Shares of Cornerstone, a foreign exchange and payments solution provider, surged nearly 35% today (Monday) on the London Stock Exchange following a trading update that suggested their revenue and EBITDA for the fiscal year 2023 (FY23) will be "materially above current market expectations." Although the company did not provide specific figures, this information was sufficient to spark optimism among investors.

Cornerstone's Revenue Expected to Exceed £8 Million

The latest trading update came after an announcement at the end of October, when the company reported that its full revenue for FY23 is expected to be at least £8 million, marking an increase of 66% year-over-year.

Now, the company hints that the final results will be higher than previously anticipated as it continues to experience "strong trading momentum," reflecting changes made in its operations over the past year.

"Very strong trading has continued to date and, as a result, the Group now anticipates reporting revenue and adjusted EBITDA for the year to 31 December 2023 materially ahead of current market expectations," the company commented.

These developments led Cornerstone's shares to rise 34.8% to 16.3 pence on Monday, testing over-monthly highs.

Continued Strong Performance for Cornerstone

In the first half of 2023, Cornerstone announced an increase of 90% in revenue, reaching £3.6 million. The company was optimistic about maintaining this positive trend in the latter half of FY23, anticipating results that surpass expectations.

Should Cornerstone achieve or exceed its projected outcomes for 2023, it would mark a continuation of the impressive growth seen in 2022. Last year, the company saw its revenue soar 110% to £4.8 million, up from £2.3 million the year before.

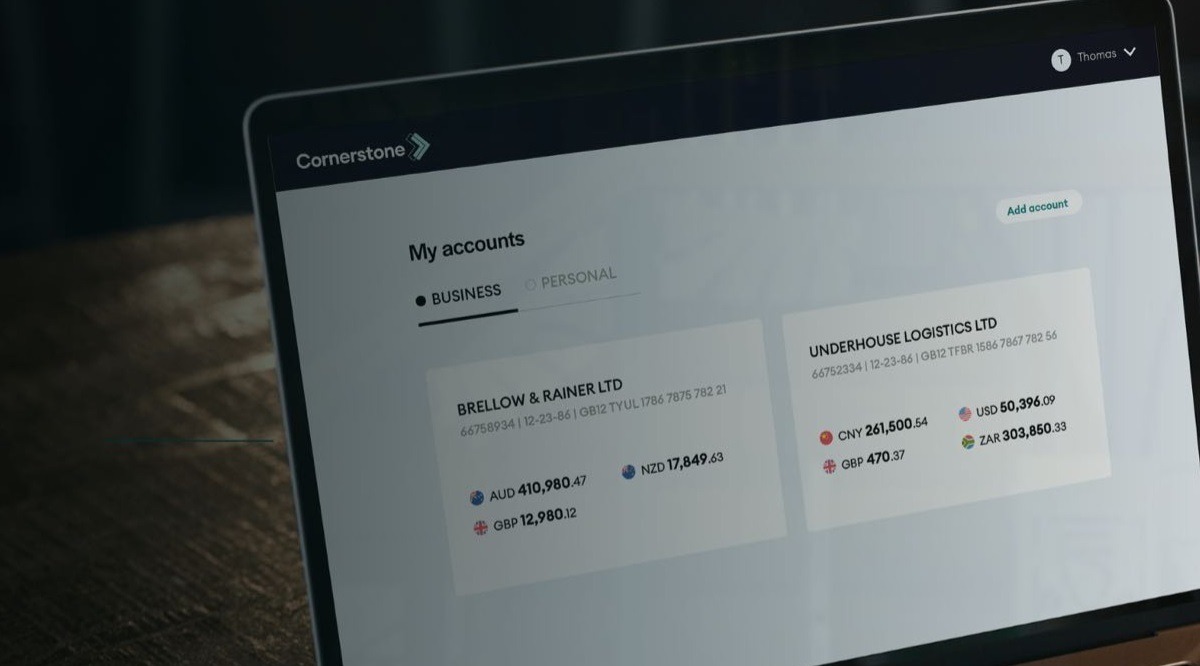

A significant portion of Cornerstone's revenue is attributed to its core services in foreign exchange and payments , especially from spot and forward transactions. These services accounted for 92% and 8% of the total revenue, respectively.