American Express has become the latest target of the Australian Securities and Investment Commission (ASIC) for breaching the design and distribution obligations (DDO). An Australian court also ordered the credit card giant to pay AU$8 million for the breaches.

Breaches of DDO Obligations

ASIC announced today (Friday) that the DDO breaches were related to two co-branded credit cards, which were primarily distributed to customers in David Jones stores. The regulator moved against the credit card issuer in December 2022 with civil penalty proceedings.

According to the court, the credit card issuer breached the DDO rules between 25 May 2022 and 5 July 2022, as it must have been aware of the inappropriateness of the target market determinations (TMDs) due to high cancelled application rates. Further, the company did not stop issuing the credit cards when it had not reviewed the TMDs.

“In addition to an obligation to identify an appropriate target market within a TMD, inherent in this consumer-centric approach is a requirement for financial product issuers and distributors to actively review events and circumstances that may suggest that an existing TMD is no longer appropriate,” the Aussie judge said when ordering the penalty.

“A penalty of this order ensures it has a ‘sting’ sufficient to deter both repetition by American Express and contravention by other providers of financial products, and one that goes beyond being a mere ‘cost of doing business’.”

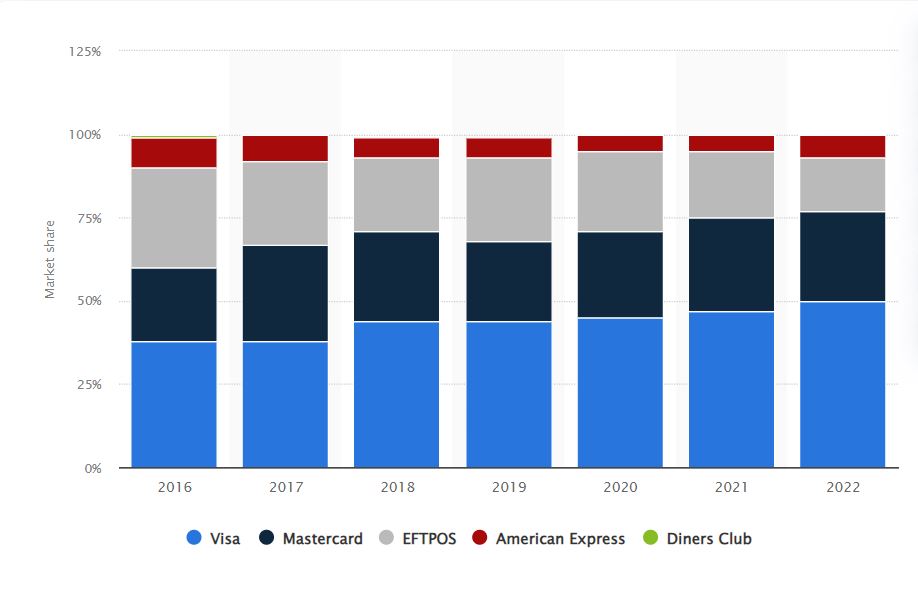

Similar to most markets, Visa and MasterCard dominated the Australian credit card market between 2016 and 2022, according to Statista. However, at the end of 2022, American Express had a 7 percent market share.

A Partial Victory

Although the court slapped the penalty, it squashed the regulator’s allegations that American Express failed to take all reasonable steps to ensure David Jones was informed and must not continue distributing the credit cards in-store.

“This is an important decision because it highlights the requirement for issuers and distributors of financial products to customers to have in place adequate systems to monitor events and circumstances that suggest a target market determination is no longer appropriate,” said Sarah Court, ASIC’s Deputy Chair.