Japanese investment bank Mizuho has hired Brendan Smith as Vice President of its Corporate FX Sales unit from Barclays Capital in New York. According to his LinkedIn profile, the executive has been at Barclays since 2007.

During his time at the New York branch of the UK’s second largest bank, Smith served as Vice President of Corporate FX Sales since 2010. Before that he was an Assistant Vice President of FX Operations at Barclays Capital.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

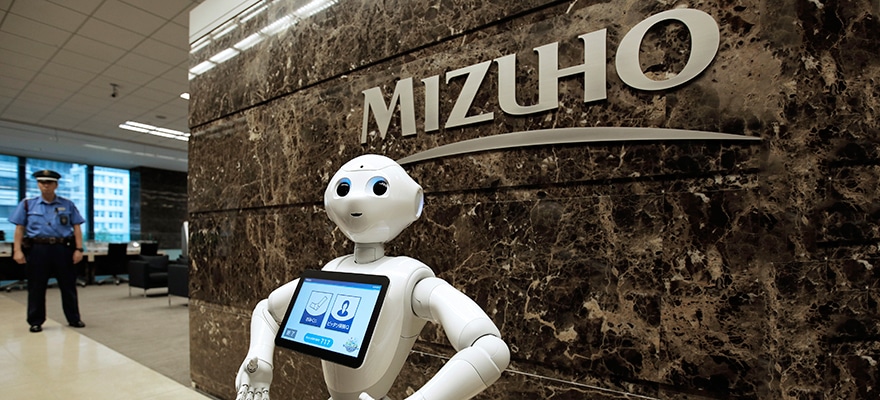

Brendan Smith, Vice President of Corporate FX Sales at Mizuho

Mizuho has been one of the providers of G20 Liquidity in the U.S. with a range of services across spot, forwards and option markets. The firm’s unit has been actively providing access to the Latin American, EMEA and Asian emerging markets with a desk providing global currency market research and analysis.

The corporate sales role which Smith joins at the Japanese bank will involve convincing large cap U.S. companies to use the services of the bank. The reputation of a number of financial institutions in the industry has greatly suffered in the aftermath of several rate rigging scandals.

The first sign of trouble of conduct at major banks was the LIBOR scandal that erupted in 2012. Later the foreign exchange market has also been identified by a number of traders as a place where disadvantageous market rates have been provided to clients of a number of banks.

As a result, the Bank of International Settlements has taken the role of the ‘central bank of central banks’ as it is usually dubbed and earlier today introduced the first step in a long process of deploying a global FX code of conduct on the foreign exchange market.