“Bloomberg Killer” - Google the words and you will find many companies trying to dethrone the popular and immensely profitable financial trading portal. In most cases the Bloomberg alternatives market themselves as being vastly cheaper with nearly all of the global giant's functionality.

Among the wannabe Bloomberg killers is Money.net. Unlike other rivals, Money.net was founded by a former Bloomberg employee with knowledge of its product and customer type.

With a monthly price of $150, Money.net costs a fraction of the price of Bloomberg Terminal’s $2000 per month fee. But can it really operate as an alternative to a Bloomberg Terminal? The answer is - it depends on what you are looking for.

Money.net overall view

Bundled vs Unbundled

According to Money.net’s founders, Bloomberg’s hefty price tag is the sum of its parts as it includes economic and breaking news, proprietary research from Bloomberg staff, charting and market data, Analytics tools and trading functionality. As the Terminal is a bundled solution, users are forced to pay full price for the product regardless of which features they use.

Along with Money.net, the theory among the many Bloomberg killers is that they can compete by offering an unbundled solution. This model allows users to purchase the parts they want at significantly lower costs.

Nuts and bolts

At the heart of Money.net is a market data platform with real time pricing, charting and research. To expand functionality, Money.net has partnered with other firms to add features allowing the platform to mimic Bloomberg.

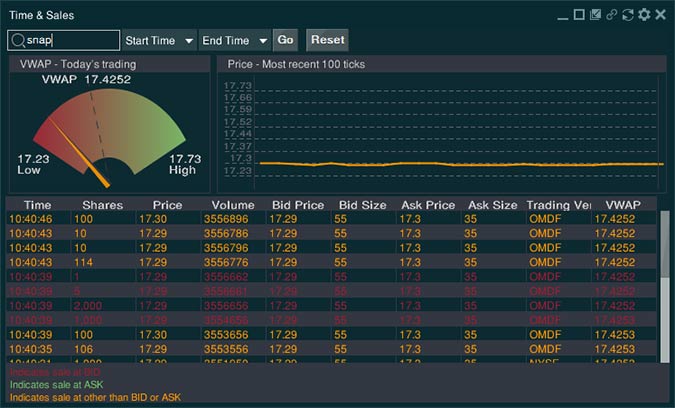

Market data: Like Bloomberg, users can build trading screens with lists of stock symbols, indexes and other traded asset classes. As well as query charts and time and sales grids of any symbol.

Trading: While not used by all Bloomberg users, a core feature of the Terminal is the ability to place trades directly from the platform. This allows traders to use the same interface for both their analysis and order management. To mimic this, Money.net has partnered with multiple brokers such as E*Trade, OptionsCity, Interactive Brokers and TD Waterhouse. Through the partnerships, broker customers of Money.net’s partners can access and trade their accounts on a GUI that is integrated directly on the market data platform.

Time & Sales

Chat: Arguably the biggest pushback in the market for leaving Bloomberg is its ‘chat’ feature. Often cited as the Facebook for millionaires, the Terminal’s chat allows users to message each other as well as create groups between themselves. Due to the advantages of being connected to other influential traders and analysts, there are many Terminal users paying the high monthly fees only to access the chat. To compete, Money.net includes its own inter-chat functionality between its users. Offered as a public forum, users can pitch real time ideas and gain feedback from the Money.net community. In addition, following with the ‘unbundling’ theme, Money.net is integrated with Symphony.

Also touted as a Bloomberg killer, Symphony is a bank backed messaging platform that was created to provide a lower cost alternative for financial professionals that only want an industry chat network without the high cost of a Terminal. Symphony also touts end to end encryption which is advanced to the Bloomberg chat.

Analytics: Arguably, Money.net’s most distinguishing feature is its Excel analytics plugin. With the plugin, users can connect data to Excel sheets containing their analytic calculations. The Excel connectivity is bolstered by the ability to use pretty much any data point for calculations such as company fundamentals and economic reports. As such, a user could create a query to compare in real time Crude Inventory results to Oil Stock prices to find laggards and strong performers to trade.

Bloomberg also provides a wide ranging list of variables available for analytic calculations, and is therefore used widely by securities analysts and traders. With Money.net’s Excel integration, many Bloomberg users should be able to cover their analytic needs with the platform.

News and research: Probably its weakest link when compared with Bloomberg and other expensive terminals such as Thomson Reuters Eikon and CapitalIQ is the available news and research on Money.net.

For real time news, Money.net aggregates data from numerous sources such as The Fly on the Wall, Seeking Alpha and Twitter. However, as those outlets predominately repost information from news tickers like Bloomberg and Dow Jones, traders used to accessing news from primary sources as it happens might be disappointed with Money.net.

Also, Wall Street analyst recommendations and commentary is lacking on Money.net compared to that of the high-end terminals.

Newsticker with Twitter news tweet

UI/UX: On a graphical level, Money.net has a lot going for it. It looks modern and users can unlock individual modules such as charts or time and sales screens to operate in their own windows.

On the downside, while looking slick, the available charting experience felt a bit clunky when compared to modern systems based on HTML5. Also, some of the fancy features such as a tick chart and VWAP scale on the time and sales window took a lot of room and weren’t adding much value.

Support:To compete against the big boys, Money.net has had to cater to customers and focus on great support. Even as they’ve grown quickly, the customer focus has continued with the company available to help individual users answer their questions and demo features.

Competition

Money.net spends a lot of time on its site comparing itself to Bloomberg. There are definite tradeoffs with the lower price. There is no question that the vast majority of Bloomberg users don’t need most of its features and can be equally productive paying for systems at a fraction of the cost.

In this regard, there are other platforms and products in Money.net’s price range competing for private individual traders and for cost conscious banks and brokers.

Eikon Xenith: From Thomson Reuters, Xenith is the company’s lower cost Trading Platform that focuses on private professional traders. While more expensive than Money.net, Xenith offers high end charting from their Metastock partnership. They also provide a very robust news stream due to being part of Thomson Reuters.

E-Signal: One of the oldest in the game, E-Signal has been providing traders real time trading data and charting at an affordable price for years. The system also allows users to export data to power their own analytic solutions.

TipRanks: On the surface, TipRanks may be an odd choice to be listed as a Money.net competitor. However, TipRanks focuses exclusively on providing and ranking Wall Street research. As such, they also compete for available dollars from professional traders with many of their customers happy to run TipRanks alongside their broker’s complementary trading platforms.

NetDania: Not as well known in the US, Denmark-based NetDania has been providing unbundled trading tools to financial institutions since the 1990’s. Specifically they have carved out a niche in Europe with their FX related products. For many trading desks, these solutions provide a cost effective alternative to the bundled and costly terminals.

TradingView: No one will confuse TradingView for a high end trading platform. But, there is no questioning that TradingView provides some of the best charting tools in the market. They’ve also built a massive community on their platform. It’s not Bloomberg’s chat network, but for private traders that are charting aficionados, the TradingView community covers this niche sector with Pro prices that are well below that of Money.net.

Conclusion

Is Money.net a Bloomberg killer? There is no doubt that it's vastly cheaper. But if you are making money using the Bloomberg Terminal, than cost isn’t the only factor.

Where you have to give Money.net credit though, is that they have succeeded in integrating both internal and external trading tools together. This provides a semblance of the bundled all-in-one environment that is behind the high cost terminals and why their users are such big fans.