As more of our day-to-day lives become more digitized, the financial world is looking at ways to take advantage of every piece of information given to them by customers and clients. Data can now be collected anywhere at any time making customer experiences easier to be personalized for each individual. A major advancement in both data collection and storage is through the use of cloud technologies. In this article, we have tried to answer one of the most frequent questions asked in the finance world – How could the cloud serve as a catalyst for enterprise business transformation — and a potential game-changer for the way financial services organizations will operate in the future.

A New Business Frontiers - Cloud-based Banking

Cloud-based banking refers to deploying and managing banking infrastructure in order to control cloud-based core banking operations and financial services without dedicated physical servers. The leading public cloud providers offer an array of innovative products-as-a-service that can be accessed on their platforms and help banks implement business and operating models to improve revenue generation, increase customer insights, contain costs, deliver market-relevant products efficiently and help monetize enterprise data assets.

The Cloud Service Model

The biggest cloud service providers (CSPs) like Microsoft (Azure) and Google handle the complex cloud infrastructure and allow banks to use it for specified fees. Depending on the company’s size and budget, a CSP can offer private, public, or hybrid clouds. There are four main cloud services offered for different situations a business would need them for. Business Process-as-a-Service (BPaaS) provides services that cover everyday operations like billing and human resources, which can be utilized by almost every banking system. The second is Infrastructure-as-a-Service (IaaS) which delivers a fully-fledged core banking infrastructure that handles business operations and software integrations which allow for greater scalability and reach.

Another is Software-as-a-Service (SaaS ), delivering cloud-based banking software for accounting, invoicing and other benefits geared towards making customer relationship management much smoother. The right cloud strategies also make it easier for banks to provide personalized service based on customer needs and preferences, by understanding how customers interact with financial products. Lastly, Platform-as-a-Service (PaaS) offers a cloud-based core banking platform for app and database development making it easier to store and manage data in one spot. Cloud platforms are designed for fast performance and can handle large amounts of data quickly and easily. This allows banks to improve their transaction processing speeds and reduce latency problems.

Potential of the Cloud Banking System – The Numbers Don’t Lie

Precedence Research shows the cloud services market received an overall value of $387.15 billion in 2021. In addition, they estimate that it will reach $1630 billion by 2030, growing at a registered CAGR of 17.32% from 2022 to 2030. Because of its ease of deployment, cost-effectiveness and low maintenance costs, SaaS had the largest market share in 2020. During the projected time frame: 2022 to 2030, IaaS is anticipated to grow at the fastest rate. The growth can be attributed to the surging demand for hybrid cloud platforms as well as the growing preference for business storage of data and security solutions.

Cloud Software Companies Redefining Global Banking

Cloud services are not going away any time soon, so to stay ahead global companies have adopted several strategies such as product launches, partnerships, collaborations, M&A and joint ventures to strengthen their foothold in the global banking cloud services market.

A surprising major facilitator in the push for larger cloud services integration was the coronavirus pandemic. In April 2020, banking software provider Temenos launched SaaS propositions using innovative Explainable AI (XAI) and cloud technology to help the banking industry maintain and even grow during the pandemic and effectively manage consumer relationships. It enabled banks to fulfil customer needs for intimate digital engagement and serve SME and retail customers with fast loan approvals and viable financial goods in a time when physical services were neutered.

