Private investment is moving online. Indeed, digital marketplaces are springing up rapidly, catering to the growing number and types of investors and issuers.

Alternative finance is becoming less – well –alternative. With a growing interest from institutional investors, venture capitalists (VCs) and angel networks, the myriad of platforms which now exist is overwhelming.

Neha Manaktala, Co-Founder & CEO, DealIndex

To help us get a grip on this rapidly evolving space is Neha Manaktala, Founder and CEO of DealIndex, a digital investment aggregator. The former investment banker turned entrepreneur caught up with Finance Magnates to share some of the insights stemming from the company’s recent research publication, which seeks to demystify alternative finance.

A Fragmented Market

Investors can now choose from a plethora of platforms and asset classes at different stages of the funding cycle.

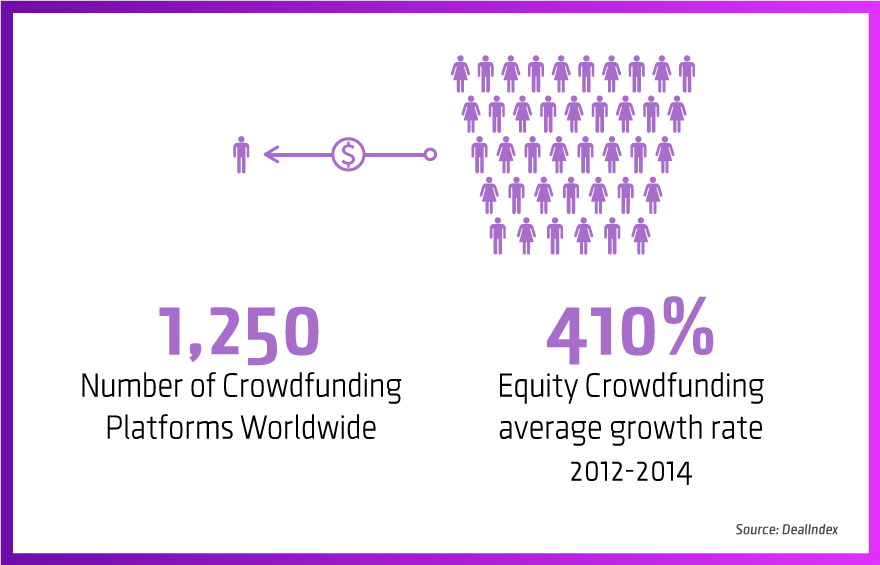

With over 1,250 crowdfunding platforms worldwide, investors can now choose from a plethora of platforms and asset classes at different stages of the funding cycle – from equity crowdfunding to online M&A platforms.

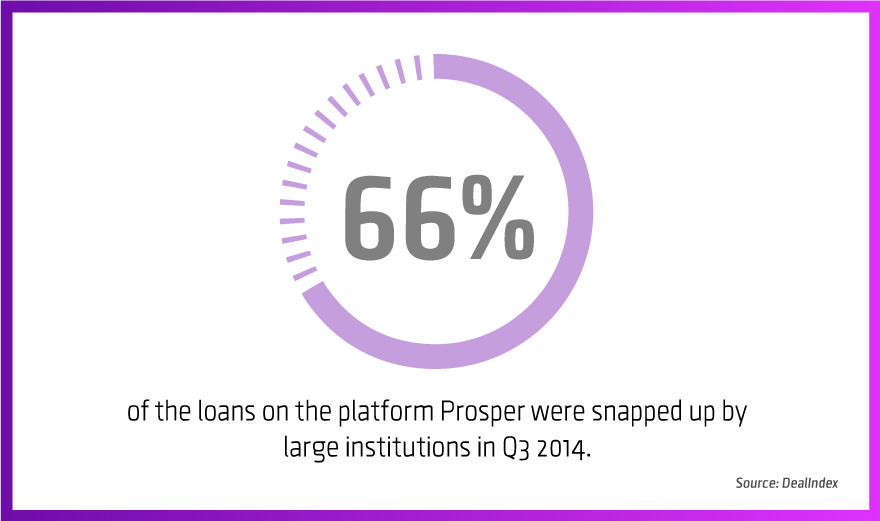

Additionally, more and more investors are flocking to the party. Equity crowdfunding, for example, saw a 410% growth rate from 2012 to 2014. Initially hesitant at first, larger institutional investors are also coming around. Indeed, 66% of the loans on the platform Prosper were snapped up by large institutions in Q3 2014, the same year in which LendingClub successfully listed and numerous other P2P lenders boasted triple digit growth.

Yet as Ms Manaktala explains, “the market is highly fragmented. So if you are an investor right now, you either invest in an angel network or alongside VCs. But with crowd funding platforms, deal flows are going up MoM incredibly, and success rates are quite high.”

Filtering Out the Noise

Given the increasing scale of the booming alternative finance sector, DealIndex seeks to link it all together for an informed view of the eco-system. Ms Manaktala highlighted the need for a singular place for investors to track opportunities and get up-to-date data, analysis and insight - “something that is akin to what people are used to using in investment banking for public market information”.

However, aggregation is not enough. Indeed, deal flow, volume, size of valuations and due diligence requirements and practices vary significantly between platforms.

We are quite focussed on having the right platforms; not every single platform on the market.

“We are quite focussed on having the right platforms; not every single platform on the market. We deal with platforms which have a good amount of volume and a good amount of deal flow – and try to cut out the noise.”

Ms Manaktala pointed to some emerging patterns. She revealed that IT is the leading sector in terms of deal flow, with food and drink and other consumer companies also doing well. No surprise, the US is leading the way in terms of deal size, frequently boasting deals exceeding $1 million, with the average deal size in the UK steadily rising.

Sharing Space

With increasing numbers of institutional investors joining private online marketplaces, there are concerns that they will crowd out retail investors by snapping up all of the best deals.

However, Ms Manaktala is more optimistic. “The best scenario is that institutional investors and private individuals and the crowd learn to co-exist, as they do in the IPO market and the public market.”

The best scenario is that institutional investors and private individuals and the crowd learn to co-exist.

In fact, she points to some benefits of co-existence; specifically, that sophisticated institutional investors help to more sensibly value deals and reduce individuals’ exposure to risk.

Ms Manaktala explains: “What we tend to see is deals like this: say a company wants to raise $1 million. A VC would put in half of it and the balance of it they would put on a crowdfunding platform. “

“The crowd then are coming in at the same terms as the VC, and because the VC has already done due diligence and has priced and valued this company -presuming they have done all the work – the crowd benefits from all that.”

The Exit Challenge

But once invested, the challenge going forward will be the inherent lack of Liquidity and opportunity to exit for both founders and investors. Indeed, only a couple of secondary markets exist, such as Founders Club and Second Market, yet volumes remain small and Regulation remains restrictive. In practice, investors are still unable to trade their newly acquired assets.

Nothing stands in the way more than regulation. Selling company shares is a highly regulated process.

“The volume in the private market is tremendous. What that means is that at some point, you’re definitely going to need liquidity because people can only hold an investment for that much amount of time. “

Yet some remain sceptical, with perhaps more questions than answers. Nothing stands in the way more than regulation. Selling company shares is a highly regulated process, with restrictions on how a stock sale is marketed, who can be a shareholder, etc.

However, there are some indications that the situation may be beginning to change, as Ms Manaktala explains: “Particularly in the US, the exchanges and regulators are starting to get more involved. There have been quite a few discussions around creating private marketplace exchanges. Indeed, you need to work with the bigger stock exchanges, which have the experience of dealing with this.”