Within the fintech lexicon, one term that often gets thrown around is ‘financial inclusion’. Loosely defined, financial inclusion is the mission to provide financial services to low-income demographics and countries. The term comes up most often in relation to providing financial services to regions such as Africa, where by far the majority of the population of many countries remains unbanked.

While many within the fintech industry are speaking about how advancements in financial technology such as the Blockchain and mobile banking will increase financial inclusion, in today’s Fintech Spotlight we take a look at Oradian, a firm that is on the ground to make this happen.

Micro-Finance

Oradian’s business is based on providing a cloud-based banking infrastructure to micro-finance institutions. A prominent sector in many parts of Africa, Latin America and Southeast Asia, micro-finance firms are lightly to non-regulated institutions that provide lending to sectors of the population being unmet by banks. Micro-finance firms tend to be mission driven, thereby providing loans in specific niches such as to merchants to acquire inventory or to carpenters to help them acquire new tools. Among lenders, loan sizes will vary from around $20 to $20,000. The vast majority of transactions are short-term financing, from as short as a week to a yearlong, with many loans using a daily repayment schedule.

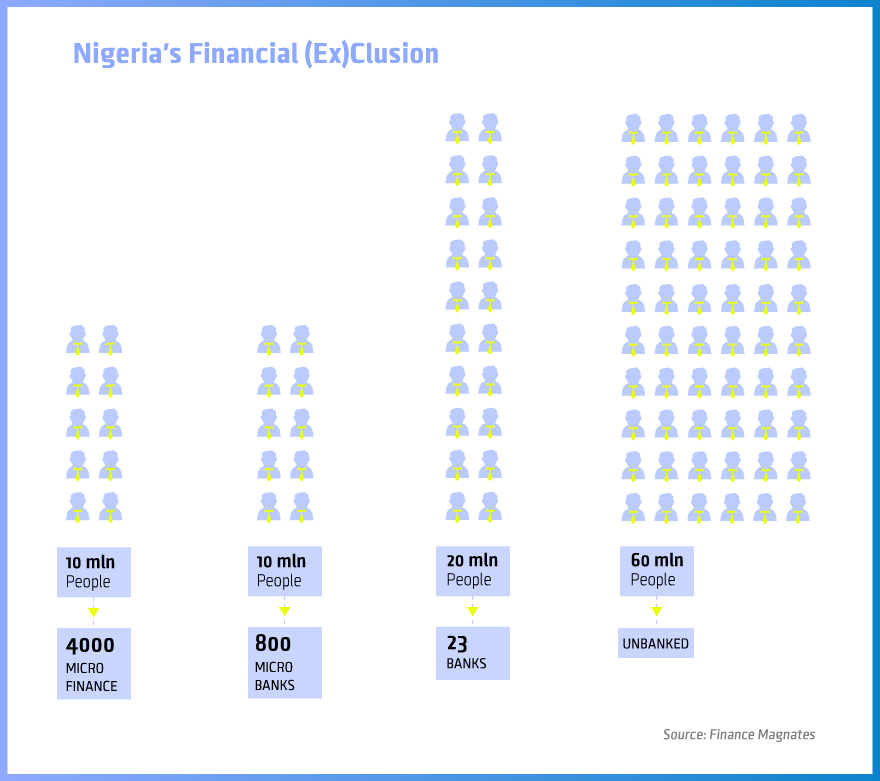

Speaking with Antonio Separovic, CEO at Oradian, he cited their largest market, Nigeria, as an example. Separovic explained that in total Nigeria has a population of around 180 million, with 100 million above 15 years of age and considered 'bankable'. Within the country, there are 23 banks that serve 20 million people. In addition, there are 800 smaller micro-finance banks that service another 10 million. On the lowest rung of financial institutions, and the fastest growing, are about 4000 micro-finance alternative finance firms that service 10 million people. However, even with the growth of micro-finance, it still leaves 60 million or 40% of the bankable population who are excluded from any forms of banking services.

Cloud-Based Banking Infrastructure

As a solution to boost the efforts of micro-finance firms, Oradian focuses on providing what it calls the ‘core banking infrastructure’. Separovic explained that at the bottom of the chain, many firms are using little to no banking or accounting software to help them monitor outstanding loans and real-time repayments of loans.

Within a country like Nigeria, the lack of product specific software creates a scenario that is prone to errors and fraud. Specifically, many micro-finance firms rely on loan officers who go out to their customers to both hand out and collect loans. In replace of banking software, much of the loan data from loan officers is collected on handwritten notes or manual updates to Excel sheets. The result of this fractured lending and repayment structure is the lack of real-time information due to gaps between loan officers handling loans and reporting changes to their central office.

First world technology at a fraction of the price

To provide a solution, Oradian’s software provides a unified system for loan officers to update information about their customers such as repayments and loans outstanding. As a cloud-based software, entries of information by loan officers then become available to the micro-finance firm in real-time to both monitor individual and aggregated lending. Separovic explained that the bottom line of their goal is to provide their micro-finance customers with “first world technology at a fraction of the price.”

Internet Requirements

As a cloud-based financial software firm, the foundation of Oradian’s model is the ability for individual loan officers to enter information that becomes available in real-time. However, that can only work where internet connectivity is available.

In this regard, Separovic explained that despite beliefs to the contrary, within emerging markets such as West Africa, internet connectivity is fairly reliable. Separovic described that due to internet infrastructure being newer than other technologies, basic necessities like electricity and water pumping are more likely to fail than internet connectivity. As a result, loan officers of Oradian’s customers work like any other distributed workforce, connecting remotely with laptops or tablets.

Credit Scoring and Looking Ahead

Within the alternative finance industry, big data has become an important technology to better understand customers and reduce lending risk. Specifically in marketplace lending, many firms are using non-credit score data such as their social presence, spending habits and university attended, in order to create customer risk profiles.

When asked whether Oradian is also able to provide customer insights through the customer that is collected, Separovic answered, “Oradian is collecting user data.” However, he added that the firm “isn’t a credit scoring specialist.” As such, to Leverage the data that they are collecting, the firm has begun to work with specialists in the credit scoring industry to provide data mining services in order to supply Oradian’s customers with more understanding of their users.

Currently, Separovic explained that he believes Oradian’s best value is that “in real-time, firms know what their loans are and who is late on their loans and this helps them collect better.”

Fintech Spotlight is a new column on Finance Magnates devoted to reviewing innovative financial technology companies and sector trends.