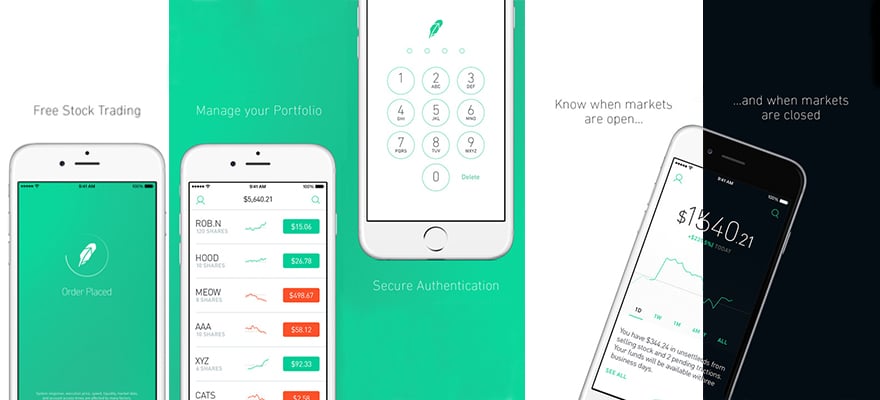

OneSpan, a cyber security software, released a security application for banks. It helps customers to safely transact and perform banking through mobile applications. It uses a wide array of cloud data for authentication methods, such as One-Time-Password, usage biometrics, fingerprint, facial recognition, Out-of-band SMS and geo-location. It also allows bank customers to e-sign documentation, fulfil regulatory requirements for strong authentication, and maintain app security features.

The Israeli Angel

Israel is a powerhouse for cloud consumption, bigger than many other countries in Europe, the Middle East and Africa because of both the high concentration of startups and now more traditional banks, insurers and retailers are now moving to the cloud because of Israel’s Nimbus project, a cross-government project intended to provide a comprehensive framework for the provision of cloud services to the Government of Israel. This makes it much easier for companies to adapt to a cloud-centered infrastructure.

In June 2022, the Bank of Israel just announced the removal of barriers to using cloud computing services, prompting even further growth across the country. The Supervisor of Banks, Mr Yair Avidan said: “Cloud computing services promote and enhance the organizational computing abilities and enable banking corporations to increase efficiency and respond rapidly to market needs.”

Critical Sources of Value Enabled by Cloud Transformation

Everyone is starting to realize the fundamental role cloud technologies are going to have in the future of banking around the globe. Research revealed that 86% of bankers have adopted cloud services to harness its virtually unlimited scalability. 82% and 83% of banks in APAC and EMEA, respectively, also plan to increase investment in the cloud over the next three years.

Cloud services increase the digital accessibility and allow synchronization of the entire enterprise through better integration of business units by sharing data, driving integrated decisions, moving more quickly to solve customer problems, enhancing collaboration through new shared platforms and tools, and increasing the speed of decisions. Cloud services also have a reputation of extreme security standards. These services facilitate resilient operations by decentralizing companies’ data storage. This gains the ability to replicate data and app services across more than a single data center or region making it much harder for data breaches to occur. Banks use the cloud for fraud detection and prevention by analyzing large amounts of data from multiple sources. This helps financial institutions detect suspicious activity before it causes any damage.

Cloud integration pushes business innovation and drives strategy to build new customer experiences, create and market offers, optimize operations, and manage talent through leveraging tools such as machine learning, Internet of Things platforms, AR and VR, image recognition, natural language processing, etc. With greater a focus on innovation, cloud also allows for easier scaling and manageable costs as needed. It captures cost efficiencies in dynamic cloud pricing by increasing or decreasing computing capacity as needed and facilitating granular spending control. Businesses can move at whatever speed they need and can easily change on demand.

Going forwards, cloud technology is the primary option for banks seeking to evolve and scale their business, whilst minimizing risk, time and cost. Bankers recognize these benefits and the overall findings of the research suggest they will continue to grow their investment in cloud technology. We believe that over time it will become a powerful mainstay within the financial services industry.

If you would like to hear more about Cloud for Banking, join us for the FinTech-Aviv Cloud Event on August 17th to hear our experts’ insights on ways to integrate FinTech solutions in banks in the transition era between Legacy systems and Cloud solutions for the financial industry.

Nir Netzer | C.P.A (LL.B, MBA) | Founding Partner at Equitech Group | Chairman of the Israeli FinTech Association - FinTech-Aviv |