As the former CEO of Thomson Reuters, Tom Glocer got to see his share of technology products introduced to the financial and media markets. During his time heading Thomson Reuters, Glocer also got to see up close how new media such as social network sites were changing the way that news was being both distributed and discovered. As a result, it’s no surprise that since leaving his CEO and becoming in investor in startups, he has targeted firms involved with data analysis, news, and the financial markets.

Among Glocer’s investments include Selerity and DataMinr. Similar but different, the two firms analyze news and social streams in real time to discover actionable events. Examples include the ability to alert first responders of calamities as well notifying journalists when breaking political related events are taking place.

In the financial world, the two firms, have garnered a following from traders and hedge funds who use the real time services to discover market moving events before they become known to the larger public. In this regard, Selerity made headlines in April, when it posted Twitter’s quarterly financial results before the company announced them. Although scheduled to be made public before the close, Selerity’s machine reading program was able to discover the report on Twitter’s Investor Relations web site ahead of time.

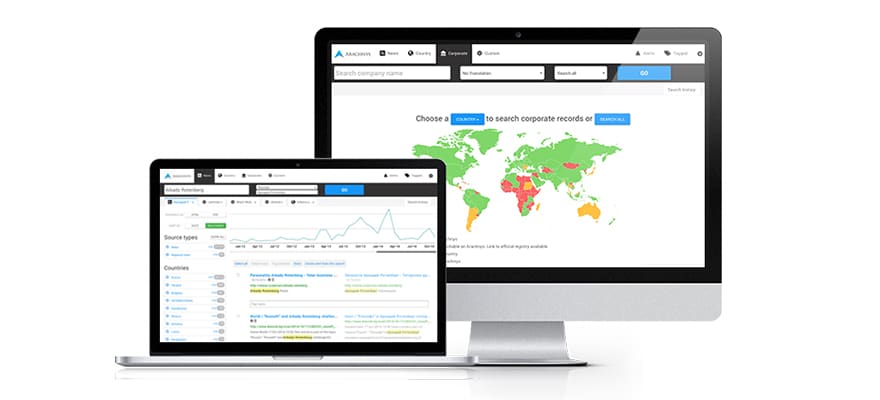

Continuing on the mantra of investing in financial products analyzing data from diverse sources, Gloser’s newest stake is in Arachnys. Headed by former Thomson Reuters colleagues of Gloser, Arachnys provides customer verification tools for financial institutions. Focusing on customers from emerging markets, once uploading client information, the Arachnys service scans global and local news sources, government and court records, as well as corporate registries to provide data to assist in the KYC and AML process used by financial institutions. Gloser’s investment is part of a $3.5 million Funding Round that also included participation from previous investor Martlet.

The investment comes as compliance costs were cited in an April report by Gartner Group on banking trends to be one of the largest and fastest growing expenses for financial firms. Included in the costs are both technology such as reporting software and data storage, as well as added employees to operate the products and include IT staff, accountants and legal personnel. As such, although selling compliance products to financial firms often comes with a long sales cycle due to security and integration requirements, the sector is also one that is ripe for Fintech innovation.