Alessandro Ravanetti is co-founder and CMO of Crowd Valley, a global Fintech company.

Securities-based Crowdfunding is finally here. From May 16, 2016, it's possible for registered platforms to offer securities under Title III of the JOBS Act, for companies to use crowdfunding to offer and sell securities, and to retail investors to place their money on the next big thing. The number of opportunities arising for retail investors through equity crowdfunding is huge.

The SEC adopted the final rules and forms on October 30, 2015, implementing the new Section 4(a)(6) of the Securities Act of 1933, as amended (the "Securities Act"), allowing issuers to sell securities to the public under certain circumstances without registering such securities with the SEC. But what will these new rules mean for small investors?

Basically, anyone will be able to invest, but given the risks involved by investing in early stage companies, there is an investment limit which depends on your net worth and annual income.

- If either your net worth or your annual income is < $100,000, then you can invest, in any 12 month period, up to the greater of either $2,000 or 5% of the lesser of your annual income or net worth

- If both your annual income and your net worth are = or > than $100,000, then you can invest, in any 12 month period, up to 10% of annual income or net worth, whichever is lesser. In any case you can't exceed $100,000 invested per year.

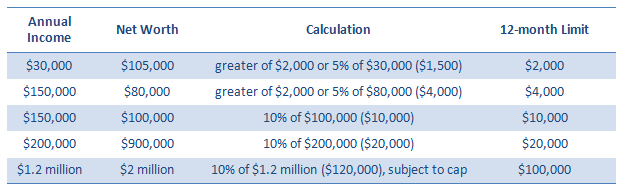

A few examples in the table below taken from the SEC investor bulletin:

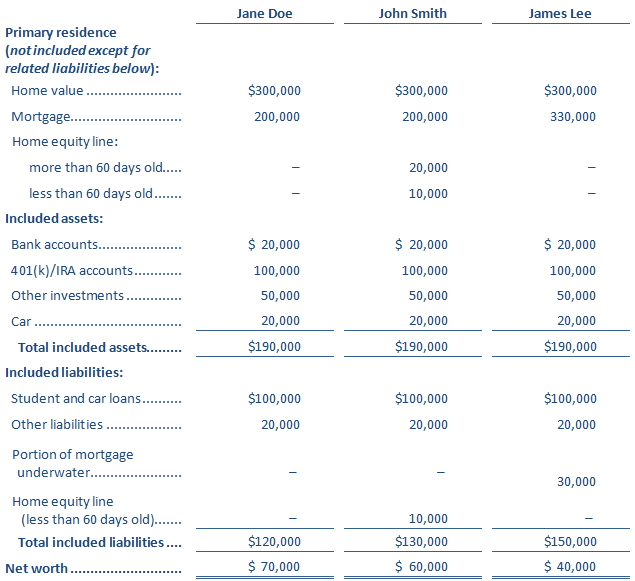

In order to calculate your net worth you should add all your assets and subtract all your liabilities. If you calculate your income or assets jointly with your spouse, each of your investments together cannot exceed the limit that would apply to an individual investor.

Examples of net worth calculations, in order to determine the investment limits, are showed in the following table:

Making an investment in a crowdfunding offering will be very easy. It will be just needed to open an account with the crowdfunding intermediary (broker-dealer or funding portal ).

Even if it's a great opportunity to invest early on in a promising startup, there are various risks that you should consider when you place your money in early stage ventures. The main risks are listed below:

1. This is a speculative investment and you should be able to afford to lose the entire amount invested.

2. It's an illiquid investment, as you will be limited in your ability to resell your investment for the first year. You may have to locate an interested buyer in order to resell your crowdfunded investment.

3. There are cancellation restrictions, but there are up to 48 hours prior to the end of the offer period to cancel your investment commitment for any reason.

4. The valuation of private companies is particularly difficult, and there is the risk to overpay the percentage of equity that you receive.

5. A part of your investment may be used as compensation of the company's employees, including its management.

6. As it happens with other investments, there is no guarantee that crowdfunding investments will be immune from fraud.

7. No early-stage investors, as for example angel investors and venture capital firms, can translate into a lack of professional guidance.

8. The required financial disclosure is limited compared to public listed companies.

This last point, about the limited disclosure required for a private company compared to a publicly listed company, is one of the main differences between a crowdfunding investor and a shareholder in a publicly traded company.

Public listed companies are generally required to disclose information about their performances every quarter, while private companies raising money through crowdfunding are required to disclose the results of their operations and financial statements on an annual basis. All the persons representing the company must identify themselves, and broker-dealers/funding portals are required to have transparent communication channels to allow the investors to discuss the pros and cons of an investment opportunity, as well as be able to ask questions directly to the management of the company.

Another big difference, in the points listed above, is the illiquidity of the shares you buy. You cannot resell your shares for the first year unless the shares are transferred:

- to the company that issued the securities;

- to an accredited investor;

- to a family member;

- in connection with your death or divorce or other similar circumstance;

- to a trust controlled by you or a trust created for the benefit of a family member;

- as part of an offering registered with the SEC.

Even if there are requirements and risks that you should think about when you consider investing your money through equity crowdfunding, the investment could be definitely worth it. E-Car Club, the UK's first entirely electric car sharing club for businesses and communities, is one of the most successful case so far, as the 63 investors which helped the company to raise £100,000 in 2013 have received a "multiple return" on their investment following the sale of the business to Europcar in July 2015.

Many more exits with big returns are expected in the year ahead, are you ready to place your bets?