If you had to come up with a list of sectors that are a match for equity Crowdfunding , biotech would probably be low on the list. A capital intensive industry, even finding winners among publicly traded firms that are required to provide quarterly updates and research disclosure is a hit or miss business. The result is that even the most experienced investors in the field tend to use a shotgun approach, by putting their money into a basket of biotech stocks, either in specific research areas, or betting on proven management teams.

As such, it is no surprise that biotech investments barely appear on crowdfunding platforms, with the majority of funds being raised going towards real estate deals and consumer services. But, regardless of what seems like a strange combination, biotech and crowdfunding may actually be a perfect match.

Looking at it another way, equity crowdfunding could do for biotechs what rewards-based crowdfunding sites like Kickstarter and Indiegogo are doing for content and hardware creators. With over $500 million raised on Kickstarter in 2014, the platform has proven to be a launching ground for creators to not only fund their projects, but gain insight into whether markets exist for their products. As a result, the Pebble smartwatch and indie movie Wyrmwood were able to surprise their creators by finding strong demand via crowdfunding.

After a slow 2014 for biotech, the market has begun to warm up to crowdfunding

In relation to biotechs, equity crowdfunding could become popular is assisting firms in receiving seed funding to take initial research out of the lab, and into the initial trial stage. For biotech firms, being able to tap smaller funding would allow them to efficiently initiate experiments to verify whether their research theories are correct and then only seek larger funding rounds after initial results look promising.

After a slow 2014 for biotech, the market has begun to warm up to crowdfunding. Closing its Funding Round last week, UK-based Venomtech, which uses venom to create medicines, successfully raised $526,023 (£353,296) on SyndicateRoom. The deal followed a nearly $1,042,232 (£700,000) crowdfunding raise by Cell Therapy on CrowdCube in February. The Cell Therapy funding is believed to be the largest successful crowdfunding for a biotech firm.

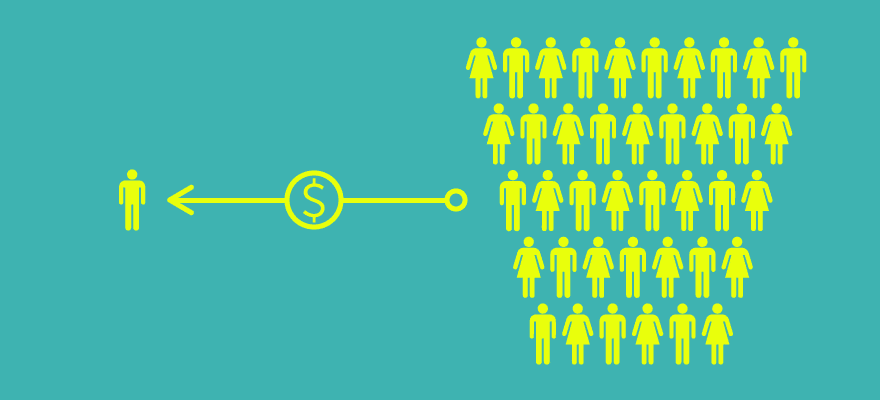

In terms of being a profitable investment, early stage biotechs are the most risky due to high failure rates in their trials. In addition, even if initial trials prove successful, there is no guarantee that a biotech firm will be able to raise additional funds or partner with larger pharmaceuticals to continue their research and monetize their products. As such, for crowdfunding investors, funding biotechs would be best served using the shotgun approach and limiting exposure in any one firm. Over the long-term, the percentage of individual biotech firms providing a profit to crowdfund investors may be low, but could outperform other asset classes thanks to winners providing outsized gains. More importantly, an emergence of biotech crowdfunding deals could also prove to expedite the pace of new life-saving medicine making its way to the market.