First Derivatives (AIM:FDP) reported an 87 percent increase in revenues in its software division for the first half of its 2015/16 financial year, largely driven by new clients from the financial services industry.

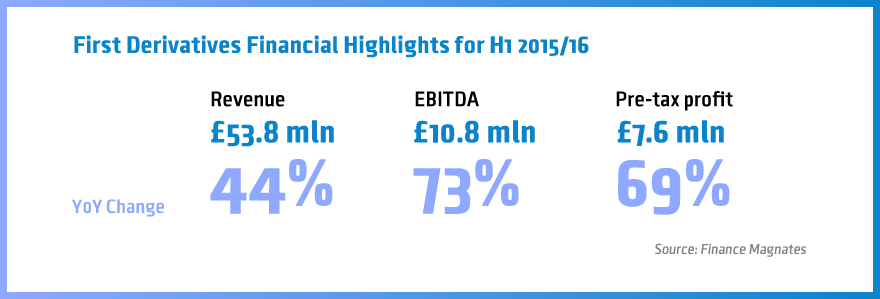

Total revenues stood at £53.8 million ($81.6 mln), up 44 percent on the year, with earnings before interest, tax, depreciation and amortization (EBITDA) coming in at £10.8 million ($16.4 mln), up 73 percent. Adjusted pre-tax profits were £7.6 million ($11.5 mln), an impressive 69 percent improvement on the year.

Organic Growth Plus Acquisitions

First Derivatives attributed its positive results to its growth strategy across the consulting and software business divisions. During the reporting period the service provider made two acquisitions: a Canadian data management company, Affinity Systems, and an Irish software development company, ActivateClients. The two deals should enhance organic growth and strengthen its product portfolio.

Increasing demand for Big Fast Data

In the software division, First Derivatives reported revenues of £18.3 million ($27.7 mln), up 87 percent on the year thanks to the addition of new clients from the financial services circles, the bulk coming from capital markets. The company said in its financial report, however, that it is eyeing other markets as well, as a growing number of companies across industries require capabilities for processing large data sets, First Derivatives noted. A few days ago, the company announced the addition of the Stock Exchange of India to the list of its clients.

The company boasts a leading position among providers of Big Fast Data, which involves the capture and processing of large data sets as well as data streaming. Earlier this year, it also launched a new product, Marketing Cloud , which it now says has been taken on by tech majors including Cisco, Commvault and Citrix. As part of efforts to enhance its offering, it recently launched a new research and development facility in Canada.

Consulting Services Also Enjoy Healthy Demand

In consulting, First Derivatives reported a 28 percent improvement in revenues to £35.5 million ($53.8 mln) in the six months to end-August, enjoying a healthy demand for its services. These services included implementation, support and development across asset classes such as foreign Exchange , derivatives, credit and interest rates.

The robust performance for the first half of 2015/16 is a continuation of its 2014/15 performance, when revenues grew by 19 percent, EBITDA improved by 24 percent, and profit before tax skyrocketed by 120 percent.