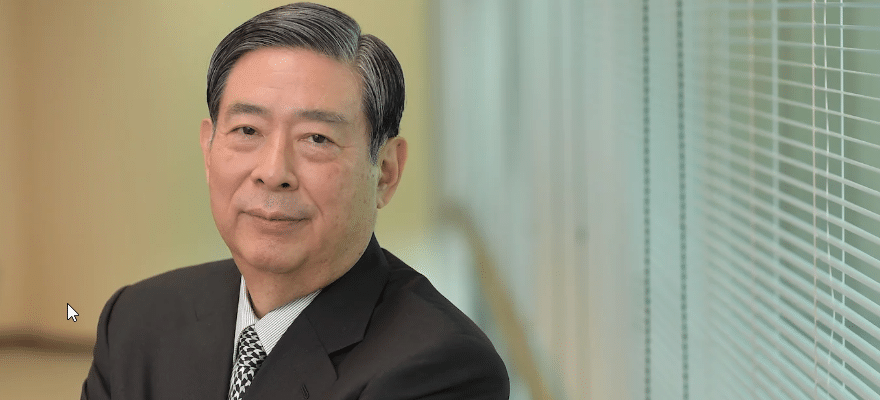

Ripple has announced the appointment of SBI Holdings president and CEO Yoshitaka Kitao as a board member.

Ripple and SBI already formed a joint venture called SBI Ripple Asia in 2016, and the inclusion of Kitao in its board will further strengthen their ties and might accelerate their joint blockchain initiatives. Last year, the joint venture introduced the Money Tap application in the Japanese market to reduce the payment settlement time.

Commenting on this new role at the San Francisco-headquartered company, Kitao said: “Blockchain and digital assets are changing the way we move money around the world, and Ripple is the driving force behind this positive change. I am excited by this opportunity to lend my expertise and be part of the company’s next phase of growth.”

A veteran on the table

Kitao is a financial industry veteran and bringing forty years of experience to the table. In 1999, Kitao established SBI Holdings in Japan which turned out to be a leading holding company in the region.

Prior to that, he served as the executive vice president and chief financial officer at Softbank and played a significant role in strengthing the company’s path to many investments. Being an economics graduate, he initiated his career at Nomura Securities as an investment banker.

Welcoming Kitao, Chris Larsen, co-founder and executive chairman of Ripple, said: “I am excited to welcome Mr. Kitao to our Board of Directors. From conventional financial markets to digital asset markets, his deep understanding of the financial services industry will offer valuable business and financial expertise to help Ripple continue to scale.”

“Approximately half of our customers are located in Asia-Pac today, and we’re rapidly expanding our global footprint across the region. Mr. Kitao comes at a perfect time for Ripple as we look to deepen our customer base in Asia and beyond.”

Yesterday, Ripple published its quarterly reports which showed that the demand for XRP surged drastically in the market - the company sold 31 percent more XRP in Q1 2019 than the previous quarter.

Meanwhile, earlier this month, Japanese crypto startup FXcoin completed a third-party allotment of shares with SBI to open a digital asset Exchange in the country.