client funds over the USD billion threshold in January, as well as a variety of other ambitions in the UK and beyond.

Why did you buy City Index? What are your plans to make City Index stand out from the crowd?

The acquisition of City Index is the latest chapter in the execution of GAIN’s strategic plan to scale our retail business, diversify our revenue across products and geographies and add complementary products and services. Scale is becoming increasingly important in the retail trading industry due to a combination of factors, including higher fixed operating costs as a result of additional regulation and increasing capital requirements.

Passporting is not in itself a problem. The problem we face is the conduct of firms that do not comply fully with the rules

In addition, successful companies need to have a robust Liquidity network and significant risk management expertise to support clients in all types of market conditions, both of which require substantial scale and resources. Retail traders have very high expectations and it takes constant investment to keep innovating and deliver an exceptional customer experience.

At GAIN, we have built our reputation over the past 16 years through transparency to our clients, partners and investors, as well as by being an honest and dependable partner in M&A transactions. The City Index deal is a clear continuation of these themes, marrying GAIN’s position as a large publicly listed leader in the forex industry, with City Index’s 32-year reputation as a premier CFD provider.

We intend to leverage City Index’s brand recognition, reputation and technology to build on our market share in key CFD markets, including the UK, Australia and Singapore.

Glenn Stevens, CEO, GAIN Capital

What are GAIN Capital’s next acquisition plans in the UK space?

In terms of our retail business, the focus right now is on integrating City Index and maximizing the value of the acquisition. That said we are always on the lookout for corporate development opportunities that can deliver value to our customers and shareholders.

We have been very active in M&A in recent years, successfully completing eight transactions over the last four years. These deals have enabled us to triple our retail asset base in less than two years and enter new, complementary business lines, including futures and our institutional FX business, GTX. These two new businesses contributed approximately 30% of our total revenues in 2014.

It makes perfect sense that GAIN, much like Finance Magnates, is expanding beyond FX to cover a broader range of markets

Following your recent Mickey Mouse statement, Are you concerned about foreign firms passporting into the UK?

Passporting is not in and of itself a problem. The rules in the jurisdictions that allow passporting are comparable in terms of the protections that they provide to the retail investor. The problem we face as an industry is the conduct of firms that do not comply fully with the rules.

The continued vigilance of regulators is extremely important to ensure that all brokers operate within a consistent standard and there is a level playing field. This will provide retail investors with the confidence that, whichever broker they choose, they will receive the same high levels of protection.

GAIN is regulated in seven countries and publicly listed in the U.S., so we are very familiar and comfortable with high levels of regulation. We believe regulation can be a competitive advantage for larger, more established firms and we welcome the opportunity to work with regulators to ensure that our industry provides a safe and transparent service to our customers.

Do you think the FCA has allowed the UK market to become overcrowded?

Competition is positive for customers as it requires brokers to keep innovating and improving the quality of the products and services provided. The market – not regulators – then dictates which brokers have succeeded in their efforts and which have not. If there are too many brokers, the market will “speak” and those that do not compete effectively will struggle.

Rather than focusing on regulating that which the market itself should determine, we believe the FCA has focused on introducing regulations to help protect retail customers. For example client money segregation, which requires brokerages in the UK to ring-fence customer funds from operating capital, – and client suitability requirements to ensure that customers trade only those products that are appropriate given their level of experience and financial situation and they are provided with clear information regarding the risks associated with the products they trade.

We believe these are the types of areas that should be at the top of the regulators’ agendas, not questions of market size or competition.

You have mentioned the Middle East and Latin America as expansion targets. What has prevented GAIN from establishing a foothold in these regions thus far?

We already have a significant business in the Middle East today. FOREX.com has a full service Arabic language offering and, between GAIN Capital and City Index, we have several important partnerships in the region. That said, the region is large and diverse and we would like to expand our business there, both with our own retail brands, as well as through strategic partnerships with local providers.

Latin America is a region we have not focused on to date, and we are approaching that market in a similar way – leveraging our own brands where it makes sense and teaming up with partners in other circumstances where local market expertise is needed or required by regulation. This approach has worked very well for us in the past.

Almost three months after the Black Swan , how do you see the industry post-SNB? Do you recognize immediate signs of long-term changes? Will we see a “regulation storm?”

The SNB event was certainly unprecedented in terms of its impact on the markets, but our risk team had been watching for a dislocation in the EUR/CHF trade for months and had modeled a variety of potential outcomes. This is why we raised client margin requirements months ahead of the SNB’s action.

Nonetheless, the event has certainly changed the industry– some big names are gone and others have changed their business models in the wake of the event. Above all, it has reinforced the importance of doing business with financially strong, well-managed companies. We may see some regulatory change as a result, but the industry will be better for it in the long run.

Contrary to some opinions, GAIN and other reputable brokers do not fear regulation; rather, strong regulation is critical for the success of our industry. We want our clients to have a positive experience trading the financial markets so they stay with us for the long term. In order for this to happen, they need to have confidence that their money is protected properly.

Does GAIN take part in the market trend of cross industry diversification?

GAIN’s roots are in FX and we have built a strong business in FX over the past 16 years. However, over the past several years we have been focused on expanding beyond FX into new products, new customer segments and new regional markets. That was a key driver behind our acquisition of GFT in 2013 and also the City Index deal.

We now offer our retail customers a choice of over 12,000 markets, including FX, CFDs on indices, commodities and equities, OTC options and exchange-traded futures and options.

Retail traders now have so many markets available to them online, and will trade the markets that present the most interesting opportunities, so it makes perfect sense that GAIN, much like Finance Magnates by the way, is expanding beyond FX to cover a broader range of markets.