There has been a shake-up at the top of Mizuho Americas’s US Equities business. The asset manager and provider of corporate and investment banking services has onboarded Darlene Pasquill, a Credit Suisse veteran, to lead its Equity Division. Pasquill has been involved in the securities industry since 1985.

Mizuho America’s latest hire represents one of the group’s most senior additions to date. Pasquill will be strengthening the company’s equities research, sales, and trading offering and will be tasked with managing the continued growth of the firm’s coverage universe. She will report to Jerry Rizzieri, president and CEO of Mizuho Securities USA.

Pasquill had been a long-serving executive at Credit Suisse for nearly two decades. She most recently served as head of its Americas equities business until she decided last year to leave the bank to pursue external opportunities. She had been in that role with the Swiss lender since 2015.

Prior to Credit Suisse, Pasquill was the vice president of institutional equity sales with the US investment bank Donaldson, Lufkin & Jenrette.

Commenting on the appointment, Jerry Rizzieri, said: “Darlene is a leader with a proven track record of client focus and product enhancements. Her ability to identify and create synergies which Leverage firm resources will further enhance our growth.”

Mizuho Securities agreed in July to settle charges – without admitting or denying them – that its employees accessed and transferred “material nonpublic customer buyback information to other traders and Mizuho’s hedge fund clients.”

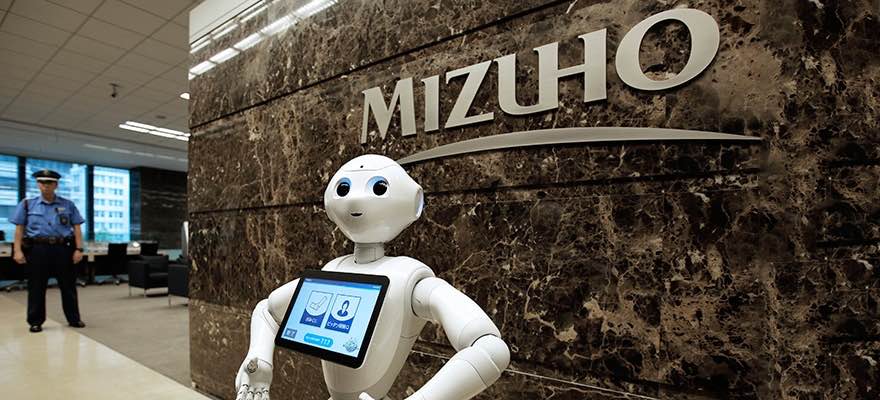

In 2016, Japanese parent firm, Mizuho Financial Group launched Mizuho Americas, which has since grown as a North American banking holding entity. The group comprises a host of legal entities, aggregating segments in the corporate and investment banking, financing, securities, treasury services, asset management, and research services spaces for clients in North America.