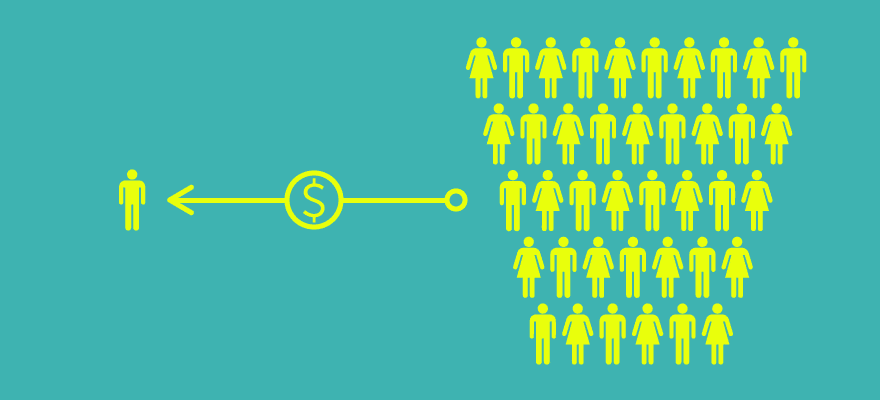

Equity Crowdfunding for non-accredited investors in the US became legal today with Title IV of the JOBS Act, also known as Regulation A+ going into effect today. After a multi-year period of back and forth in the halls of the SEC, Regulation A+ officially got the go ahead. With it, it relaxes rules for private companies to raise funds from non-accredited private investors.

For crowdfunding firms, today’s news is a big deal as it allows them to open up their platforms beyond just accredited investors and include mainstream retail customers. As a result, Seedrs, which has successfully been able to blend both accredited and non-accredited crowdfunding platform in the UK and Europe, is expected to launch its planned US operations with Regulation A+ going into effect. In addition, IndieGoGo, which already has a large user base of US customers using its non-equity selling crowdfunding platform has revealed interest in entering the equity selling space.

Regulation A+

Regulation A+ contains two types of fundraising opportunities for private firms:

Type 1 – Companies can raise up to $20 million in a 12 month period. Requires sending funding proposals to SEC for review. Also requires abiding by Blue Sky filings to register the sale in individual states

Type 2 – Companies can raise up to $50 million in a 12 month period. Requires sending funding proposals to SEC for review. Exempted from Blue Sky filings. Required to submit semi-annual and annual reports with the SEC.

While firms will now have easier access to raising funds from private investors, the costs associated with complying with Regulation A+ requirements create a barrier for startups. As such, ‘hotter’ startups that have a demand from accredited and institutional investors, may elect not to use Regulation A+. The result is that despite equity crowdfunding creating an aura of retail investors gaining access to invest in the next Uber or Airbnb, those types of deals may never appear on crowdfunding platforms.

On the other hand, startups, especially those that are consumer-facing, have been able to raise awareness for their brands by using crowdfunding campaigns. Therefore, even among startups that have plenty of access to capital, they may see benefits in raising a portion of their funds on an equity crowdfunding platform.