This article was written by Arik Shtilman, CEO of CashDash and Member of its Board of Directors.

In our interconnected world, the need to use cash to pay for goods and services has been dwindling. While it’s unlikely that paper money will ever disappear completely anytime soon, electronic cash transfers through debit card transactions are the norm for many consumers. Meanwhile, time – and technology – marches on.

An increasing number of consumers around the world have grown accustomed to not even pulling their debit cards out of their pockets, thanks to the rise of digital wallet services. Simply tapping your mobile phone against a kiosk or POS with an integrated NFC receiver, or allowing a POS to scan a QR code on your mobile, means losing or misplacing your bank card is no longer a worry.

Visa’s recent ‘Digital Payment’ report has showed how the number of regular mobile tripled since 2015 (54% vs 18%) paying close attention to the UK market, where 74% of consumers are ‘Mobile Payments users’. However, what about money transfers not between consumers and retailers?

Sure, you can run down to the local cashpoint, pull some money out of an ATM, and physically hand it to a friend or a family member, but this is woefully inadequate; it’s inconvenient, time-consuming, and not an option for someone who’s not in close physical proximity to you.

Wiring someone money is even more inconvenient, what with the fees charged by traditional money transfer services. Shouldn’t there be a way to harness modern technology and move away from these outdated cash transfer methods?

The Solution’s Already Here

The same technological advances that led to fast, easy, and convenient electronic card payments have already begun to revolutionize cash transfers. Online payment processors have been paving the way for a more decentralized electronic cash transfer paradigm that works on a peer-to-peer basis.

According to eMarketer’s latest mobile banking and payments forecast, the transaction value of US mobile P2P payments will grow 55.0% this year to $120.38 billion and, by the end of the year, 63.5 million US adults will use a P2P payment app at least once a month.

P2P cash transfer systems are lightweight, intuitive, and faster than any other cash transfer methods out there – including handing your friend a fistful of cash directly. An excellent example of the freedom that P2P cash transfer systems have brought to the money transfer industry on its head is PayPal, the longtime market leader in using a peer-to-peer model. The company’s ecosystem has encouraged free and easy cash transfers since nearly the very beginning.

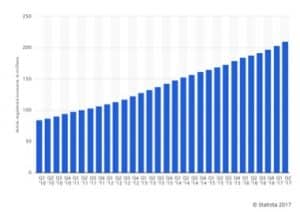

Number of active registered users on PayPal

This statistic shows the number of total active registered user accounts to online payment platform PayPal. In the second quarter of 2017, more than 210 million accounts were active worldwide.

However, as the industry leader, there’s not much impetus for PayPal to innovate or differentiate its services from other P2P systems. There are several drawbacks to the system, as account holders who use the service as an e-commerce payment processor have to cope with fees of up to 3% or more levied on any incoming funds.

Meanwhile, using a PayPal-branded debit card to make ATM withdrawals entails extra additional fees, and transferring money out of the PayPal environment to a traditional bank account can take up to 72 hours in some instances.

The Future of P2P Cash Transfers

Despite its high adoption numbers, PayPal is hardly the best P2P cash transfer platform out there. Thankfully, there are many other companies that have innovated their way to market share – platforms like Popmoney, Venmo, Squarecash, Snapcash, and even Facebook Messenger all exist to facilitate P2P cash transfers, either from directly debiting existing bank accounts or by transferring cash maintained in a user’s account.

The world of digital cash transfers via P2P payment processors still suffers from a lack of widespread adoption. 62% of the world’s adult population has a traditional bank account – all of whom are prospective customers for P2P banking.

In fact, the number of people who opened bank accounts grew by 700 million alone from 2011 through 2014. Traditional financial service providers will have to embrace electronic systems in order for P2P cash transfers to truly become more widespread.

This process is off to a halting start. Major US banks have begun to band together to launch a joint venture in offering P2P transfers to any of their account holders – a good start, but P2P cash transfer services can do so much more.

Digital infrastructures are currently being overhauled around the world with an aim to creating truly global P2P solutions that include not just cash transfers in one currency but Exchange services as well – and at rates that don’t leave world travelers in a slump. This is a clear sign that P2P transfers won't just be a stand-alone, optional service, but a substantial feature permanently integrated into our digital wallets.

All of these developments mean that peer-to-peer cash transfer systems are off to a good start – certainly one that will make a major difference when it comes to increasing accessibility to everyday banking customers around the world. Between the currently existing platforms and those that are in the pipeline, the future of peer-to-peer electronic cash transfers is undoubtedly bright.