The shares of the London-listed mobile payment solutions provider Boku (LSE: surged over 7% today (Tuesday) and tested two-year highs following the presentation of the company's latest trading update for 2023.

The published information indicated that Boku achieved better-than-expected results while anticipating continued growth momentum into 2024.

Boku Announces Strong Revenue and EBITDA Growth in 2023 Trading Update

The company reported strong growth in revenues and adjusted EBITDA compared to 2022. Revenues are expected to be at least $82.7 million, up 30% year-over-year (YoY) or 33% on a constant currency basis. This growth was driven by increasing transaction volumes from major global merchants.

Adjusted EBITDA is anticipated to be at least $27.3 million, representing YoY growth of 33%. This exceeds current market expectations despite Boku's continued investments in its payment network.

Boku also saw significant growth in its Local Payment Methods (LPMs), which accounted for $16.9 million in revenue in 2023. This represents 153% growth compared to LPM revenues of $6.7 million in 2022.

Additional operational highlights include 67.4 million Monthly Active Users on Boku's platform in December 2023, up 29%, and $10.5 billion in Total Payment Volume for the year, up 19% or 23% on a constant currency basis.

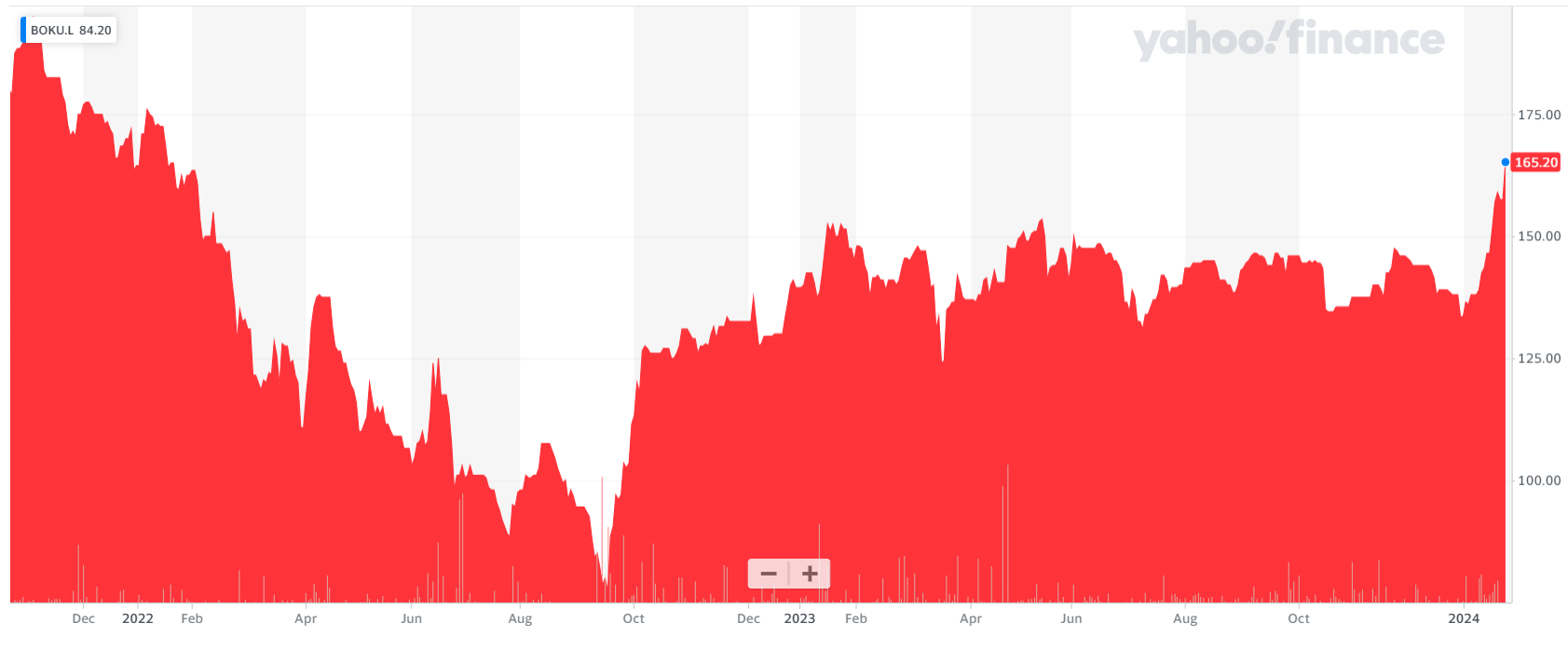

Two-Year Highs for Boku on the Chart

Boku's shares on the London Stock Exchange are rising by about 5% in response to the publication of the trading update 2023, changing hands at 165 pence. Initially, however, they tested 169 pence, opening with an upward gap and reaching the highest levels in over two years.

This makes Boku the second company in the payments sector today covered by Finance Magnates, whose shares have risen to the highest levels since January 2022. Earlier, a similar jump was observed in Cornerstone's shares following news of a partnership with Mastercard.

Boku Changes the CEO

The positive update occurred as Stuart Neal takes over as the CEO, replacing the retiring Jon Prideaux.

"It is very pleasing to be picking up the reins at Boku with the Company experiencing such incredible momentum," Neal added. Neal also expressed confidence that Boku's success will continue into 2024 and beyond.

"We finished 2023 strongly which gives us a good trajectory into this year and I am confident the success of our strategy will continue in 2024 and beyond," the new CEO concluded.